# Install required packages if not already installed

if (!require("tidyverse")) install.packages("tidyverse")

if (!require("fixest")) install.packages("fixest")

if (!require("modelsummary")) install.packages("modelsummary")

if (!require("performance")) install.packages("performance")

if (!require("car")) install.packages("car")

if (!require("lmtest")) install.packages("lmtest")

if (!require("sandwich")) install.packages("sandwich")

if (!require("ggeffects")) install.packages("ggeffects")

if (!require("marginaleffects")) install.packages("marginaleffects")

if (!require("broom")) install.packages("broom")3 📈 Predictive Modeling I: Regression Analysis & Model Diagnostics

3.1 Learning Objectives

By the end of this chapter, you will be able to:

- Understand the principles of regression analysis for business applications

- Implement multiple linear regression models in R

- Apply non-linear regression techniques

- Use the feols package for efficient fixed effects regression

- Understand and implement fixed effects models to control for unobserved heterogeneity

- Identify and address multicollinearity using VIF analysis

- Interpret regression results in business contexts

- Perform model diagnostics to validate regression assumptions

- Compare and select models based on statistical criteria

- Visualize regression results for business presentations

3.2 Prerequisites

For this chapter, you’ll need:

- R and RStudio installed on your computer

- Understanding of data manipulation with dplyr (covered in Chapter 1)

- Basic knowledge of data visualization with ggplot2 (covered in Chapter 2)

- The following R packages installed:

# Load required packages

library(tidyverse) # For data manipulation and visualization

library(fixest) # For fixed effects regression

library(modelsummary) # For creating tables of model results

library(performance) # For model diagnostics

library(car) # For additional regression diagnostics

library(lmtest) # For hypothesis tests

library(sandwich) # For robust standard errors

library(ggeffects) # For visualizing effects

library(marginaleffects) # For calculating marginal effects

library(broom) # For tidying model output3.3 Introduction to Regression Analysis

Regression analysis is a statistical method for estimating the relations between a dependent variable and one or more independent variables. It’s one of the most widely used techniques in business analytics for prediction and understanding relations in data.

Why Regression Analysis in Business?

Regression analysis is valuable in business for several reasons:

- Prediction: Forecasting sales, demand, customer behavior, and other business metrics

- Understanding Relations: Identifying factors that influence business outcomes

- Quantifying Effects: Measuring the impact of different variables on business performance

- Decision Making: Informing strategic decisions based on data-driven insights

- Optimization: Finding the optimal levels of controllable factors to maximize outcomes

Types of Regression Models

There are several types of regression models, each suited for different types of data and relations:

- Simple Linear Regression: One dependent variable and one independent variable

- Multiple Linear Regression: One dependent variable and multiple independent variables

- Polynomial Regression: For modeling non-linear relations

- Fixed Effects Regression: For panel data with time-invariant effects

- Logistic Regression: For binary dependent variables (covered in Chapter 4)

- Other Non-linear Models: For various non-linear relations

3.4 Simple Linear Regression

Simple linear regression models the relation between two variables using a straight line.

The Simple Linear Regression Model

The simple linear regression model is:

\[Y = \beta_0 + \beta_1 X + \varepsilon\]

Where: - \(Y\) is the dependent variable - \(X\) is the independent variable - \(\beta_0\) is the intercept - \(\beta_1\) is the slope - \(\varepsilon\) is the error term

Implementing Simple Linear Regression in R

Let’s start with a simple example using the built-in mtcars dataset:

# Load the mtcars dataset

data(mtcars)

# Explore the data

glimpse(mtcars)Rows: 32

Columns: 11

$ mpg <dbl> 21.0, 21.0, 22.8, 21.4, 18.7, 18.1, 14.3, 24.4, 22.8, 19.2, 17.8,…

$ cyl <dbl> 6, 6, 4, 6, 8, 6, 8, 4, 4, 6, 6, 8, 8, 8, 8, 8, 8, 4, 4, 4, 4, 8,…

$ disp <dbl> 160.0, 160.0, 108.0, 258.0, 360.0, 225.0, 360.0, 146.7, 140.8, 16…

$ hp <dbl> 110, 110, 93, 110, 175, 105, 245, 62, 95, 123, 123, 180, 180, 180…

$ drat <dbl> 3.90, 3.90, 3.85, 3.08, 3.15, 2.76, 3.21, 3.69, 3.92, 3.92, 3.92,…

$ wt <dbl> 2.620, 2.875, 2.320, 3.215, 3.440, 3.460, 3.570, 3.190, 3.150, 3.…

$ qsec <dbl> 16.46, 17.02, 18.61, 19.44, 17.02, 20.22, 15.84, 20.00, 22.90, 18…

$ vs <dbl> 0, 0, 1, 1, 0, 1, 0, 1, 1, 1, 1, 0, 0, 0, 0, 0, 0, 1, 1, 1, 1, 0,…

$ am <dbl> 1, 1, 1, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 1, 1, 1, 0, 0,…

$ gear <dbl> 4, 4, 4, 3, 3, 3, 3, 4, 4, 4, 4, 3, 3, 3, 3, 3, 3, 4, 4, 4, 3, 3,…

$ carb <dbl> 4, 4, 1, 1, 2, 1, 4, 2, 2, 4, 4, 3, 3, 3, 4, 4, 4, 1, 2, 1, 1, 2,…# Create a scatter plot

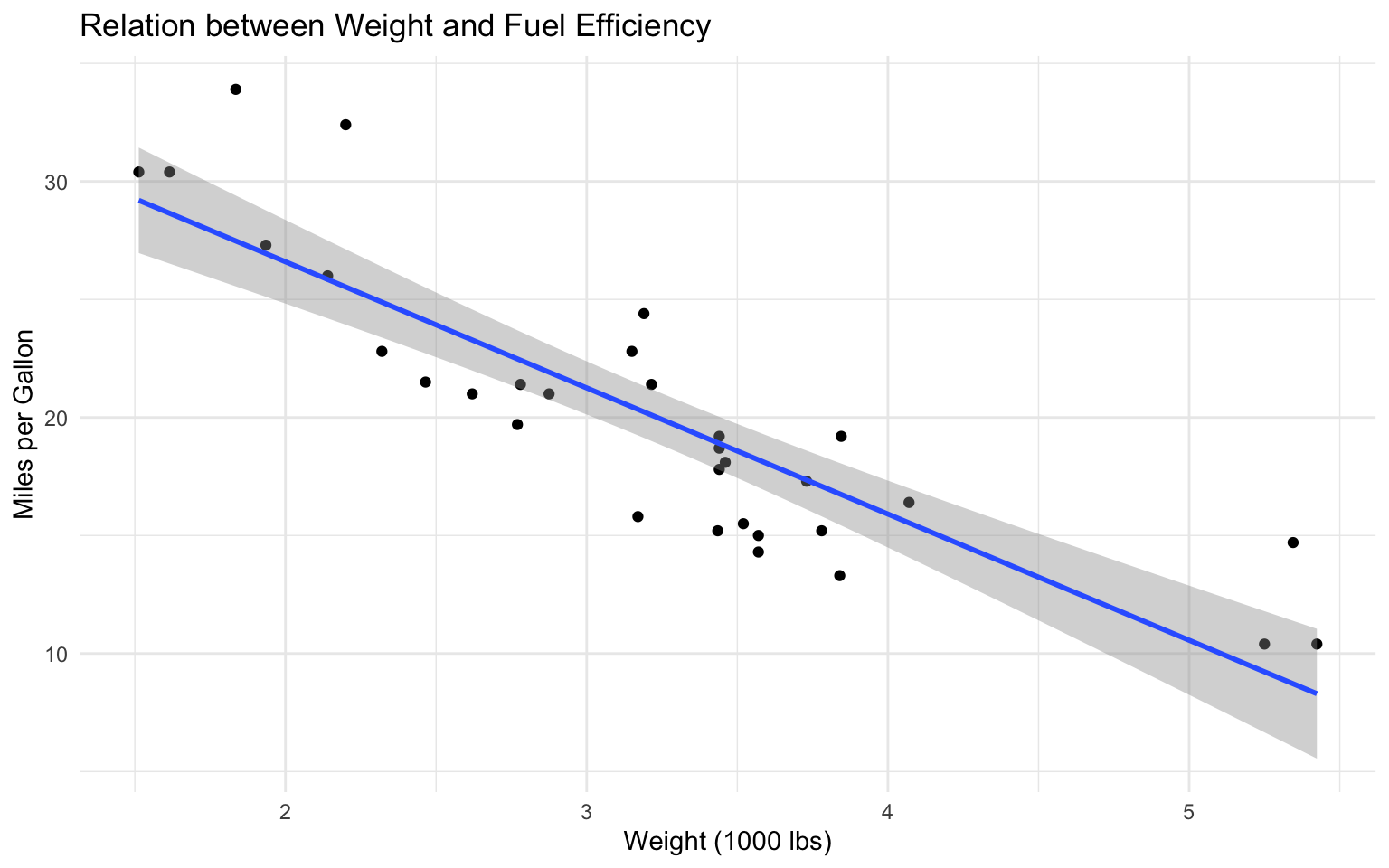

ggplot(mtcars, aes(x = wt, y = mpg)) +

geom_point() +

geom_smooth(method = "lm", se = TRUE) +

labs(

title = "Relation between Weight and Fuel Efficiency",

x = "Weight (1000 lbs)",

y = "Miles per Gallon"

) +

theme_minimal()`geom_smooth()` using formula = 'y ~ x'

# Fit a simple linear regression model

model1 <- lm(mpg ~ wt, data = mtcars)

# View the model summary

summary(model1)

Call:

lm(formula = mpg ~ wt, data = mtcars)

Residuals:

Min 1Q Median 3Q Max

-4.5432 -2.3647 -0.1252 1.4096 6.8727

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 37.2851 1.8776 19.858 < 2e-16 ***

wt -5.3445 0.5591 -9.559 1.29e-10 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 3.046 on 30 degrees of freedom

Multiple R-squared: 0.7528, Adjusted R-squared: 0.7446

F-statistic: 91.38 on 1 and 30 DF, p-value: 1.294e-10Interpreting the Results

The model output provides several important pieces of information:

- Coefficients: The estimated values of \(\beta_0\) and \(\beta_1\)

- Standard Errors: The uncertainty in the coefficient estimates

- t-values and p-values: Tests of statistical significance

- R-squared: The proportion of variance explained by the model

- F-statistic: Test of overall model significance

In our example: - The intercept (\(\beta_0\)) is 37.2851262, meaning a car with zero weight would have an estimated MPG of 37.2851262 (not meaningful in this context). - The slope (\(\beta_1\)) is -5.3444716, meaning for each additional 1,000 lbs of weight, MPG decreases by 5.3444716 on average. - The R-squared is 0.7528328, indicating that 75.3% of the variation in MPG is explained by weight.

Making Predictions

We can use the model to make predictions:

# Create new data for prediction

new_cars <- data.frame(wt = c(2.5, 3.0, 3.5))

# Make predictions

predictions <- predict(model1, newdata = new_cars, interval = "confidence")

# View the predictions

cbind(new_cars, predictions) wt fit lwr upr

1 2.5 23.92395 22.55284 25.29506

2 3.0 21.25171 20.12444 22.37899

3 3.5 18.57948 17.43342 19.725533.5 Multiple Linear Regression

Multiple linear regression extends simple linear regression to include multiple independent variables.

The Multiple Linear Regression Model

The multiple linear regression model is:

\[Y = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \ldots + \beta_p X_p + \varepsilon\]

Where: - \(Y\) is the dependent variable - \(X_1, X_2, \ldots, X_p\) are the independent variables - \(\beta_0, \beta_1, \beta_2, \ldots, \beta_p\) are the coefficients - \(\varepsilon\) is the error term

Implementing Multiple Linear Regression in R

Let’s extend our example to include multiple predictors:

# Fit a multiple linear regression model

model2 <- lm(mpg ~ wt + hp + disp, data = mtcars)

# View the model summary

summary(model2)

Call:

lm(formula = mpg ~ wt + hp + disp, data = mtcars)

Residuals:

Min 1Q Median 3Q Max

-3.891 -1.640 -0.172 1.061 5.861

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 37.105505 2.110815 17.579 < 2e-16 ***

wt -3.800891 1.066191 -3.565 0.00133 **

hp -0.031157 0.011436 -2.724 0.01097 *

disp -0.000937 0.010350 -0.091 0.92851

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.639 on 28 degrees of freedom

Multiple R-squared: 0.8268, Adjusted R-squared: 0.8083

F-statistic: 44.57 on 3 and 28 DF, p-value: 8.65e-11Interpreting Multiple Regression Results

In multiple regression, each coefficient represents the effect of the corresponding variable, holding all other variables constant. This is known as the “ceteris paribus” interpretation.

In our example: - The coefficient for wt is -3.8008906, meaning for each additional 1,000 lbs of weight, MPG decreases by 3.8008906 on average, holding horsepower and displacement constant. - The coefficient for hp is -0.0311566, meaning for each additional horsepower, MPG decreases by 0.0311566 on average, holding weight and displacement constant. - The R-squared is 0.8268361, indicating that 82.7% of the variation in MPG is explained by the model.

Comparing Models

We can compare models using various criteria:

# Compare models using modelsummary

modelsummary(

list(

"Model 1" = model1,

"Model 2" = model2

),

stars = TRUE,

gof_map = c("nobs", "r.squared", "adj.r.squared", "AIC", "BIC")

)| Model 1 | Model 2 | |

|---|---|---|

| + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001 | ||

| (Intercept) | 37.285*** | 37.106*** |

| (1.878) | (2.111) | |

| wt | -5.344*** | -3.801** |

| (0.559) | (1.066) | |

| hp | -0.031* | |

| (0.011) | ||

| disp | -0.001 | |

| (0.010) | ||

| Num.Obs. | 32 | 32 |

| R2 | 0.753 | 0.827 |

| R2 Adj. | 0.745 | 0.808 |

We can also use the anova() function to formally test whether adding variables improves the model:

# Compare nested models

anova(model1, model2)Analysis of Variance Table

Model 1: mpg ~ wt

Model 2: mpg ~ wt + hp + disp

Res.Df RSS Df Sum of Sq F Pr(>F)

1 30 278.32

2 28 194.99 2 83.331 5.983 0.006863 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1A significant p-value indicates that the more complex model (model2) provides a significantly better fit than the simpler model (model1).

3.6 Model Diagnostics

Regression models rely on several assumptions. We need to check these assumptions to ensure the validity of our results.

Key Regression Assumptions

- Linearity: The relation between the dependent and independent variables is linear.

- Independence: The observations are independent of each other.

- Homoscedasticity: The variance of the residuals is constant across all levels of the independent variables.

- Normality: The residuals are normally distributed.

- No Multicollinearity: The independent variables are not highly correlated with each other.

- No Influential Outliers: There are no extreme values that disproportionately influence the results.

Checking Assumptions with Diagnostic Plots

R provides several diagnostic plots for checking regression assumptions:

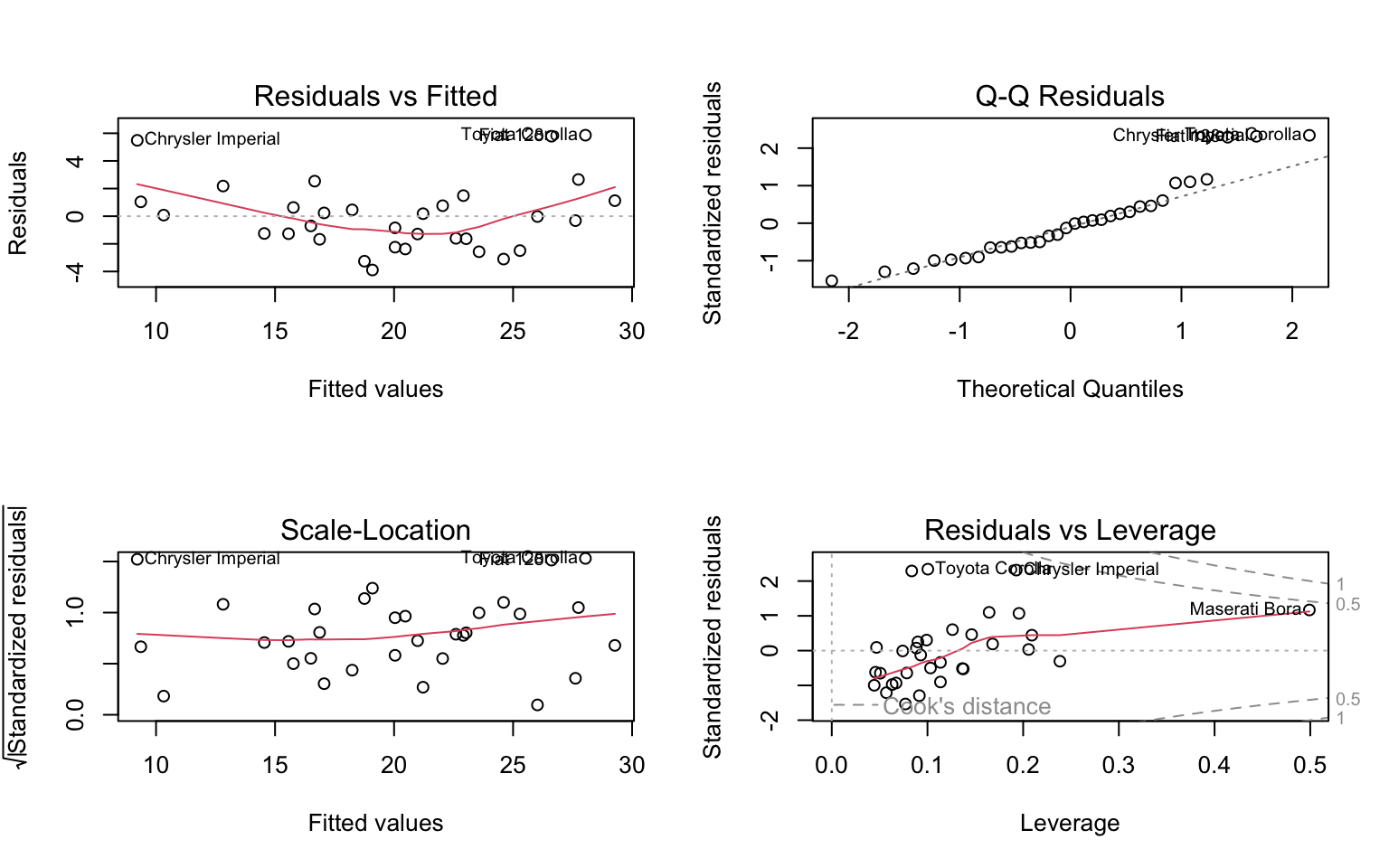

# Basic diagnostic plots

par(mfrow = c(2, 2))

plot(model2)

par(mfrow = c(1, 1))These plots help us check: 1. Residuals vs Fitted: Checks linearity and homoscedasticity 2. Normal Q-Q: Checks normality of residuals 3. Scale-Location: Another check for homoscedasticity 4. Residuals vs Leverage: Identifies influential observations

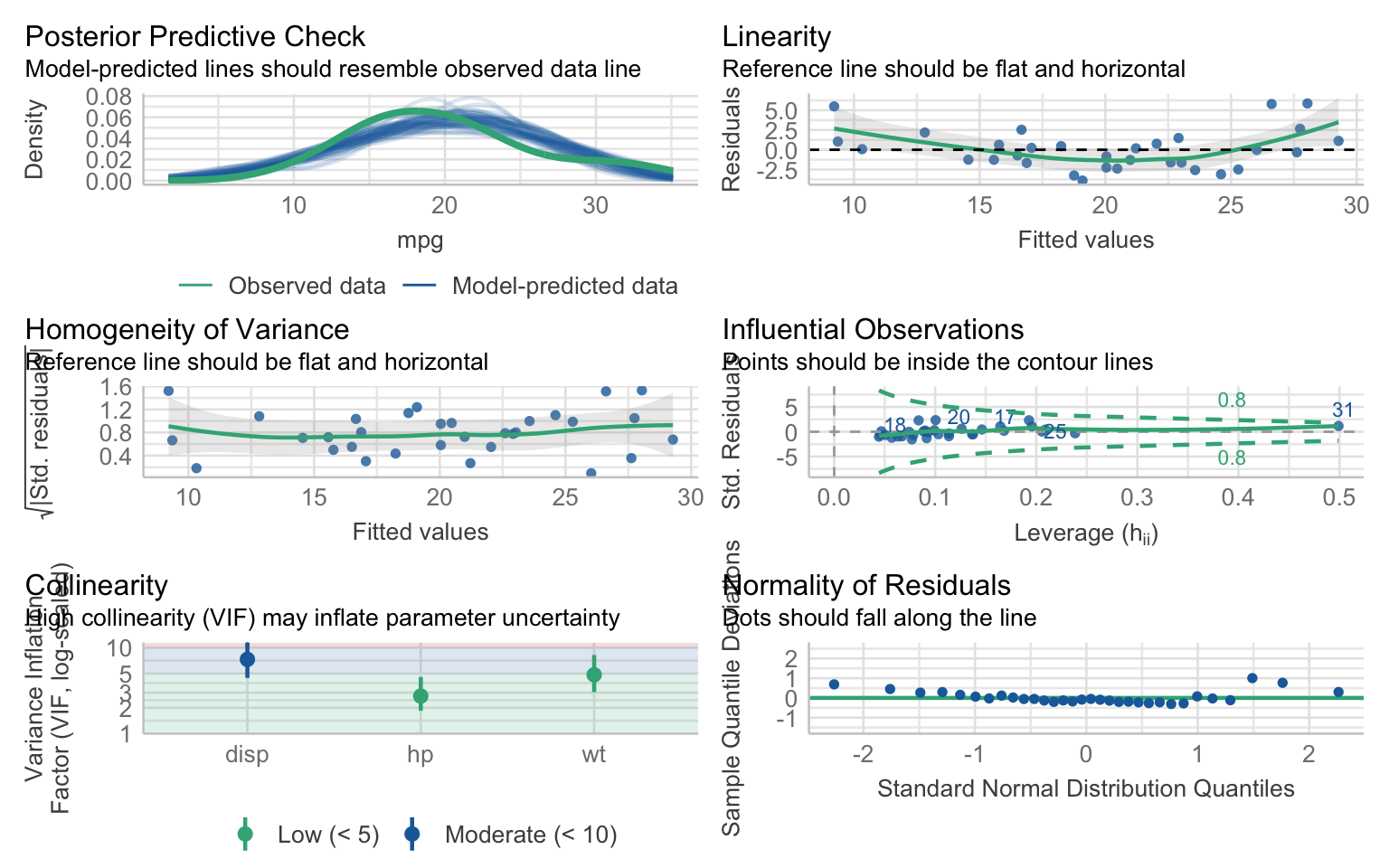

Advanced Diagnostics

We can use the performance package for more comprehensive diagnostics:

# Check model assumptions

check_model(model2)

3.7 Multicollinearity and VIF Analysis

Multicollinearity is a critical issue in regression analysis that occurs when independent variables are highly correlated with each other. This section explores how to detect, understand, and address multicollinearity in your regression models.

Understanding Multicollinearity

Multicollinearity occurs when two or more independent variables in a regression model are highly correlated. This creates several problems:

- Unstable Coefficient Estimates: Small changes in the data can lead to large changes in the estimated coefficients.

- Inflated Standard Errors: The standard errors of the coefficients become larger, making it harder to detect significant relations.

- Reduced Statistical Power: The model’s ability to identify significant relations is diminished.

- Difficult Interpretation: It becomes challenging to isolate the effect of individual variables.

Detecting Multicollinearity

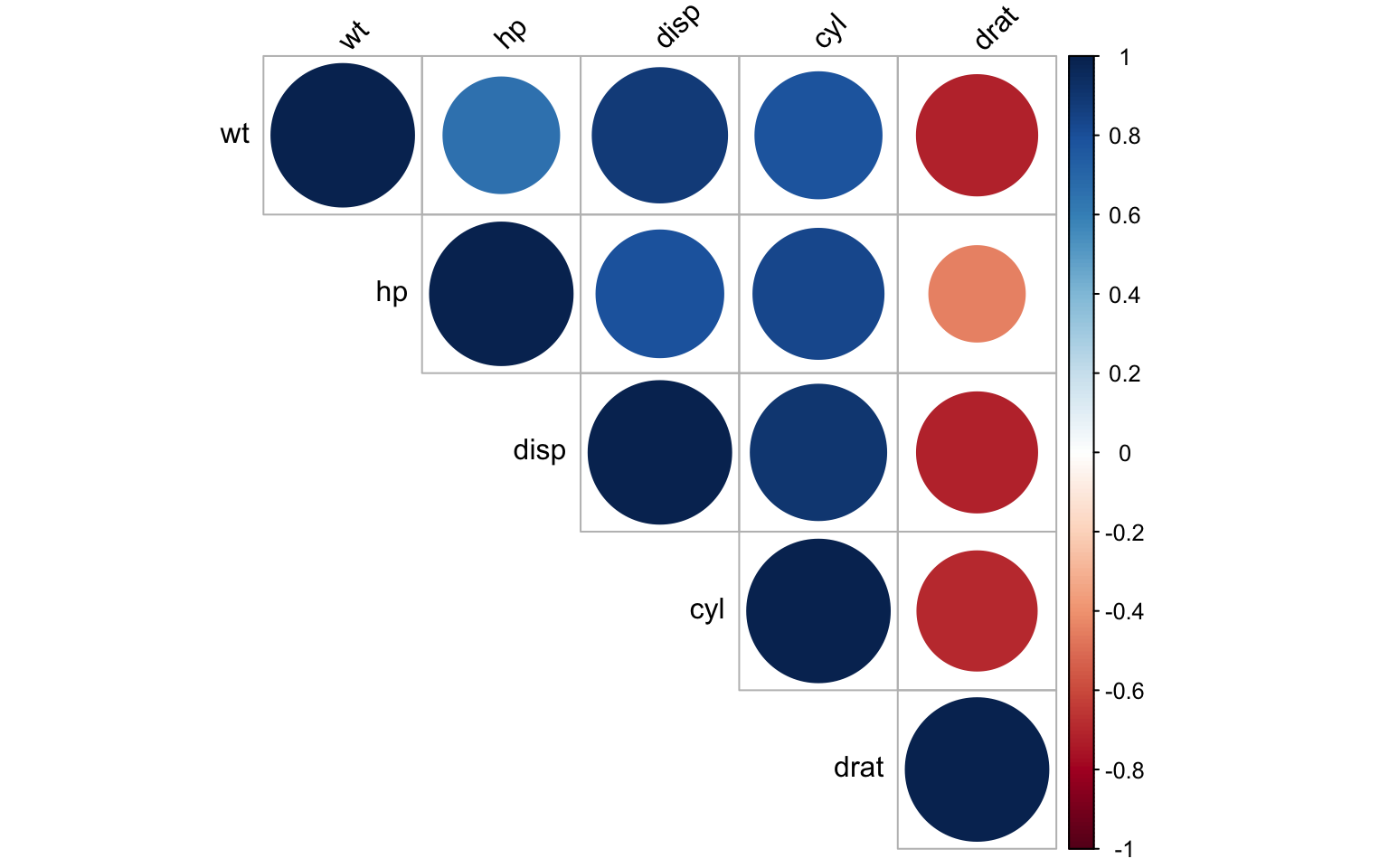

Correlation Matrix

A simple first step is to examine the correlation matrix of your independent variables:

# Create correlation matrix for independent variables in the mtcars dataset

cor_matrix <- cor(mtcars[, c("wt", "hp", "disp", "cyl", "drat")])

round(cor_matrix, 3) wt hp disp cyl drat

wt 1.000 0.659 0.888 0.782 -0.712

hp 0.659 1.000 0.791 0.832 -0.449

disp 0.888 0.791 1.000 0.902 -0.710

cyl 0.782 0.832 0.902 1.000 -0.700

drat -0.712 -0.449 -0.710 -0.700 1.000# Visualize the correlation matrix

corrplot::corrplot(cor_matrix, method = "circle", type = "upper",

tl.col = "black", tl.srt = 45)

Correlation coefficients close to 1 or -1 indicate potential multicollinearity. However, correlation matrices only detect pairwise relations and may miss more complex multicollinearity involving multiple variables.

Variance Inflation Factor (VIF)

The Variance Inflation Factor (VIF) is a more comprehensive measure of multicollinearity. For each independent variable, VIF measures how much the variance of the estimated regression coefficient is increased due to multicollinearity.

The VIF for a variable \(X_j\) is calculated as:

\[VIF_j = \frac{1}{1 - R_j^2}\]

Where \(R_j^2\) is the R-squared value obtained by regressing \(X_j\) on all other independent variables.

# Create a more complex model with potential multicollinearity

model_multi <- lm(mpg ~ wt + hp + disp + cyl + drat, data = mtcars)

# Calculate VIF values

vif_values <- car::vif(model_multi)

vif_values wt hp disp cyl drat

5.168795 3.990380 10.463957 7.869010 2.662298 Interpreting VIF Values

VIF values are interpreted as follows:

- VIF = 1: No multicollinearity

- 1 < VIF < 5: Moderate multicollinearity

- 5 < VIF < 10: High multicollinearity

- VIF > 10: Severe multicollinearity that requires attention

In our example, we can see that disp and cyl have high VIF values, indicating substantial multicollinearity with other predictors.

Addressing Multicollinearity

When multicollinearity is detected, several approaches can be taken:

2. Combine Variables

Another approach is to combine correlated variables into a single index or factor:

# Example: Create a composite "engine size" variable

mtcars$engine_size <- scale(mtcars$disp) + scale(mtcars$cyl)

# Model with the composite variable

model_composite <- lm(mpg ~ wt + hp + engine_size + drat, data = mtcars)

# Check VIF values

car::vif(model_composite) wt hp engine_size drat

4.065587 3.909665 9.184216 2.604446 3. Use Principal Component Analysis (PCA)

PCA can transform correlated variables into a set of uncorrelated components:

# Perform PCA on the correlated variables

pca_result <- prcomp(mtcars[, c("wt", "hp", "disp", "cyl", "drat")], scale = TRUE)

# Summary of PCA

summary(pca_result)Importance of components:

PC1 PC2 PC3 PC4 PC5

Standard deviation 1.9977 0.7593 0.50407 0.33746 0.25439

Proportion of Variance 0.7982 0.1153 0.05082 0.02278 0.01294

Cumulative Proportion 0.7982 0.9135 0.96428 0.98706 1.00000# Create a dataset with principal components

pc_data <- as.data.frame(pca_result$x[, 1:2]) # Using first two components

pc_data$mpg <- mtcars$mpg

# Fit a model using principal components

model_pca <- lm(mpg ~ PC1 + PC2, data = pc_data)

summary(model_pca)

Call:

lm(formula = mpg ~ PC1 + PC2, data = pc_data)

Residuals:

Min 1Q Median 3Q Max

-3.8280 -1.6324 -0.5814 1.1879 6.1691

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 20.0906 0.4699 42.755 < 2e-16 ***

PC1 -2.7265 0.2390 -11.408 3.06e-12 ***

PC2 0.2877 0.6288 0.458 0.651

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.658 on 29 degrees of freedom

Multiple R-squared: 0.818, Adjusted R-squared: 0.8055

F-statistic: 65.18 on 2 and 29 DF, p-value: 1.863e-114. Ridge Regression

Ridge regression is a regularization technique that can handle multicollinearity by adding a penalty term to the regression:

# Load the glmnet package for ridge regression

if (!require("glmnet")) install.packages("glmnet")Loading required package: glmnetLoading required package: MatrixWarning: package 'Matrix' was built under R version 4.4.1

Attaching package: 'Matrix'The following objects are masked from 'package:tidyr':

expand, pack, unpackLoaded glmnet 4.1-8library(glmnet)

# Prepare data for glmnet

x <- as.matrix(mtcars[, c("wt", "hp", "disp", "cyl", "drat")])

y <- mtcars$mpg

# Fit ridge regression with cross-validation to find optimal lambda

cv_ridge <- cv.glmnet(x, y, alpha = 0)

best_lambda <- cv_ridge$lambda.min

# Fit ridge regression with optimal lambda

ridge_model <- glmnet(x, y, alpha = 0, lambda = best_lambda)

# Display coefficients

coef(ridge_model)6 x 1 sparse Matrix of class "dgCMatrix"

s0

(Intercept) 32.0444326440

wt -2.5290823422

hp -0.0208093437

disp -0.0007426654

cyl -0.7701453676

drat 1.1599900587Practical Considerations for VIF in Business Analytics

In business applications, multicollinearity requires careful consideration:

Business Context: Sometimes, even with high VIF values, keeping certain variables may be important for business interpretation.

Prediction vs. Explanation: If your primary goal is prediction, multicollinearity is less problematic than if you’re trying to understand the impact of individual variables.

Domain Knowledge: Use industry expertise to decide which variables to keep or combine.

Continuous Monitoring: As new data becomes available, reassess multicollinearity as relations between variables may change over time.

Example: Addressing Multicollinearity in Marketing Mix Modeling

Let’s consider a marketing mix modeling scenario where advertising channels might be correlated:

# Create a simulated marketing dataset with multicollinearity

set.seed(123)

n <- 100

# Generate correlated advertising variables

tv_spend <- rnorm(n, mean = 50, sd = 10)

digital_spend <- 0.7 * tv_spend + rnorm(n, mean = 10, sd = 5)

social_spend <- 0.5 * digital_spend + rnorm(n, mean = 20, sd = 8)

# Generate sales with some noise

sales <- 10 + 0.3 * tv_spend + 0.2 * digital_spend + 0.1 * social_spend + rnorm(n, mean = 0, sd = 15)

# Create a data frame

marketing_data <- data.frame(

tv_spend = tv_spend,

digital_spend = digital_spend,

social_spend = social_spend,

sales = sales

)

# Check correlation

cor(marketing_data[, c("tv_spend", "digital_spend", "social_spend")]) tv_spend digital_spend social_spend

tv_spend 1.0000000 0.7865247 0.2540935

digital_spend 0.7865247 1.0000000 0.3946187

social_spend 0.2540935 0.3946187 1.0000000# Fit a model

marketing_model <- lm(sales ~ tv_spend + digital_spend + social_spend, data = marketing_data)

# Check VIF

car::vif(marketing_model) tv_spend digital_spend social_spend

2.648118 2.934047 1.196216 # Address multicollinearity by creating a composite digital variable

marketing_data$total_digital <- marketing_data$digital_spend + marketing_data$social_spend

# Fit a revised model

marketing_model_revised <- lm(sales ~ tv_spend + total_digital, data = marketing_data)

# Check VIF of the revised model

car::vif(marketing_model_revised) tv_spend total_digital

1.607237 1.607237 # Compare models

modelsummary(

list(

"Original Model" = marketing_model,

"Revised Model" = marketing_model_revised

),

stars = TRUE,

gof_map = c("nobs", "r.squared", "adj.r.squared", "AIC", "BIC")

)| Original Model | Revised Model | |

|---|---|---|

| + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001 | ||

| (Intercept) | 14.634 | 13.488 |

| (11.099) | (11.006) | |

| tv_spend | 0.120 | 0.274 |

| (0.283) | (0.220) | |

| digital_spend | 0.392 | |

| (0.347) | ||

| social_spend | -0.008 | |

| (0.210) | ||

| total_digital | 0.121 | |

| (0.150) | ||

| Num.Obs. | 100 | 100 |

| R2 | 0.061 | 0.054 |

| R2 Adj. | 0.032 | 0.034 |

In this example, we addressed multicollinearity by combining digital and social spending into a single variable, which reduced VIF values while maintaining the model’s explanatory power.

3.8 Fixed Effects Regression

Fixed effects regression is a powerful method for controlling for unobserved heterogeneity in panel data. This section provides a comprehensive overview of fixed effects models, their intuition, implementation, and advanced applications.

Understanding Fixed Effects

What are Fixed Effects?

Fixed effects regression allows us to control for unobserved variables that are constant over time (or within groups). This is particularly valuable when:

- We can’t figure out the correct causal diagram that tells us what to control for

- We can’t measure all the variables we need to control for

Fixed effects solves these problems by controlling for all variables, whether observed or not, as long as they stay constant within some larger category (like individual, firm, or country).

The Intuition Behind Fixed Effects

The key insight of fixed effects is simple but powerful: by controlling for the larger category (e.g., individual), we automatically control for everything that is constant within that category.

For example, if we’re studying the effect of rural towns getting electricity on their productivity, geography might be a confounder. However, geography doesn’t change over time for a given town. By including fixed effects for town, we effectively control for geography and all other time-invariant characteristics of each town.

How Fixed Effects Works: The Variation Within

Fixed effects focuses on variation within individuals or groups, rather than between them. Let’s understand this distinction:

- Between Variation: Differences across different individuals/groups (e.g., comparing one person’s average height to another person’s average height)

- Within Variation: Changes within the same individual/group over time (e.g., comparing a person’s height at different ages)

Fixed effects removes all between variation and focuses solely on within variation. This is how it controls for all time-invariant characteristics.

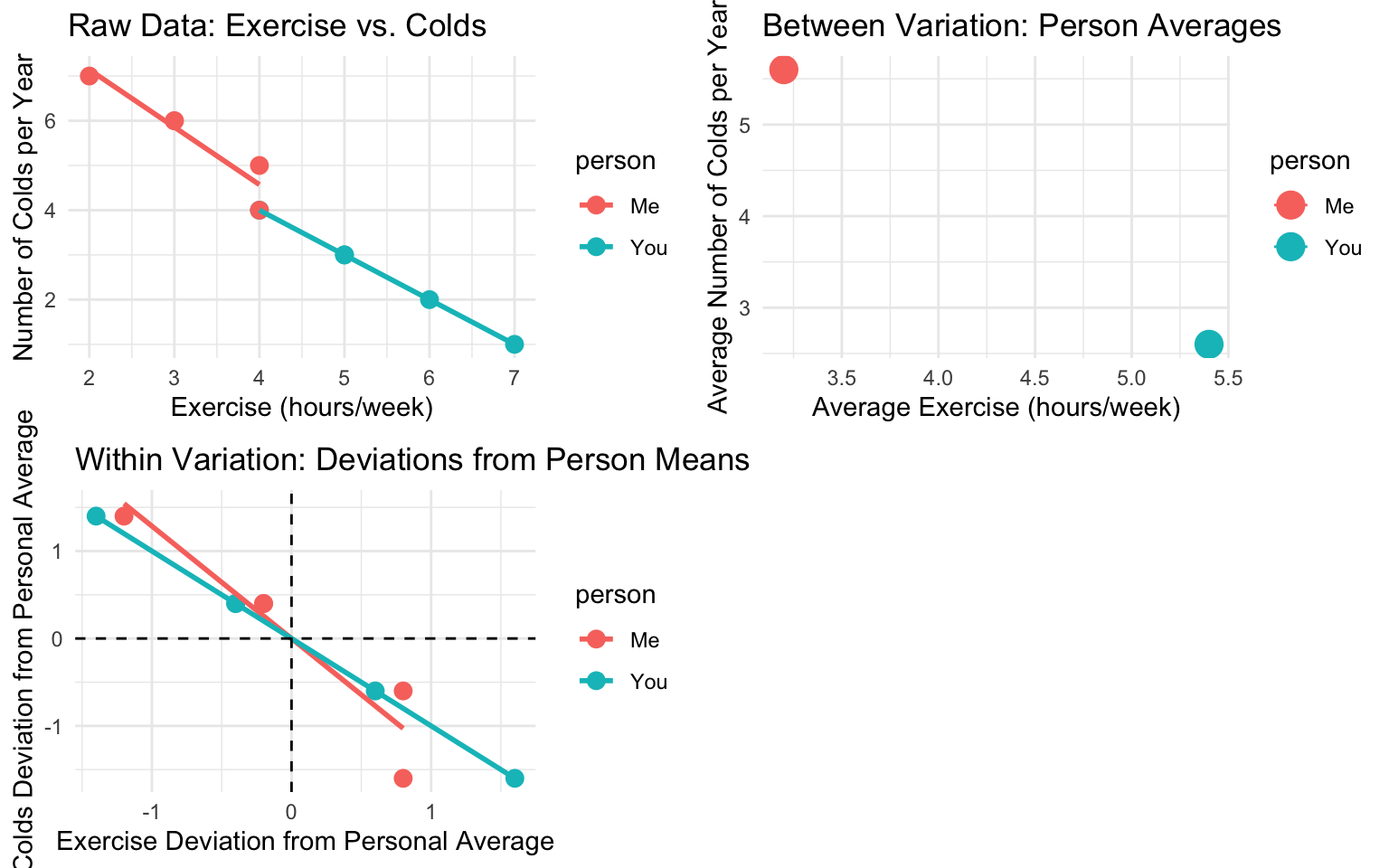

Visualizing Within and Between Variation

Let’s create a simple example to visualize this concept:

# Create a small panel dataset

set.seed(123)

person_data <- data.frame(

person = rep(c("You", "Me"), each = 5),

year = rep(2018:2022, 2),

exercise = c(5, 6, 4, 7, 5, # Your exercise hours

3, 4, 2, 3, 4), # My exercise hours

colds = c(3, 2, 4, 1, 3, # Your number of colds

6, 5, 7, 6, 4) # My number of colds

)

# Calculate person-specific means

person_means <- person_data %>%

group_by(person) %>%

summarize(

mean_exercise = mean(exercise),

mean_colds = mean(colds)

)

# Add the means and calculate within-person variation

person_data <- person_data %>%

left_join(person_means, by = "person") %>%

mutate(

exercise_within = exercise - mean_exercise,

colds_within = colds - mean_colds

)

# Plot the raw data

p1 <- ggplot(person_data, aes(x = exercise, y = colds, color = person)) +

geom_point(size = 3) +

geom_smooth(method = "lm", se = FALSE) +

labs(title = "Raw Data: Exercise vs. Colds",

x = "Exercise (hours/week)",

y = "Number of Colds per Year") +

theme_minimal()

# Plot the person means (between variation)

p2 <- ggplot(person_means, aes(x = mean_exercise, y = mean_colds, color = person)) +

geom_point(size = 5) +

geom_line() +

labs(title = "Between Variation: Person Averages",

x = "Average Exercise (hours/week)",

y = "Average Number of Colds per Year") +

theme_minimal()

# Plot the within-person variation

p3 <- ggplot(person_data, aes(x = exercise_within, y = colds_within, color = person)) +

geom_point(size = 3) +

geom_smooth(method = "lm", se = FALSE) +

labs(title = "Within Variation: Deviations from Person Means",

x = "Exercise Deviation from Personal Average",

y = "Colds Deviation from Personal Average") +

theme_minimal() +

geom_hline(yintercept = 0, linetype = "dashed") +

geom_vline(xintercept = 0, linetype = "dashed")

# Combine plots

gridExtra::grid.arrange(p1, p2, p3, ncol = 2)`geom_smooth()` using formula = 'y ~ x'

`geom_line()`: Each group consists of only one observation.

ℹ Do you need to adjust the group aesthetic?

`geom_smooth()` using formula = 'y ~ x'

In this example: - The first plot shows the raw data with a negative relations between exercise and colds - The second plot shows the between-person variation (person averages) - The third plot shows the within-person variation (deviations from personal averages)

The relation in the within-person variation (third plot) represents what fixed effects regression would estimate.

Fixed Effects in Action

Let’s see how fixed effects works with a more realistic example:

# Create a simulated panel dataset

set.seed(123)

# Number of firms and time periods

n_firms <- 50

n_years <- 10

# Create panel data

panel_data <- expand.grid(

firm_id = 1:n_firms,

year = 2010:(2010 + n_years - 1)

) %>%

as_tibble() %>%

# Add firm fixed effect (time-invariant)

group_by(firm_id) %>%

mutate(

firm_size = rnorm(1, mean = 5, sd = 2),

firm_quality = rnorm(1, mean = 0, sd = 1)

) %>%

# Add time fixed effect

group_by(year) %>%

mutate(

market_condition = rnorm(1, mean = 0, sd = 0.5)

) %>%

# Add time-varying variables

ungroup() %>%

mutate(

investment = 0.1 * firm_size + 0.05 * (year - 2010) + 0.2 * market_condition + rnorm(n(), mean = 0, sd = 0.5),

advertising = 0.2 * firm_size + 0.1 * firm_quality + rnorm(n(), mean = 0, sd = 0.3),

# Outcome variable

revenue = 2 * firm_size + 0.5 * firm_quality + 1.5 * investment + 0.8 * advertising +

0.3 * market_condition + rnorm(n(), mean = 0, sd = 1)

)

# View the data structure

glimpse(panel_data)Rows: 500

Columns: 8

$ firm_id <int> 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16…

$ year <int> 2010, 2010, 2010, 2010, 2010, 2010, 2010, 2010, 2010,…

$ firm_size <dbl> 3.879049, 4.539645, 8.117417, 5.141017, 5.258575, 8.4…

$ firm_quality <dbl> 0.25331851, -0.02854676, -0.04287046, 1.36860228, -0.…

$ market_condition <dbl> -0.3552033, -0.3552033, -0.3552033, -0.3552033, -0.35…

$ investment <dbl> 0.02919073, 0.68690601, -0.06824035, 0.41528004, 0.71…

$ advertising <dbl> 0.6820324, 0.5397943, 2.1254731, 1.1602628, 1.3516215…

$ revenue <dbl> 7.742679, 11.377814, 20.129344, 11.494925, 13.508447,…Implementing Fixed Effects Regression

There are several ways to implement fixed effects regression:

1. Using Binary Indicators

One approach is to include binary indicators for each individual/group:

# Fit a model with binary indicators for firm_id

# Note: This is computationally intensive with many firms

model_dummies <- lm(revenue ~ investment + advertising + factor(firm_id), data = panel_data)

# Display partial results

summary(model_dummies)$coefficients[1:5, ] Estimate Std. Error t value Pr(>|t|)

(Intercept) 8.0289278 0.34680651 23.151029 1.463859e-78

investment 1.6637704 0.08839923 18.821096 1.189134e-58

advertising 0.7270425 0.14714269 4.941071 1.099369e-06

factor(firm_id)2 1.0617453 0.43123398 2.462110 1.418777e-02

factor(firm_id)3 8.5384539 0.44253602 19.294371 8.055158e-612. Demeaning (Within Transformation)

A more efficient approach is to subtract the individual/group means:

# Calculate firm means

firm_means <- panel_data %>%

group_by(firm_id) %>%

summarize(

mean_revenue = mean(revenue),

mean_investment = mean(investment),

mean_advertising = mean(advertising)

)

# Merge means and calculate within variation

panel_data_within <- panel_data %>%

left_join(firm_means, by = "firm_id") %>%

mutate(

revenue_within = revenue - mean_revenue,

investment_within = investment - mean_investment,

advertising_within = advertising - mean_advertising

)

# Fit model using within variation

model_within <- lm(revenue_within ~ investment_within + advertising_within - 1, data = panel_data_within)

summary(model_within)

Call:

lm(formula = revenue_within ~ investment_within + advertising_within -

1, data = panel_data_within)

Residuals:

Min 1Q Median 3Q Max

-2.6679 -0.5634 0.0397 0.6343 3.2572

Coefficients:

Estimate Std. Error t value Pr(>|t|)

investment_within 1.66377 0.08384 19.84 < 2e-16 ***

advertising_within 0.72704 0.13956 5.21 2.78e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.9143 on 498 degrees of freedom

Multiple R-squared: 0.4554, Adjusted R-squared: 0.4533

F-statistic: 208.3 on 2 and 498 DF, p-value: < 2.2e-163. Using the fixest Package

The most efficient and user-friendly approach is to use the fixest package:

# Pooled OLS (no fixed effects)

model_pooled <- feols(revenue ~ investment + advertising, data = panel_data)

# Firm fixed effects

model_firm_fe <- feols(revenue ~ investment + advertising | firm_id, data = panel_data)

# Compare models

etable(model_pooled, model_firm_fe) model_pooled model_firm_fe

Dependent Var.: revenue revenue

Constant 3.583*** (0.2716)

investment 2.842*** (0.2072) 1.664*** (0.0949)

advertising 6.250*** (0.2332) 0.7270*** (0.1428)

Fixed-Effects: ----------------- ------------------

firm_id No Yes

_______________ _________________ __________________

S.E. type IID by: firm_id

Observations 500 500

R2 0.70199 0.95911

Within R2 -- 0.45544

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Interpreting Fixed Effects Results

The interpretation of coefficients in fixed effects models is similar to regular regression, but with an important distinction:

- Coefficients represent the effect of a one-unit change in the independent variable on the dependent variable, within the same individual/group.

For example, in our firm fixed effects model, the coefficient for investment (1.49) means that for a given firm, a one-unit increase in investment is associated with a 1.49-unit increase in revenue, on average.

The fixed effects themselves (not shown in the output) represent the time-invariant characteristics of each firm.

Multiple Sets of Fixed Effects

We can include multiple sets of fixed effects to control for different sources of unobserved heterogeneity:

Two-way Fixed Effects

Two-way fixed effects include fixed effects for both individuals/groups and time periods:

# Two-way fixed effects (firm and year)

model_twoway_fe <- feols(revenue ~ investment + advertising | firm_id + year, data = panel_data)

# Compare models

etable(model_firm_fe, model_twoway_fe) model_firm_fe model_twoway_fe

Dependent Var.: revenue revenue

investment 1.664*** (0.0949) 1.639*** (0.0958)

advertising 0.7270*** (0.1428) 0.7241*** (0.1493)

Fixed-Effects: ------------------ ------------------

firm_id Yes Yes

year No Yes

_______________ __________________ __________________

S.E.: Clustered by: firm_id by: firm_id

Observations 500 500

R2 0.95911 0.95959

Within R2 0.45544 0.42077

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1In the two-way fixed effects model, we control for both: 1. Time-invariant characteristics of each firm (firm fixed effects) 2. Firm-invariant characteristics of each year (year fixed effects)

This is particularly useful when there are both individual-specific and time-specific unobserved factors that might confound the relation of interest.

Advanced Topics in Fixed Effects

Clustered Standard Errors

When using fixed effects, it’s often recommended to use clustered standard errors to account for potential correlation in the error terms within groups:

# Fixed effects with clustered standard errors

model_fe_clustered <- feols(revenue ~ investment + advertising | firm_id,

cluster = "firm_id",

data = panel_data)

# Compare with and without clustering

etable(model_firm_fe, model_fe_clustered) model_firm_fe model_fe_clustered

Dependent Var.: revenue revenue

investment 1.664*** (0.0949) 1.664*** (0.0949)

advertising 0.7270*** (0.1428) 0.7270*** (0.1428)

Fixed-Effects: ------------------ ------------------

firm_id Yes Yes

_______________ __________________ __________________

S.E.: Clustered by: firm_id by: firm_id

Observations 500 500

R2 0.95911 0.95911

Within R2 0.45544 0.45544

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Fixed Effects vs. Random Effects

While fixed effects removes all between variation, random effects uses a weighted average of within and between variation:

# Random effects model

if (!require("plm")) install.packages("plm")Loading required package: plmRegistered S3 method overwritten by 'lfe':

method from

nobs.felm broom

Attaching package: 'plm'The following objects are masked from 'package:dplyr':

between, lag, leadlibrary(plm)

# Convert to panel data format

panel_data_plm <- pdata.frame(panel_data, index = c("firm_id", "year"))

# Fit random effects model

model_re <- plm(revenue ~ investment + advertising,

data = panel_data_plm,

model = "random")

# Compare fixed effects and random effects

summary(model_re)Oneway (individual) effect Random Effect Model

(Swamy-Arora's transformation)

Call:

plm(formula = revenue ~ investment + advertising, data = panel_data_plm,

model = "random")

Balanced Panel: n = 50, T = 10, N = 500

Effects:

var std.dev share

idiosyncratic 0.9292 0.9640 0.538

individual 0.7977 0.8931 0.462

theta: 0.677

Residuals:

Min. 1st Qu. Median 3rd Qu. Max.

-4.224431 -0.834830 -0.022734 0.840686 4.498583

Coefficients:

Estimate Std. Error z-value Pr(>|z|)

(Intercept) 8.45068 0.30038 28.134 < 2.2e-16 ***

investment 1.95363 0.12981 15.050 < 2.2e-16 ***

advertising 2.15531 0.20114 10.716 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Total Sum of Squares: 1747

Residual Sum of Squares: 1024.5

R-Squared: 0.41355

Adj. R-Squared: 0.41119

Chisq: 350.476 on 2 DF, p-value: < 2.22e-16The key difference is that random effects assumes the individual effects are uncorrelated with the independent variables, while fixed effects does not make this assumption.

Hausman Test

The Hausman test can help decide between fixed effects and random effects:

# Fit fixed effects model using plm

model_fe_plm <- plm(revenue ~ investment + advertising,

data = panel_data_plm,

model = "within")

# Perform Hausman test

phtest(model_fe_plm, model_re)

Hausman Test

data: revenue ~ investment + advertising

chisq = 123.43, df = 2, p-value < 2.2e-16

alternative hypothesis: one model is inconsistentA significant p-value suggests that fixed effects is more appropriate than random effects.

Fixed Effects in Non-linear Models

Fixed effects can also be applied to non-linear models, though the implementation is more complex:

# Create a binary outcome

panel_data$high_revenue <- ifelse(panel_data$revenue > median(panel_data$revenue), 1, 0)

# Logit model with fixed effects using fixest package

# We already loaded fixest at the beginning of the document

# Fit logit model with firm fixed effects

logit_fe <- feglm(high_revenue ~ investment + advertising | firm_id,

family = binomial,

data = panel_data)NOTE: 31 fixed-effects (310 observations) removed because of only 0 (or only 1) outcomes.summary(logit_fe)GLM estimation, family = binomial, Dep. Var.: high_revenue

Observations: 190

Fixed-effects: firm_id: 19

Standard-errors: Clustered (firm_id)

Estimate Std. Error z value Pr(>|z|)

investment 3.11163 0.806970 3.85594 0.00011528 ***

advertising 2.04345 0.811017 2.51962 0.01174811 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log-Likelihood: -72.9 Adj. Pseudo R2: 0.29284

BIC: 256.1 Squared Cor.: 0.532328Business Applications of Fixed Effects

Fixed effects regression has numerous applications in business analytics:

Marketing: Controlling for individual customer characteristics when analyzing the effect of marketing campaigns on purchase behavior

Finance: Controlling for firm-specific factors when studying the impact of policy changes on stock returns

HR Analytics: Controlling for employee characteristics when analyzing the effect of training programs on productivity

Operations: Controlling for store-specific factors when evaluating the impact of process changes on efficiency

Economics: Controlling for country-specific factors when studying the effect of policy changes on economic outcomes

Example: Store Performance Analysis

Let’s apply fixed effects to a business case of store performance analysis:

# Create a simulated store performance dataset

set.seed(456)

n_stores <- 50

n_months <- 24

# Create store performance data

store_data <- expand.grid(

store_id = 1:n_stores,

month = 1:n_months

) %>%

as_tibble() %>%

# Add store fixed effects (time-invariant)

group_by(store_id) %>%

mutate(

store_size = rnorm(1, mean = 10000, sd = 3000),

location_quality = rnorm(1, mean = 0, sd = 1),

manager_skill = rnorm(1, mean = 0, sd = 1)

) %>%

# Add time fixed effects

group_by(month) %>%

mutate(

seasonality = sin(month * pi/6) * 2, # Seasonal pattern

market_trend = 0.05 * month # Overall market trend

) %>%

# Add time-varying variables

ungroup() %>%

mutate(

# Randomly assign some stores to receive a training program

training = ifelse(store_id %% 4 == 0 & month > 12, 1, 0),

# Promotional activity varies by store and time

promo_intensity = rnorm(n(), mean = 5, sd = 1.5),

# Outcome: sales performance

sales = 100 + 0.01 * store_size + 10 * location_quality +

8 * manager_skill + 15 * training + 3 * promo_intensity +

5 * seasonality + 2 * market_trend + rnorm(n(), mean = 0, sd = 10)

)

# View the data structure

glimpse(store_data)Rows: 1,200

Columns: 10

$ store_id <int> 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16…

$ month <int> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1,…

$ store_size <dbl> 5969.436, 11865.327, 12402.624, 5833.323, 7856.929, 9…

$ location_quality <dbl> -0.66495083, -0.25652476, 0.67878215, 0.89684464, 0.6…

$ manager_skill <dbl> 0.11815133, 0.86990262, -0.09193621, 0.06889879, -1.6…

$ seasonality <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1,…

$ market_trend <dbl> 0.05, 0.05, 0.05, 0.05, 0.05, 0.05, 0.05, 0.05, 0.05,…

$ training <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0,…

$ promo_intensity <dbl> 6.800615, 4.751876, 4.258690, 2.653146, 4.468448, 3.4…

$ sales <dbl> 178.4965, 232.0142, 248.5386, 183.3743, 193.3809, 219…Now, let’s analyze the effect of the training program on sales using different models:

# Pooled OLS (ignoring store and time effects)

model_store_pooled <- feols(sales ~ training + promo_intensity, data = store_data)

# Store fixed effects

model_store_fe <- feols(sales ~ training + promo_intensity | store_id, data = store_data)

# Two-way fixed effects (store and month)

model_store_twoway <- feols(sales ~ training + promo_intensity | store_id + month, data = store_data)

# Compare models

etable(model_store_pooled, model_store_fe, model_store_twoway) model_store_poo.. model_store_fe model_store_two..

Dependent Var.: sales sales sales

Constant 207.3*** (3.744)

training 29.83*** (3.144) 16.43*** (1.288) 16.56*** (1.468)

promo_intensity 2.329*** (0.7024) 3.215*** (0.2039) 3.152*** (0.1876)

Fixed-Effects: ----------------- ----------------- -----------------

store_id No Yes Yes

month No No Yes

_______________ _________________ _________________ _________________

S.E. type IID by: store_id by: store_id

Observations 1,200 1,200 1,200

R2 0.07821 0.90057 0.93143

Within R2 -- 0.21818 0.25954

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1The fixed effects models provide a more accurate estimate of the training effect by controlling for store-specific characteristics and time trends. This is crucial for business decision-making, as it helps isolate the true impact of interventions like training programs.

3.9 Non-linear Regression

Not all relations are linear. Let’s explore some non-linear regression techniques.

Polynomial Regression

Polynomial regression adds polynomial terms to model non-linear relations:

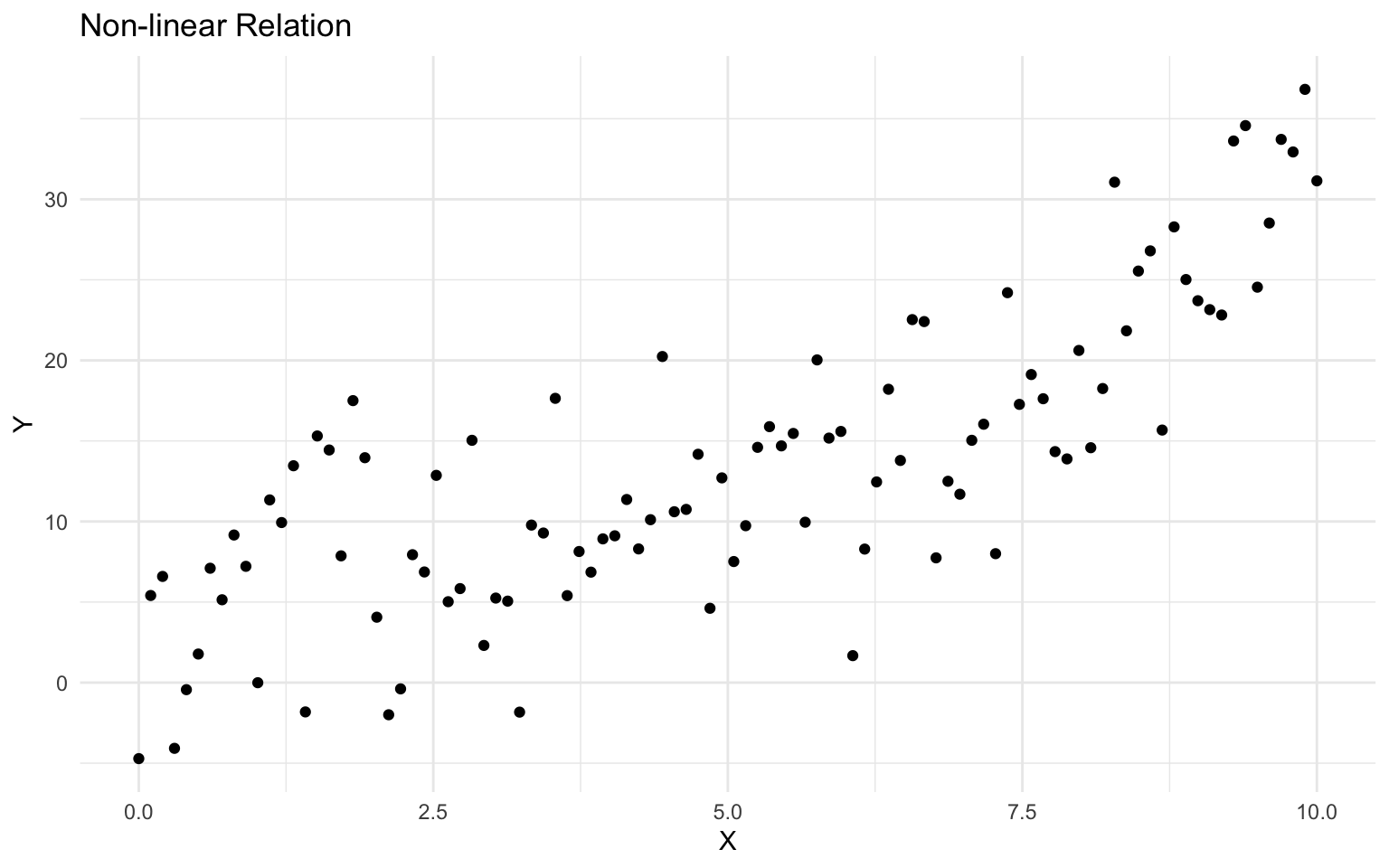

# Create a dataset with a non-linear relation

set.seed(456)

n <- 100

x <- seq(0, 10, length.out = n)

y <- 2 + 3 * x - 0.5 * x^2 + 0.05 * x^3 + rnorm(n, mean = 0, sd = 5)

nonlinear_data <- tibble(x = x, y = y)

# Plot the data

ggplot(nonlinear_data, aes(x = x, y = y)) +

geom_point() +

labs(

title = "Non-linear Relation",

x = "X",

y = "Y"

) +

theme_minimal()

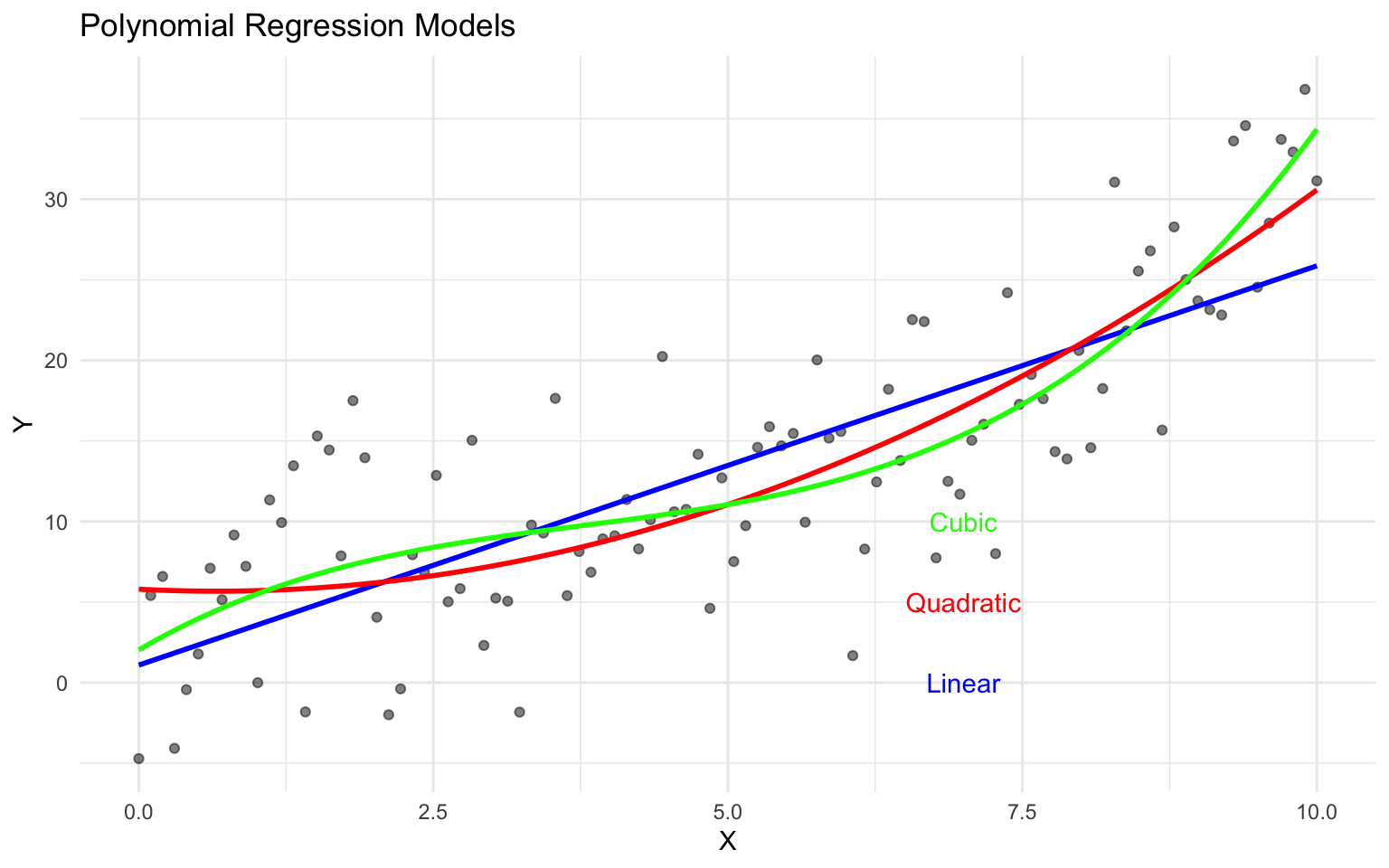

# Fit polynomial regression models

model_linear <- lm(y ~ x, data = nonlinear_data)

model_quad <- lm(y ~ x + I(x^2), data = nonlinear_data)

model_cubic <- lm(y ~ x + I(x^2) + I(x^3), data = nonlinear_data)

# Compare models

modelsummary(

list(

"Linear" = model_linear,

"Quadratic" = model_quad,

"Cubic" = model_cubic

),

stars = TRUE,

gof_map = c("nobs", "r.squared", "adj.r.squared", "AIC", "BIC")

)| Linear | Quadratic | Cubic | |

|---|---|---|---|

| + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001 | |||

| (Intercept) | 1.086 | 5.797*** | 2.034 |

| (1.125) | (1.544) | (1.945) | |

| x | 2.478*** | -0.377 | 4.255* |

| (0.194) | (0.714) | (1.693) | |

| I(x^2) | 0.286*** | -0.878* | |

| (0.069) | (0.395) | ||

| I(x^3) | 0.078** | ||

| (0.026) | |||

| Num.Obs. | 100 | 100 | 100 |

| R2 | 0.624 | 0.680 | 0.708 |

| R2 Adj. | 0.620 | 0.674 | 0.699 |

# Plot the fitted curves

ggplot(nonlinear_data, aes(x = x, y = y)) +

geom_point(alpha = 0.5) +

geom_smooth(method = "lm", formula = y ~ x, color = "blue", se = FALSE) +

geom_smooth(method = "lm", formula = y ~ x + I(x^2), color = "red", se = FALSE) +

geom_smooth(method = "lm", formula = y ~ x + I(x^2) + I(x^3), color = "green", se = FALSE) +

labs(

title = "Polynomial Regression Models",

x = "X",

y = "Y"

) +

theme_minimal() +

annotate("text", x = 7, y = 0, label = "Linear", color = "blue") +

annotate("text", x = 7, y = 5, label = "Quadratic", color = "red") +

annotate("text", x = 7, y = 10, label = "Cubic", color = "green")

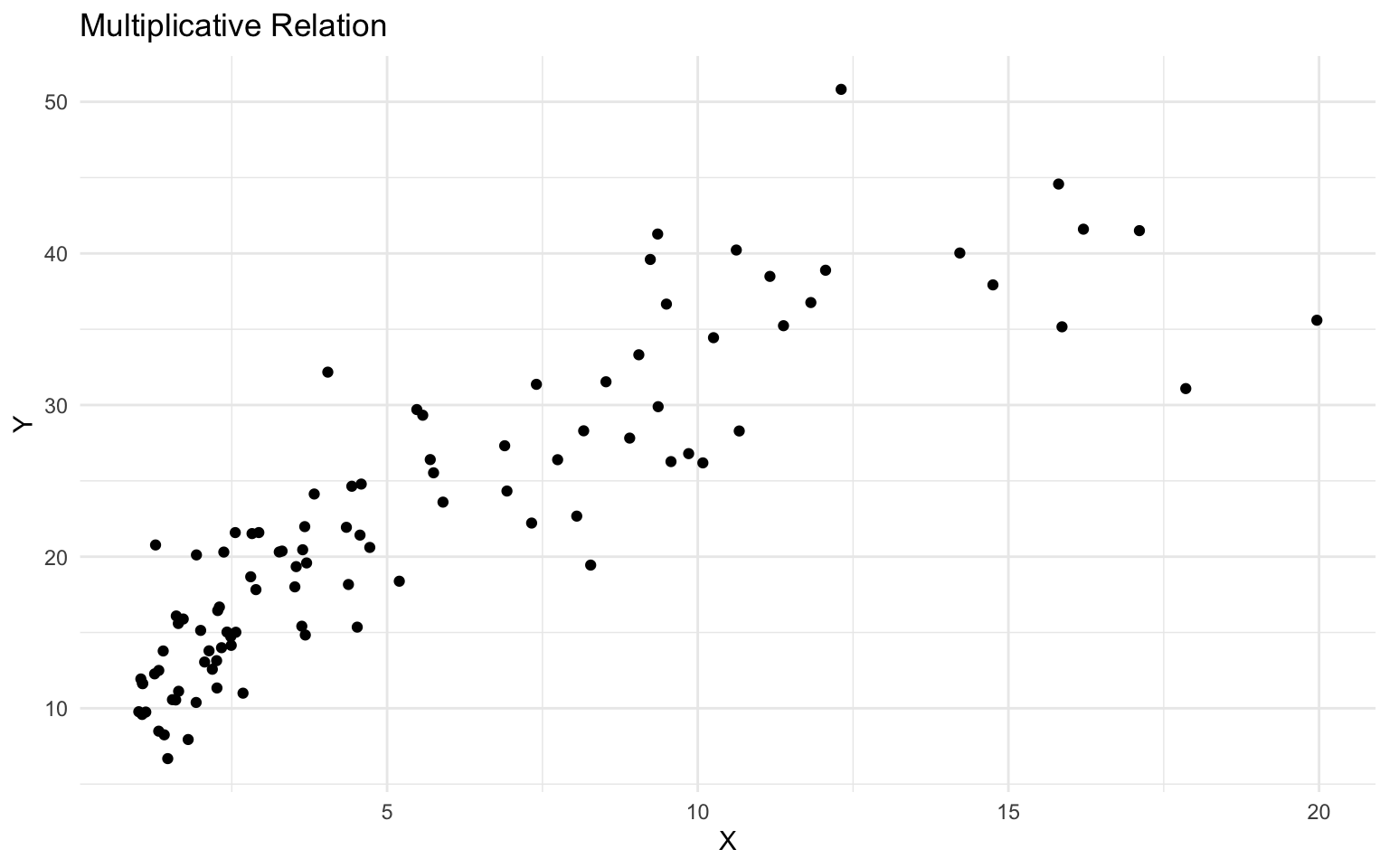

Log Transformations

Log transformations are useful for modeling relations with multiplicative effects or when the data is skewed:

# Create a dataset with a multiplicative relation

set.seed(789)

n <- 100

x <- exp(runif(n, min = 0, max = 3))

y <- 10 * x^0.5 * exp(rnorm(n, mean = 0, sd = 0.2))

log_data <- tibble(x = x, y = y)

# Plot the data

ggplot(log_data, aes(x = x, y = y)) +

geom_point() +

labs(

title = "Multiplicative Relation",

x = "X",

y = "Y"

) +

theme_minimal()

# Fit models with different transformations

model_original <- lm(y ~ x, data = log_data)

model_log_x <- lm(y ~ log(x), data = log_data)

model_log_y <- lm(log(y) ~ x, data = log_data)

model_log_log <- lm(log(y) ~ log(x), data = log_data)

# Compare models

modelsummary(

list(

"Original" = model_original,

"Log X" = model_log_x,

"Log Y" = model_log_y,

"Log-Log" = model_log_log

),

stars = TRUE,

gof_map = c("nobs", "r.squared", "adj.r.squared", "AIC", "BIC")

)| Original | Log X | Log Y | Log-Log | |

|---|---|---|---|---|

| + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001 | ||||

| (Intercept) | 11.655*** | 7.159*** | 2.536*** | 2.300*** |

| (0.791) | (0.907) | (0.042) | (0.041) | |

| x | 1.917*** | 0.084*** | ||

| (0.110) | (0.006) | |||

| log(x) | 10.877*** | 0.505*** | ||

| (0.559) | (0.025) | |||

| Num.Obs. | 100 | 100 | 100 | 100 |

| R2 | 0.757 | 0.795 | 0.681 | 0.803 |

| R2 Adj. | 0.754 | 0.792 | 0.678 | 0.801 |

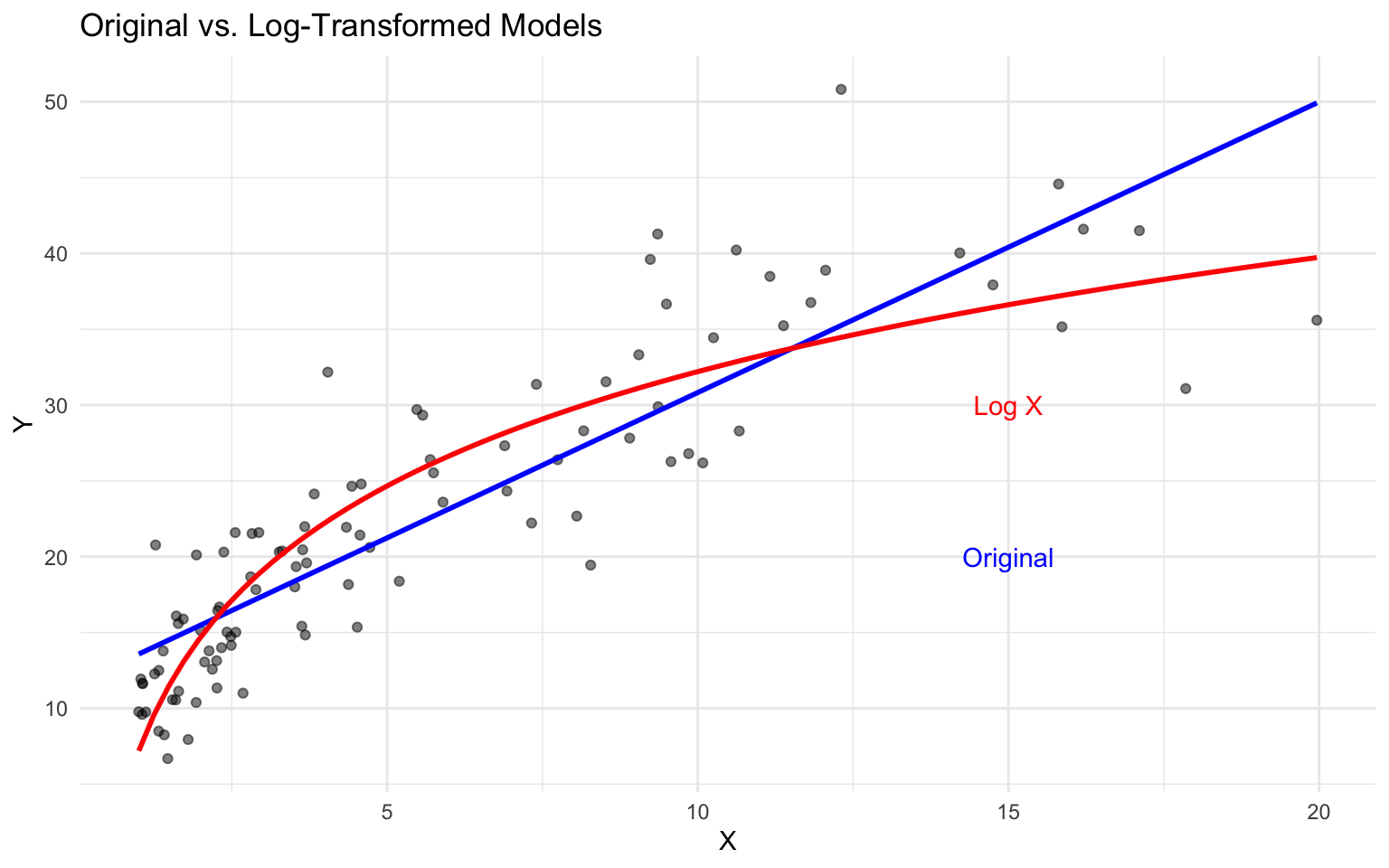

# Plot the fitted curves

ggplot(log_data, aes(x = x, y = y)) +

geom_point(alpha = 0.5) +

geom_smooth(method = "lm", formula = y ~ x, color = "blue", se = FALSE) +

geom_smooth(method = "lm", formula = y ~ log(x), color = "red", se = FALSE) +

labs(

title = "Original vs. Log-Transformed Models",

x = "X",

y = "Y"

) +

theme_minimal() +

annotate("text", x = 15, y = 20, label = "Original", color = "blue") +

annotate("text", x = 15, y = 30, label = "Log X", color = "red")

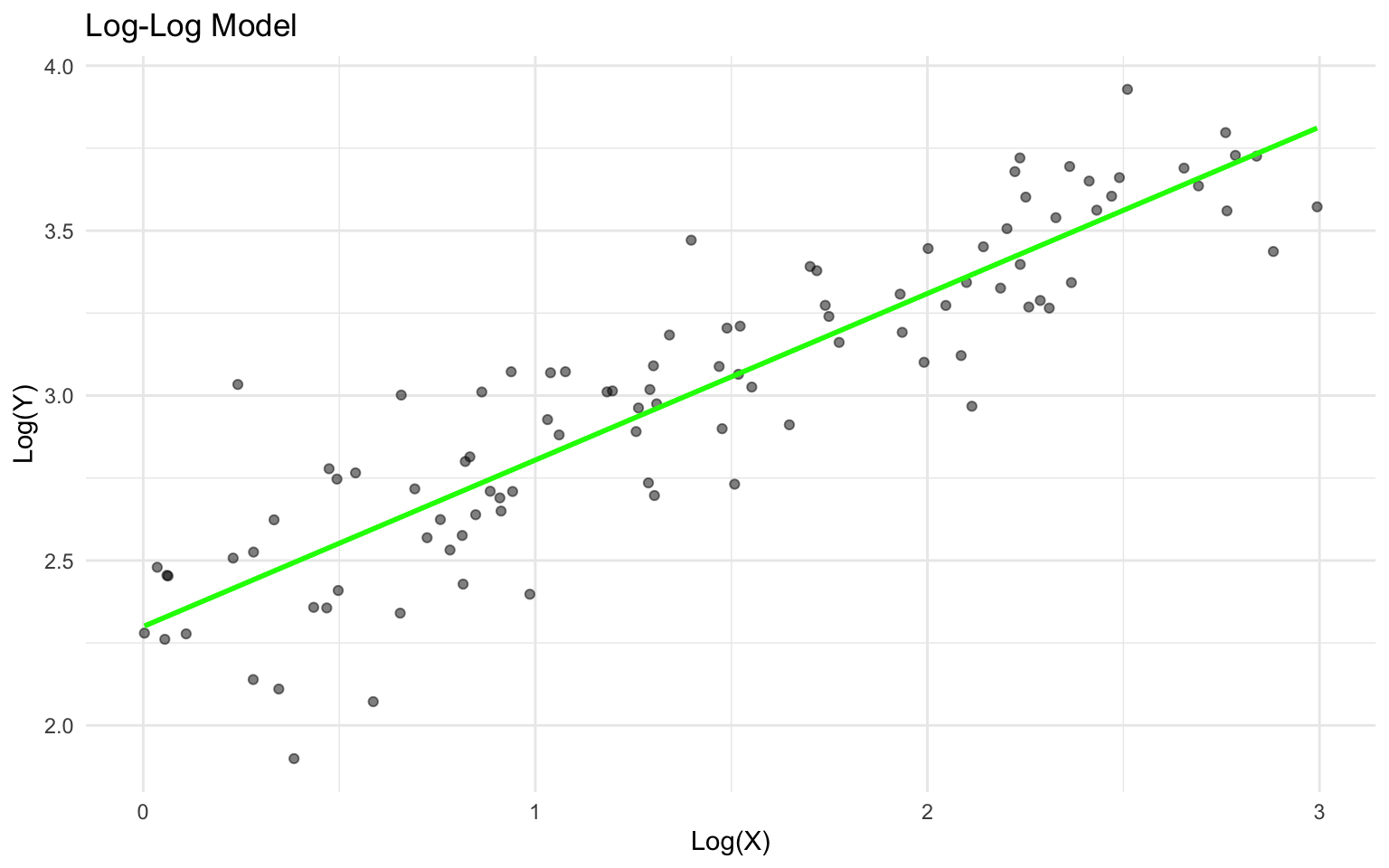

# Plot log-log model

ggplot(log_data, aes(x = log(x), y = log(y))) +

geom_point(alpha = 0.5) +

geom_smooth(method = "lm", formula = y ~ x, color = "green", se = FALSE) +

labs(

title = "Log-Log Model",

x = "Log(X)",

y = "Log(Y)"

) +

theme_minimal()

Interpreting Log-Transformed Models

The interpretation of coefficients in log-transformed models depends on the transformation:

- Log-Linear (log(y) ~ x): A one-unit increase in x is associated with a (100 * β)% change in y.

- Linear-Log (y ~ log(x)): A 1% increase in x is associated with a (β/100) unit change in y.

- Log-Log (log(y) ~ log(x)): A 1% increase in x is associated with a β% change in y (elasticity).

In our log-log model, the coefficient is 0.5048107, meaning a 1% increase in x is associated with a 0.5048107% increase in y.

3.10 Interaction Effects

Interaction effects allow the relation between an independent variable and the dependent variable to depend on the value of another independent variable.

Implementing Interaction Effects

Let’s add an interaction term to our car example:

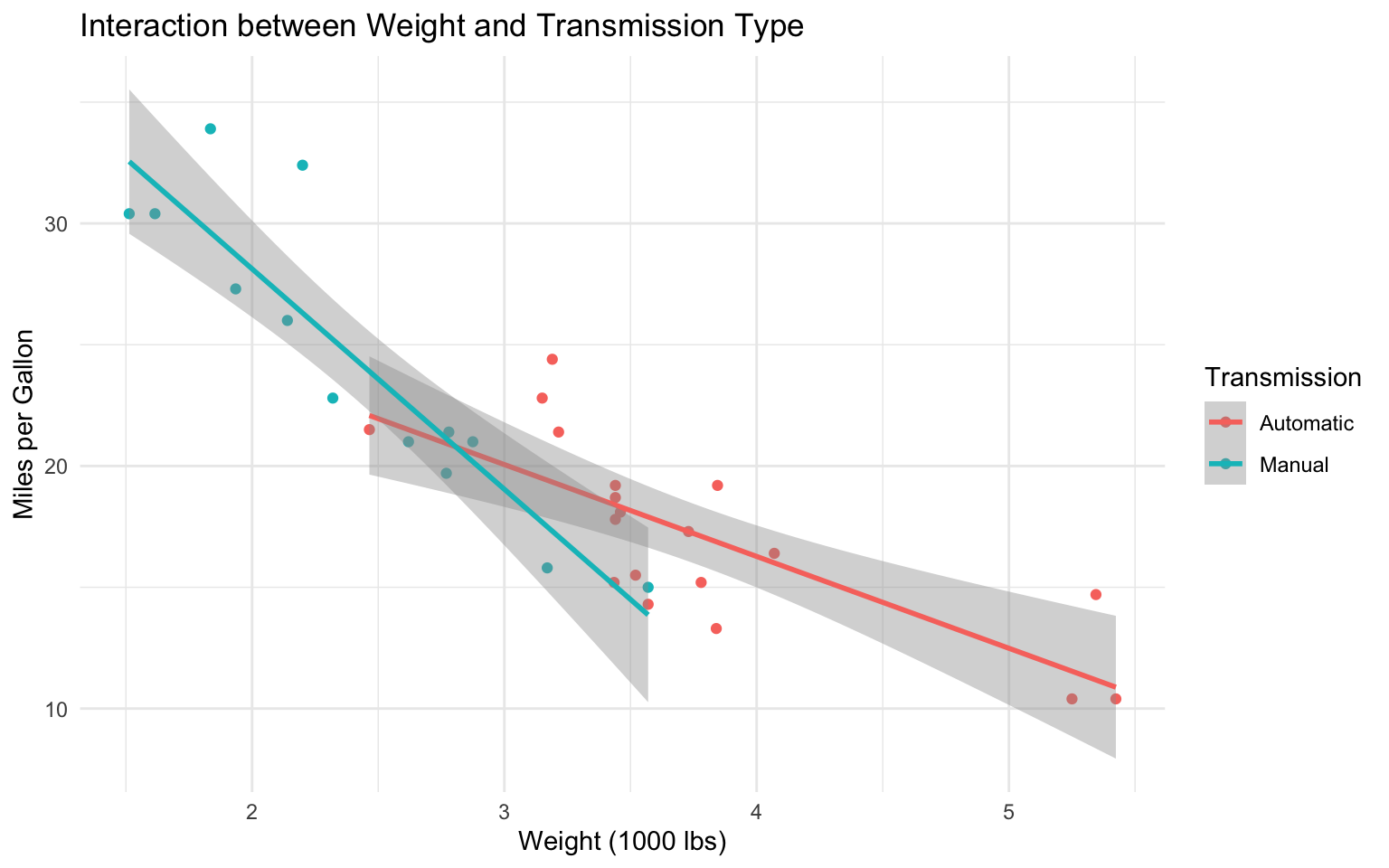

# Create a categorical variable

mtcars$am_factor <- factor(mtcars$am, labels = c("Automatic", "Manual"))

# Fit a model with an interaction

model_interaction <- lm(mpg ~ wt * am_factor, data = mtcars)

# View the model summary

summary(model_interaction)

Call:

lm(formula = mpg ~ wt * am_factor, data = mtcars)

Residuals:

Min 1Q Median 3Q Max

-3.6004 -1.5446 -0.5325 0.9012 6.0909

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 31.4161 3.0201 10.402 4.00e-11 ***

wt -3.7859 0.7856 -4.819 4.55e-05 ***

am_factorManual 14.8784 4.2640 3.489 0.00162 **

wt:am_factorManual -5.2984 1.4447 -3.667 0.00102 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.591 on 28 degrees of freedom

Multiple R-squared: 0.833, Adjusted R-squared: 0.8151

F-statistic: 46.57 on 3 and 28 DF, p-value: 5.209e-11Interpreting Interaction Effects

In a model with an interaction term, the effect of one variable depends on the value of another variable:

- The coefficient for

wt(-3.7859075) represents the effect of weight on MPG for automatic transmission cars. - The coefficient for

am_factorManual(14.8784225) represents the difference in MPG between manual and automatic transmission cars when weight is zero (not meaningful in this context). - The coefficient for the interaction term

wt:am_factorManual(-5.2983605) represents the additional effect of weight on MPG for manual transmission cars compared to automatic transmission cars.

Visualizing Interaction Effects

We can visualize the interaction effect:

# Create a plot of the interaction

ggplot(mtcars, aes(x = wt, y = mpg, color = am_factor)) +

geom_point() +

geom_smooth(method = "lm", formula = y ~ x, se = TRUE) +

labs(

title = "Interaction between Weight and Transmission Type",

x = "Weight (1000 lbs)",

y = "Miles per Gallon",

color = "Transmission"

) +

theme_minimal()

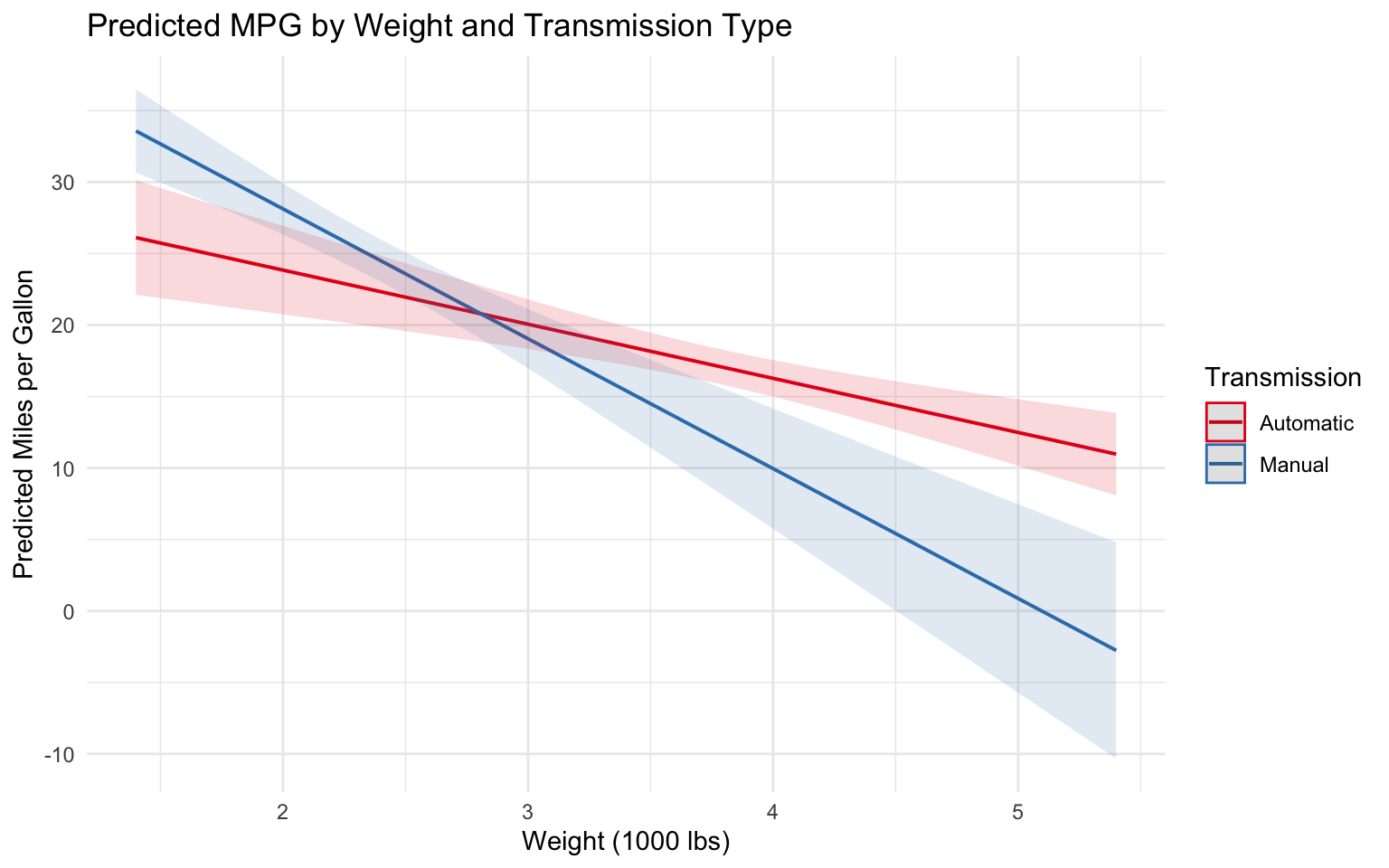

We can also use the ggeffects package to visualize predicted values:

# Visualize predicted values

pred_interaction <- ggpredict(model_interaction, terms = c("wt", "am_factor"))

# Plot predicted values

plot(pred_interaction) +

labs(

title = "Predicted MPG by Weight and Transmission Type",

x = "Weight (1000 lbs)",

y = "Predicted Miles per Gallon",

color = "Transmission"

) +

theme_minimal()

3.11 Marginal Effects

Marginal effects represent the change in the dependent variable associated with a one-unit change in an independent variable, holding other variables constant.

Calculating Marginal Effects

The marginaleffects package provides tools for calculating marginal effects:

# Calculate average marginal effects

mfx <- avg_slopes(model_interaction)

mfx

Term Contrast Estimate Std. Error z Pr(>|z|) S 2.5 %

am_factor Manual - Automatic -2.17 1.419 -1.53 0.127 3.0 -4.95

wt dY/dX -5.94 0.678 -8.75 <0.001 58.7 -7.27

97.5 %

0.613

-4.609

Type: response Visualizing Marginal Effects

We can visualize how marginal effects vary across different values of a variable:

# # Calculate marginal effects of weight at different values

# mfx_by_wt <- slopes(model_interaction, variables = "wt", newdata = datagrid(wt = seq(1.5, 5.5, by = 0.5), am_factor = "Automatic"))

#

# # Plot marginal effects

# plot_cme(mfx_by_wt) +

# labs(

# title = "Marginal Effect of Weight on MPG",

# subtitle = "For Automatic Transmission Cars",

# x = "Weight (1000 lbs)",

# y = "Marginal Effect on MPG"

# ) +

# theme_minimal()3.12 Business Case Study: Sales Response Modeling

Let’s apply regression analysis to a business case study on sales response modeling.

The Scenario

You’re a marketing analyst at a retail company. You’ve been asked to analyze the relation between advertising spending across different channels (TV, radio, and online) and sales. The goal is to understand the effectiveness of each channel and optimize the marketing budget allocation.

The Data

# Create a simulated advertising dataset

set.seed(123)

n <- 200

# Generate advertising spending

tv_spend <- runif(n, min = 5, max = 50)

radio_spend <- runif(n, min = 1, max = 20)

online_spend <- runif(n, min = 10, max = 40)

# Generate sales with diminishing returns and interaction effects

sales <- 10 + 3 * log(tv_spend) + 2 * sqrt(radio_spend) + 1.5 * online_spend +

0.1 * sqrt(tv_spend * radio_spend) + 0.05 * sqrt(tv_spend * online_spend) +

rnorm(n, mean = 0, sd = 5)

# Create a data frame

advertising_data <- tibble(

tv_spend = tv_spend,

radio_spend = radio_spend,

online_spend = online_spend,

sales = sales

)

# View the data

glimpse(advertising_data)Rows: 200

Columns: 4

$ tv_spend <dbl> 17.940988, 40.473731, 23.403961, 44.735783, 47.321028, 7.…

$ radio_spend <dbl> 5.535795, 19.284820, 12.425949, 10.785565, 8.648894, 17.7…

$ online_spend <dbl> 39.58163, 14.11202, 37.15929, 27.28906, 21.86347, 23.4940…

$ sales <dbl> 81.49215, 51.27820, 80.73489, 67.58520, 61.69338, 62.9376…Exploratory Data Analysis

Let’s start by exploring the relations in the data:

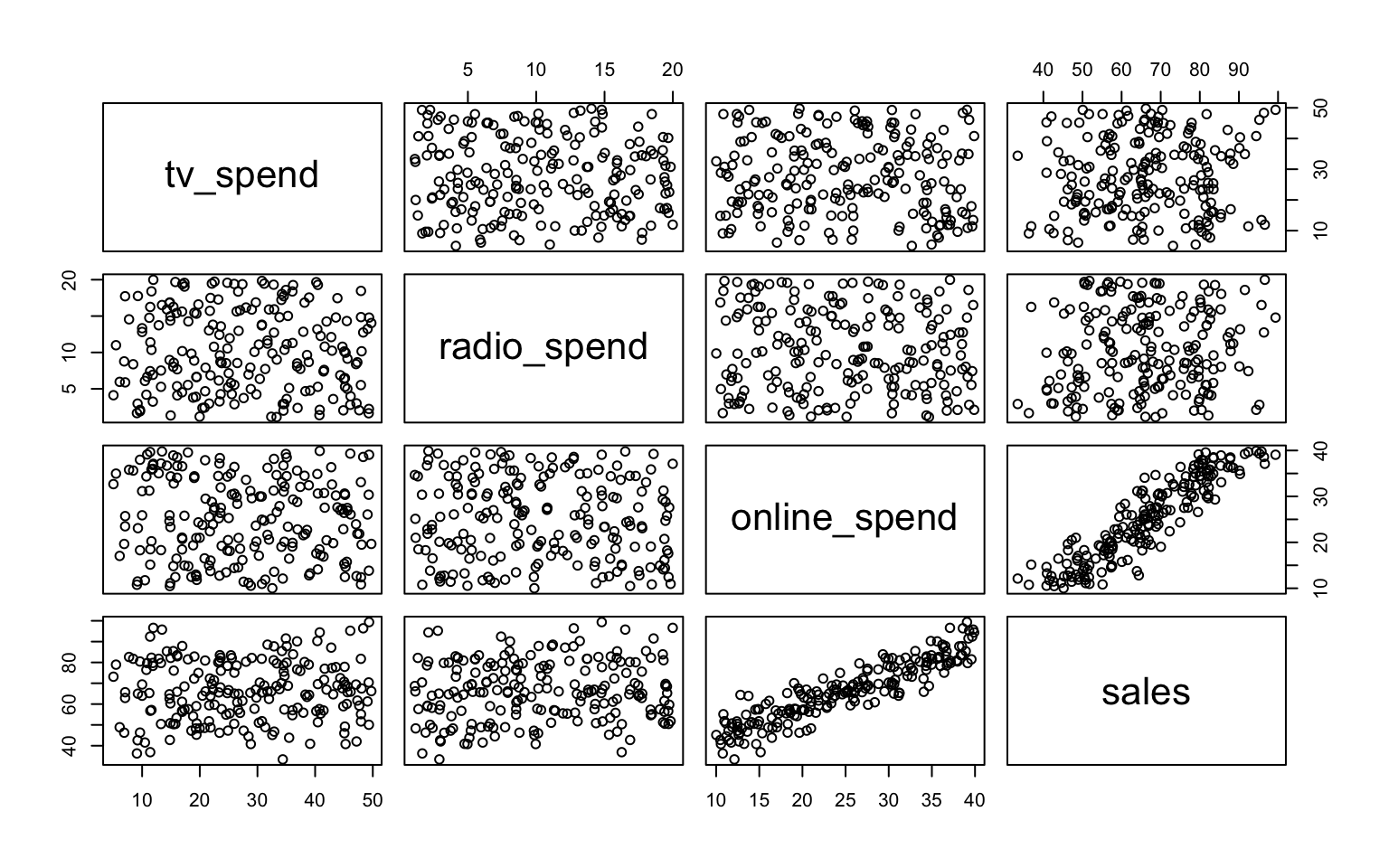

# Scatter plot matrix

pairs(advertising_data)

# Correlation matrix

cor(advertising_data) tv_spend radio_spend online_spend sales

tv_spend 1.00000000 -0.05250087 -0.06925880 0.04543969

radio_spend -0.05250087 1.00000000 -0.07378403 0.10309680

online_spend -0.06925880 -0.07378403 1.00000000 0.91240242

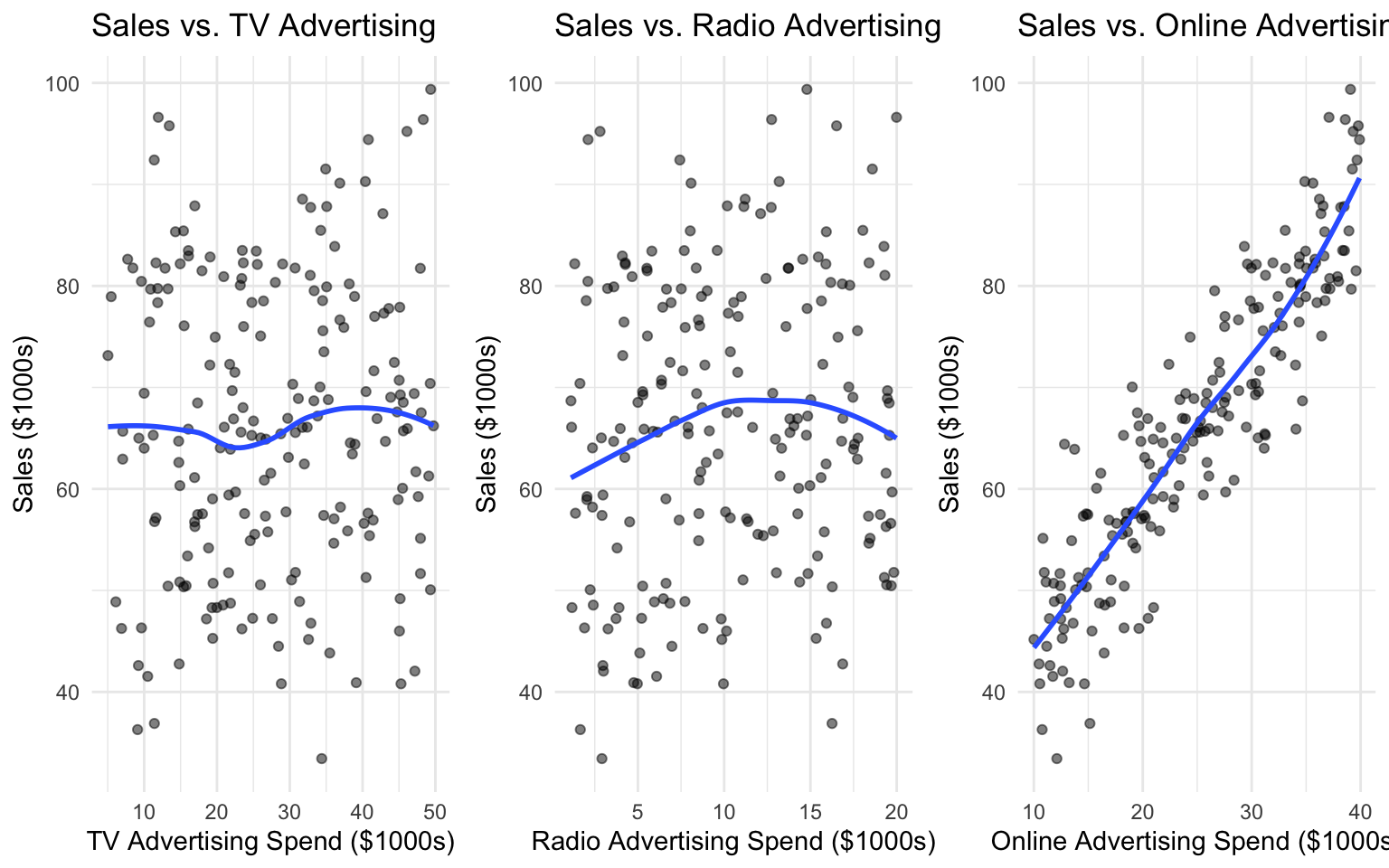

sales 0.04543969 0.10309680 0.91240242 1.00000000# Visualize relations

p1 <- ggplot(advertising_data, aes(x = tv_spend, y = sales)) +

geom_point(alpha = 0.5) +

geom_smooth(method = "loess", se = FALSE) +

labs(

title = "Sales vs. TV Advertising",

x = "TV Advertising Spend ($1000s)",

y = "Sales ($1000s)"

) +

theme_minimal()

p2 <- ggplot(advertising_data, aes(x = radio_spend, y = sales)) +

geom_point(alpha = 0.5) +

geom_smooth(method = "loess", se = FALSE) +

labs(

title = "Sales vs. Radio Advertising",

x = "Radio Advertising Spend ($1000s)",

y = "Sales ($1000s)"

) +

theme_minimal()

p3 <- ggplot(advertising_data, aes(x = online_spend, y = sales)) +

geom_point(alpha = 0.5) +

geom_smooth(method = "loess", se = FALSE) +

labs(

title = "Sales vs. Online Advertising",

x = "Online Advertising Spend ($1000s)",

y = "Sales ($1000s)"

) +

theme_minimal()

# Combine plots

gridExtra::grid.arrange(p1, p2, p3, ncol = 3)`geom_smooth()` using formula = 'y ~ x'

`geom_smooth()` using formula = 'y ~ x'

`geom_smooth()` using formula = 'y ~ x'

Model Building

Let’s build and compare several models:

# Linear model

model_linear <- lm(sales ~ tv_spend + radio_spend + online_spend, data = advertising_data)

# Model with transformations

model_trans <- lm(sales ~ log(tv_spend) + sqrt(radio_spend) + online_spend, data = advertising_data)

# Model with interactions

model_interact <- lm(sales ~ log(tv_spend) + sqrt(radio_spend) + online_spend +

I(sqrt(tv_spend * radio_spend)) + I(sqrt(tv_spend * online_spend)),

data = advertising_data)

# Compare models

modelsummary(

list(

"Linear" = model_linear,

"Transformed" = model_trans,

"Interaction" = model_interact

),

stars = TRUE,

gof_map = c("nobs", "r.squared", "adj.r.squared", "AIC", "BIC")

)| Linear | Transformed | Interaction | |

|---|---|---|---|

| + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001 | |||

| (Intercept) | 19.545*** | 9.796*** | 13.997+ |

| (1.614) | (2.833) | (8.462) | |

| tv_spend | 0.138*** | ||

| (0.029) | |||

| radio_spend | 0.457*** | ||

| (0.065) | |||

| online_spend | 1.526*** | 1.523*** | 1.525*** |

| (0.041) | (0.041) | (0.141) | |

| log(tv_spend) | 3.229*** | 1.914 | |

| (0.684) | (3.318) | ||

| sqrt(radio_spend) | 2.614*** | 1.619 | |

| (0.383) | (1.525) | ||

| I(sqrt(tv_spend * radio_spend)) | 0.197 | ||

| (0.291) | |||

| I(sqrt(tv_spend * online_spend)) | -0.002 | ||

| (0.261) | |||

| Num.Obs. | 200 | 200 | 200 |

| R2 | 0.876 | 0.875 | 0.876 |

| R2 Adj. | 0.874 | 0.873 | 0.873 |

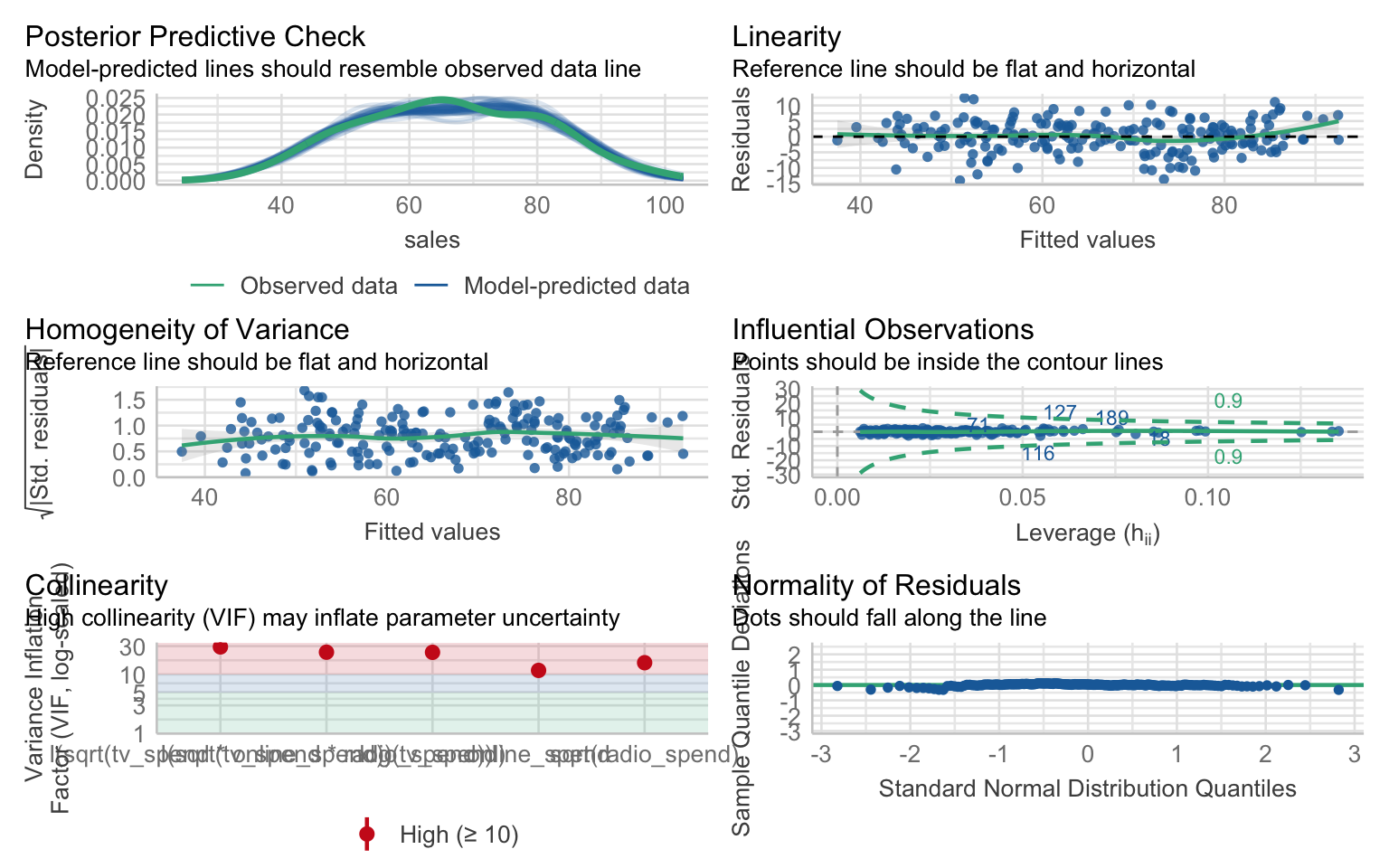

Model Diagnostics

Let’s check the assumptions of our best model:

# Check model assumptions

check_model(model_interact)

Calculating Elasticities

In marketing, elasticities are often used to measure the responsiveness of sales to changes in advertising spending:

# Calculate elasticities at the mean

mean_values <- colMeans(advertising_data)

# TV elasticity

tv_elasticity <- coef(model_interact)[2] * (mean_values["tv_spend"] / mean_values["sales"])

# Radio elasticity

radio_elasticity <- coef(model_interact)[3] * (0.5 / sqrt(mean_values["radio_spend"])) * (mean_values["radio_spend"] / mean_values["sales"])

# Online elasticity

online_elasticity <- coef(model_interact)[4] * (mean_values["online_spend"] / mean_values["sales"])

# Create a table of elasticities

elasticities <- tibble(

Channel = c("TV", "Radio", "Online"),

Elasticity = c(tv_elasticity, radio_elasticity, online_elasticity)

)

elasticities# A tibble: 3 × 2

Channel Elasticity

<chr> <dbl>

1 TV 0.802

2 Radio 0.0391

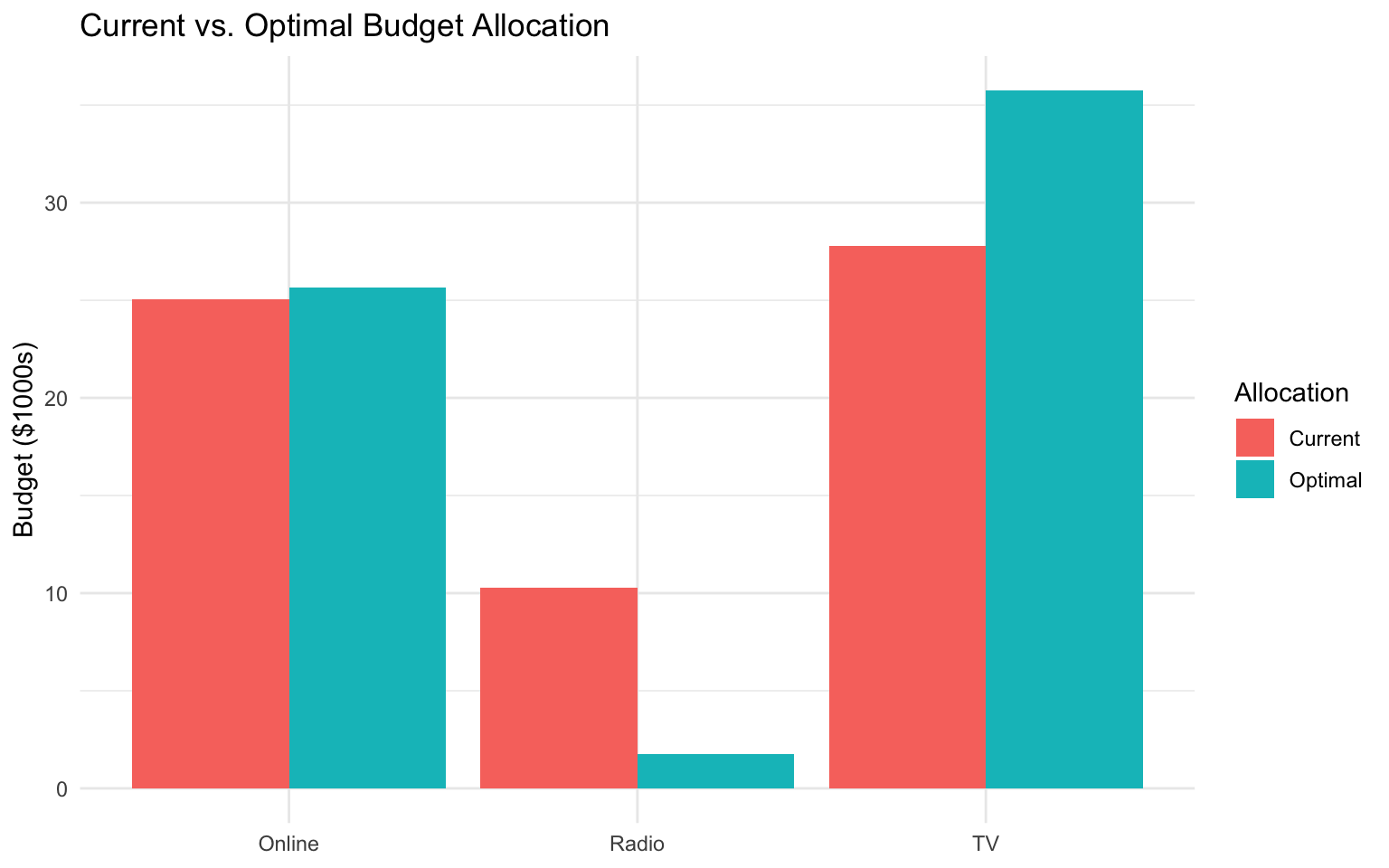

3 Online 0.576 Optimal Budget Allocation

Based on the elasticities, we can determine the optimal budget allocation:

# Total budget

total_budget <- sum(mean_values[c("tv_spend", "radio_spend", "online_spend")])

# Optimal allocation based on elasticities

optimal_allocation <- elasticities %>%

mutate(

Proportion = Elasticity / sum(Elasticity),

Optimal_Budget = Proportion * total_budget

)

optimal_allocation# A tibble: 3 × 4

Channel Elasticity Proportion Optimal_Budget

<chr> <dbl> <dbl> <dbl>

1 TV 0.802 0.566 35.7

2 Radio 0.0391 0.0276 1.74

3 Online 0.576 0.407 25.7 Visualizing the Results

Let’s visualize the current vs. optimal budget allocation:

# Current allocation

current_allocation <- tibble(

Channel = c("TV", "Radio", "Online"),

Budget = c(mean_values["tv_spend"], mean_values["radio_spend"], mean_values["online_spend"]),

Allocation = "Current"

)

# Combine with optimal allocation

allocation_comparison <- bind_rows(

current_allocation,

optimal_allocation %>% select(Channel, Budget = Optimal_Budget) %>% mutate(Allocation = "Optimal")

)

# Plot the comparison

ggplot(allocation_comparison, aes(x = Channel, y = Budget, fill = Allocation)) +

geom_bar(stat = "identity", position = "dodge") +

labs(

title = "Current vs. Optimal Budget Allocation",

x = NULL,

y = "Budget ($1000s)"

) +

theme_minimal()

Business Recommendations

Based on our analysis, we can provide the following recommendations:

- Budget Reallocation: Shift some budget from online advertising to TV and radio advertising, as they have higher elasticities.

- Diminishing Returns: Be aware of diminishing returns, especially for TV advertising (log transformation).

- Synergy Effects: Leverage the positive interaction effects between TV and radio advertising.

- Continuous Monitoring: Regularly update the model as new data becomes available to ensure optimal budget allocation.

3.13 Exercises

Exercise 1: Simple and Multiple Regression

Using the mtcars dataset:

- Fit a simple linear regression model with

mpgas the dependent variable andhpas the independent variable. - Fit a multiple regression model with

mpgas the dependent variable andhp,wt, andqsecas independent variables. - Compare the two models using appropriate statistical tests and criteria.

- Interpret the coefficients of the multiple regression model in business terms.

- Check the assumptions of the multiple regression model and address any violations.

Exercise 2: Fixed Effects Regression

Using the panel data example from this chapter:

- Create a new panel dataset with firms, years, and additional variables of your choice.

- Fit a pooled OLS model, a firm fixed effects model, and a two-way fixed effects model.

- Compare the models and interpret the results.

- Explain why fixed effects might be important in this context.

- Visualize the estimated fixed effects and discuss their implications.

Exercise 3: Non-linear Regression

Using a dataset of your choice:

- Identify a relation that appears to be non-linear.

- Fit at least three different non-linear models (e.g., polynomial, log-transformed).

- Compare the models using appropriate criteria.

- Interpret the results of the best-fitting model.

- Create visualizations to illustrate the non-linear relation.

Exercise 4: Business Application

You are a business analyst at a company that wants to understand the factors affecting employee productivity:

- Create a simulated dataset with variables such as hours worked, experience, training, team size, and productivity.

- Explore the relations in the data using appropriate visualizations.

- Fit multiple regression models to identify the key drivers of productivity.

- Check model assumptions and address any issues.

- Provide business recommendations based on your analysis.

Exercise 5: Multicollinearity Analysis

Using a dataset of your choice:

- Create a regression model with potential multicollinearity issues.

- Calculate and interpret VIF values for the independent variables.

- Apply at least two different methods to address multicollinearity.

- Compare the original and modified models.

- Discuss the trade-offs between addressing multicollinearity and maintaining model interpretability.

3.14 Summary

In this chapter, we’ve covered the fundamentals of regression analysis for business applications. We’ve learned how to:

- Implement and interpret simple and multiple linear regression models

- Use fixed effects regression for panel data

- Apply non-linear regression techniques

- Perform model diagnostics to validate regression assumptions

- Identify and address multicollinearity using VIF analysis

- Compare and select models based on statistical criteria

- Visualize regression results for business presentations

- Calculate and interpret marginal effects and elasticities

- Apply regression analysis to business problems like sales response modeling

These skills provide a solid foundation for predictive modeling in business contexts. By understanding the relations between variables and quantifying their effects, you can make more informed business decisions and develop effective strategies.

In the next chapter, we’ll build on these skills to explore classification models, which are useful for predicting categorical outcomes such as customer churn, credit default, and purchase decisions.

3.15 References

- Fox, J. (2015). Applied Regression Analysis and Generalized Linear Models. SAGE Publications.

- Wooldridge, J. M. (2010). Econometric Analysis of Cross Section and Panel Data. MIT Press.

- James, G., Witten, D., Hastie, T., & Tibshirani, R. (2021). An Introduction to Statistical Learning with Applications in R. Springer.

- Bergeaud, A., & Vermare, L. (2022). The fixest R Package: Fast Fixed-Effects Estimation. https://cran.r-project.org/web/packages/fixest/vignettes/fixest_walkthrough.html

- Huntington-Klein, N. (2021). The Effect: An Introduction to Research Design and Causality. https://theeffectbook.net/ch-FixedEffects.html

- Belsley, D. A., Kuh, E., & Welsch, R. E. (1980). Regression Diagnostics: Identifying Influential Data and Sources of Collinearity. Wiley.