# Install required packages if not already installed

if (!require("tidyverse")) install.packages("tidyverse")

if (!require("tidymodels")) install.packages("tidymodels")

if (!require("rpart")) install.packages("rpart")

if (!require("rpart.plot")) install.packages("rpart.plot")

if (!require("ranger")) install.packages("ranger")

if (!require("vip")) install.packages("vip")

if (!require("pROC")) install.packages("pROC")

if (!require("ROSE")) install.packages("ROSE")

if (!require("themis")) install.packages("themis")4 🔍 Predictive Modeling II: Probabilistic & 🌳 Tree-Based Classification

4.1 Learning Objectives

By the end of this chapter, you will be able to:

- Understand the principles of classification for business applications

- Implement logistic regression models for binary classification

- Apply tree-based classification algorithms including decision trees and random forests

- Evaluate classification model performance using appropriate metrics

- Interpret classification results in business contexts

- Handle class imbalance in classification problems

- Compare and select models based on business requirements

- Visualize classification results for business presentations

4.2 Prerequisites

For this chapter, you’ll need:

- R and RStudio installed on your computer

- Understanding of data manipulation with dplyr (covered in Chapter 1)

- Basic knowledge of data visualization with ggplot2 (covered in Chapter 2)

- Familiarity with regression analysis (covered in Chapter 3)

- The following R packages installed:

# Load required packages

library(tidyverse) # For data manipulation and visualization

library(tidymodels) # For modeling framework

library(rpart) # For decision trees

library(rpart.plot) # For plotting decision trees

library(ranger) # For random forests

library(vip) # For variable importance plots

library(pROC) # For ROC curves

library(ROSE) # For handling class imbalance

library(themis) # For handling class imbalance in recipes4.3 Introduction to Classification

Classification is a supervised learning technique used to predict categorical outcomes. It’s one of the most widely used techniques in business analytics for predicting customer behavior, risk assessment, and decision-making.

Why Classification in Business?

Classification models are valuable in business for several reasons:

- Customer Segmentation: Identifying customer groups for targeted marketing

- Churn Prediction: Predicting which customers are likely to leave

- Credit Scoring: Assessing creditworthiness and default risk

- Fraud Detection: Identifying fraudulent transactions

- Product Recommendation: Recommending products based on customer preferences

- Quality Control: Detecting defective products

Types of Classification Models

There are several types of classification models, each with its own strengths and weaknesses:

- Logistic Regression: A probabilistic approach for binary classification

- Decision Trees: Rule-based models with a tree-like structure

- Random Forests: Ensemble of decision trees for improved accuracy

- Support Vector Machines: Models that find the optimal boundary between classes

- Naive Bayes: Probabilistic classifiers based on Bayes’ theorem

- Neural Networks: Deep learning models for complex patterns

In this chapter, we’ll focus on logistic regression and tree-based methods, which are widely used in business applications.

4.4 Binary Classification with Logistic Regression

Logistic regression is a statistical method for binary classification that models the probability of an observation belonging to a particular category.

The Logistic Regression Model

The logistic regression model is:

\[P(Y = 1) = \frac{1}{1 + e^{-(\beta_0 + \beta_1 X_1 + \beta_2 X_2 + \ldots + \beta_p X_p)}}\]

Where: - \(P(Y = 1)\) is the probability of the positive class - \(X_1, X_2, \ldots, X_p\) are the independent variables - \(\beta_0, \beta_1, \beta_2, \ldots, \beta_p\) are the coefficients

The logit transformation converts this to a linear model:

\[\log\left(\frac{P(Y = 1)}{1 - P(Y = 1)}\right) = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + \ldots + \beta_p X_p\]

Implementing Logistic Regression in R

Let’s start with a simple example using the Default dataset from the ISLR package, which contains information about credit card default:

# Load the ISLR package for the Default dataset

if (!require("ISLR")) install.packages("ISLR")Loading required package: ISLRWarning: package 'ISLR' was built under R version 4.4.1library(ISLR)

# Explore the data

glimpse(Default)Rows: 10,000

Columns: 4

$ default <fct> No, No, No, No, No, No, No, No, No, No, No, No, No, No, No, No…

$ student <fct> No, Yes, No, No, No, Yes, No, Yes, No, No, Yes, Yes, No, No, N…

$ balance <dbl> 729.5265, 817.1804, 1073.5492, 529.2506, 785.6559, 919.5885, 8…

$ income <dbl> 44361.625, 12106.135, 31767.139, 35704.494, 38463.496, 7491.55…# Convert to a tibble for better printing

default_data <- as_tibble(Default)

# Check the class distribution

default_data %>%

count(default) %>%

mutate(pct = n / sum(n) * 100)# A tibble: 2 × 3

default n pct

<fct> <int> <dbl>

1 No 9667 96.7

2 Yes 333 3.33Let’s visualize the relations between default status and some predictors:

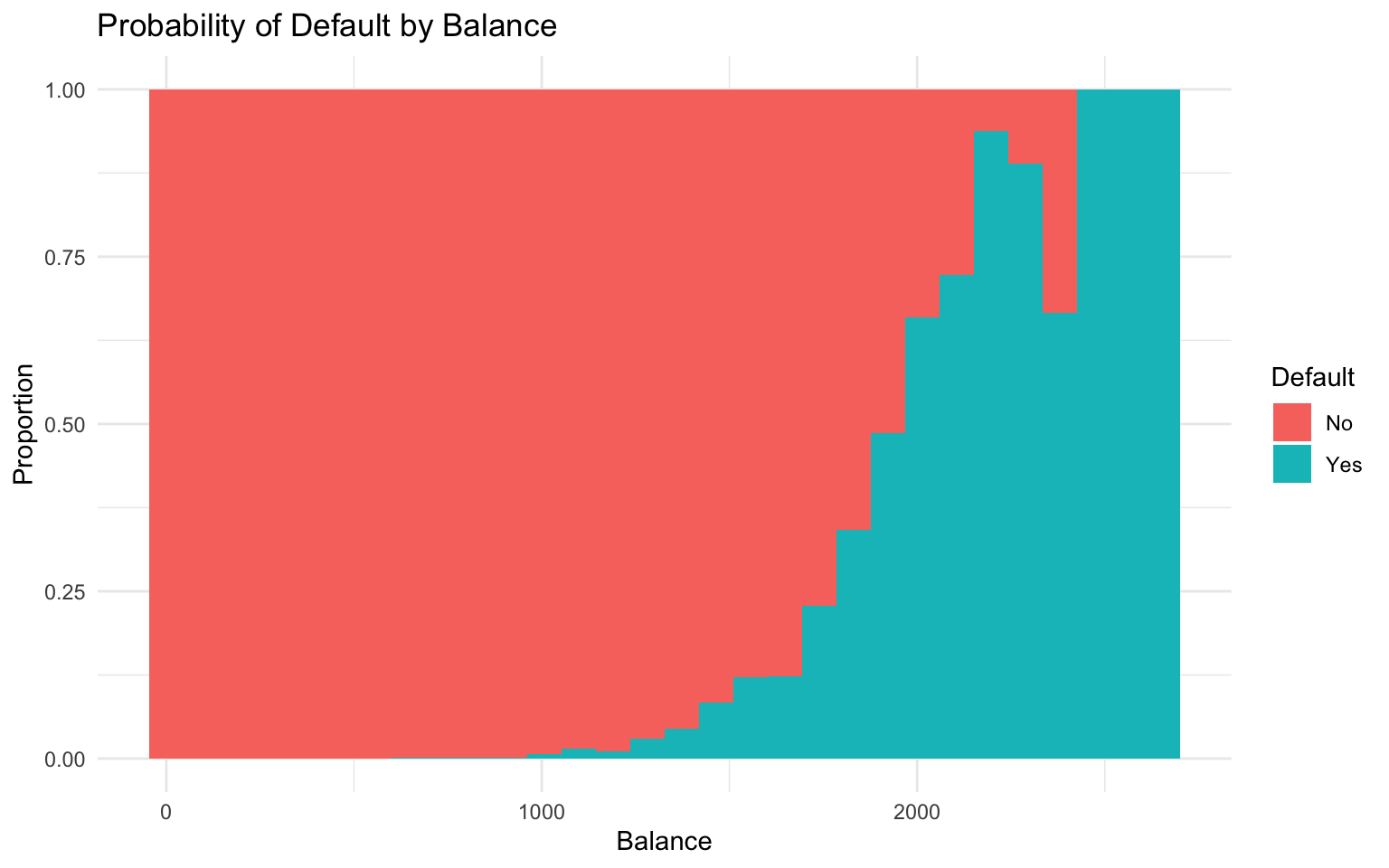

# Visualize the relation between balance and default

ggplot(default_data, aes(x = balance, fill = default)) +

geom_histogram(position = "fill", bins = 30) +

labs(

title = "Probability of Default by Balance",

x = "Balance",

y = "Proportion",

fill = "Default"

) +

theme_minimal()

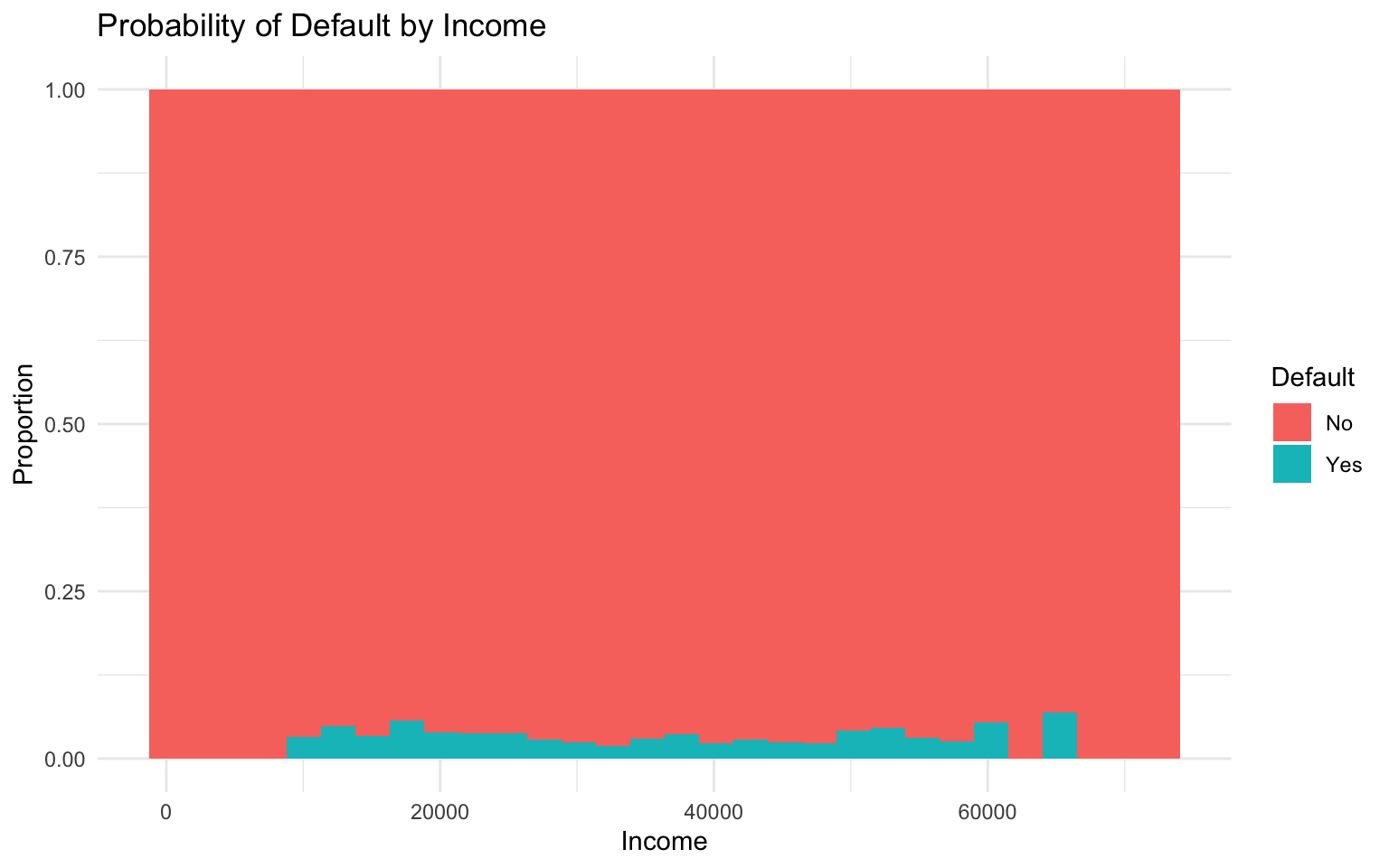

# Visualize the relation between income and default

ggplot(default_data, aes(x = income, fill = default)) +

geom_histogram(position = "fill", bins = 30) +

labs(

title = "Probability of Default by Income",

x = "Income",

y = "Proportion",

fill = "Default"

) +

theme_minimal()

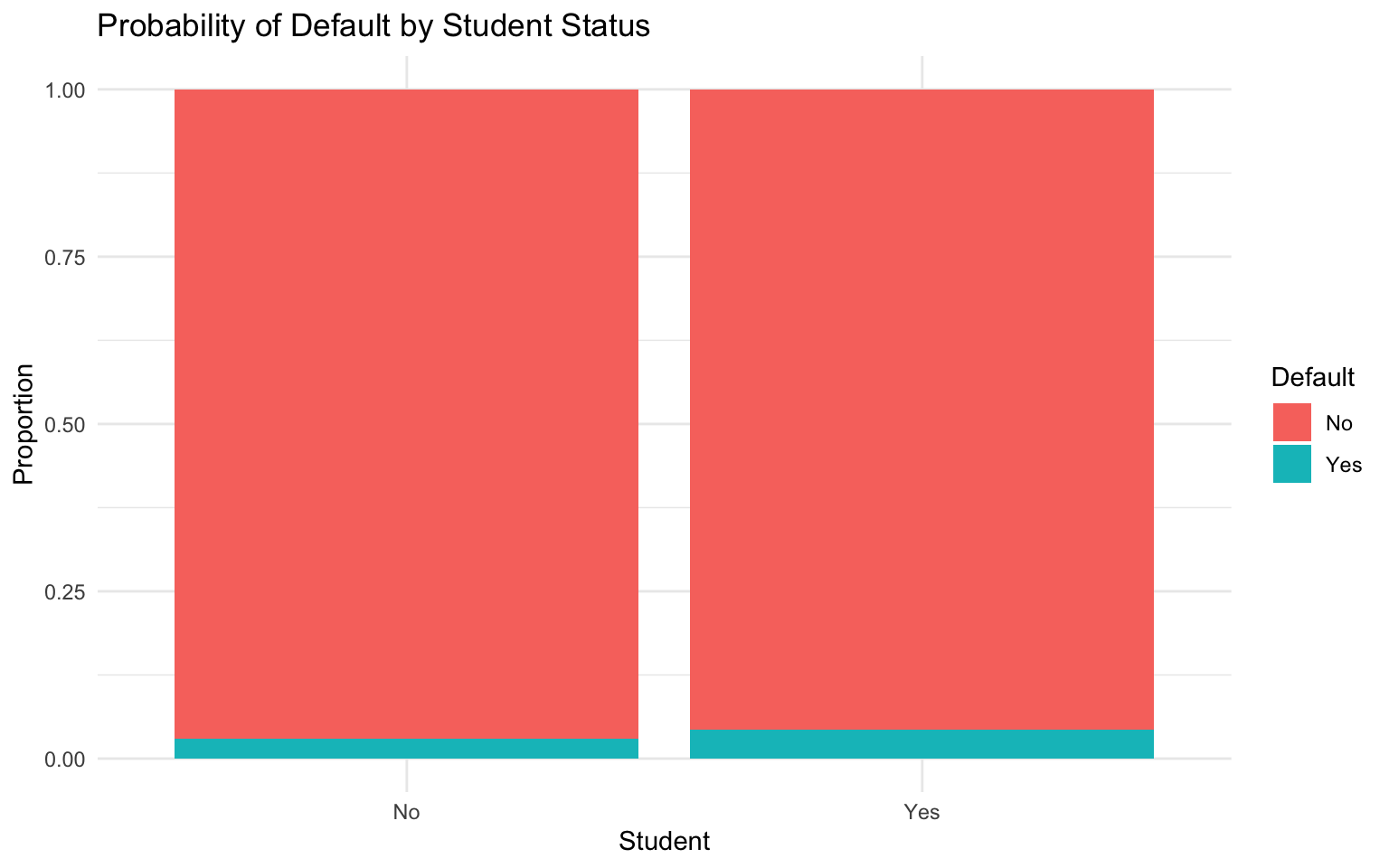

# Visualize the relation between student status and default

ggplot(default_data, aes(x = student, fill = default)) +

geom_bar(position = "fill") +

labs(

title = "Probability of Default by Student Status",

x = "Student",

y = "Proportion",

fill = "Default"

) +

theme_minimal()

Now, let’s fit a logistic regression model:

# Split the data into training and testing sets

set.seed(123)

default_split <- initial_split(default_data, prop = 0.75, strata = default)

default_train <- training(default_split)

default_test <- testing(default_split)

# Fit a logistic regression model

logistic_model <- glm(default ~ balance + income + student,

data = default_train,

family = "binomial")

# View the model summary

summary(logistic_model)

Call:

glm(formula = default ~ balance + income + student, family = "binomial",

data = default_train)

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -1.088e+01 5.748e-01 -18.922 <2e-16 ***

balance 5.780e-03 2.701e-04 21.398 <2e-16 ***

income 5.678e-07 9.613e-06 0.059 0.953

studentYes -7.005e-01 2.754e-01 -2.544 0.011 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 2158.4 on 7499 degrees of freedom

Residual deviance: 1138.7 on 7496 degrees of freedom

AIC: 1146.7

Number of Fisher Scoring iterations: 8Interpreting Logistic Regression Results

The coefficients in logistic regression represent the change in the log odds of the positive class for a one-unit increase in the predictor, holding other predictors constant.

To make the interpretation more intuitive, we can convert the coefficients to odds ratios by exponentiating them:

# Convert coefficients to odds ratios

odds_ratios <- exp(coef(logistic_model))

odds_ratios (Intercept) balance income studentYes

1.891114e-05 1.005797e+00 1.000001e+00 4.963453e-01 For example, the odds ratio for balance is 1.0058, meaning that for each additional dollar in balance, the odds of default increase by a factor of 1.0058, holding other variables constant.

For categorical variables like student, the odds ratio represents the odds of default for students compared to non-students, holding other variables constant.

Making Predictions with Logistic Regression

We can use the model to make predictions on the test set:

# Make predictions on the test set

default_pred <- default_test %>%

mutate(

default_prob = predict(logistic_model, newdata = default_test, type = "response"),

default_pred = ifelse(default_prob > 0.5, "Yes", "No"),

default_pred = factor(default_pred, levels = c("No", "Yes"))

)

# View the first few predictions

default_pred %>%

select(default, default_prob, default_pred) %>%

head(10)# A tibble: 10 × 3

default default_prob default_pred

<fct> <dbl> <fct>

1 No 0.00191 No

2 No 0.000325 No

3 No 0.00864 No

4 No 0.000786 No

5 No 0.0796 No

6 No 0.00380 No

7 No 0.0345 No

8 No 0.00106 No

9 No 0.000147 No

10 No 0.000843 No Evaluating Logistic Regression Performance

To evaluate the performance of our logistic regression model, we can use various metrics:

# Create a confusion matrix

conf_mat <- conf_mat(default_pred, truth = default, estimate = default_pred)

conf_mat Truth

Prediction No Yes

No 2405 65

Yes 7 23# Calculate accuracy, precision, recall, and F1 score

metrics <- metric_set(accuracy, precision, recall, f_meas)

metrics(default_pred, truth = default, estimate = default_pred)# A tibble: 4 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 accuracy binary 0.971

2 precision binary 0.974

3 recall binary 0.997

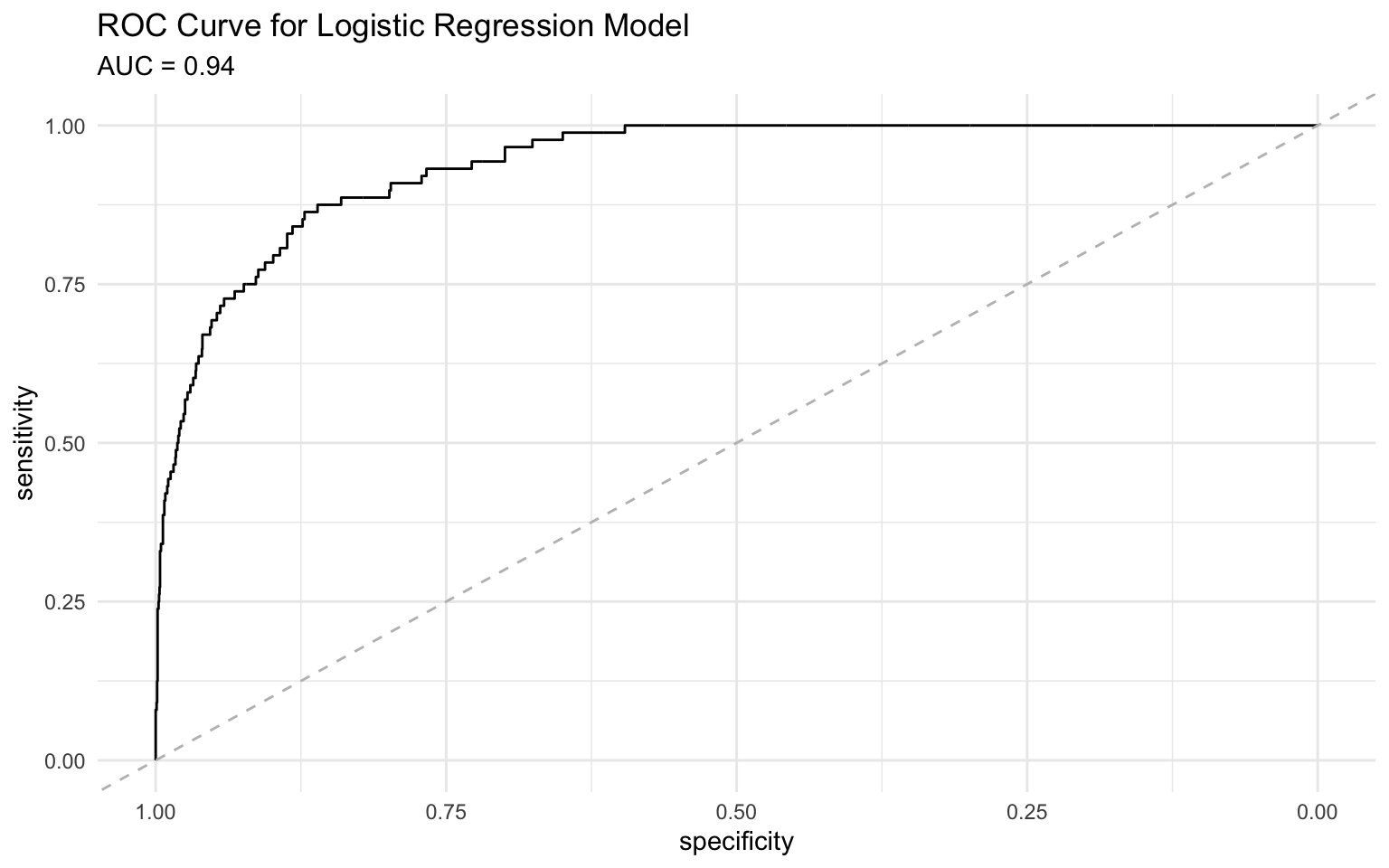

4 f_meas binary 0.985We can also create an ROC curve to visualize the trade-off between sensitivity and specificity:

# Create an ROC curve using pROC package for better curve properties

roc_obj <- roc(default_pred$default, default_pred$default_prob)Setting levels: control = No, case = YesSetting direction: controls < casesauc_value <- round(auc(roc_obj), 3)

# Plot the ROC curve

ggroc(roc_obj) +

geom_abline(slope = 1, intercept = 1, linetype = "dashed", color = "gray") +

labs(

title = "ROC Curve for Logistic Regression Model",

subtitle = paste("AUC =", auc_value)

) +

theme_minimal()

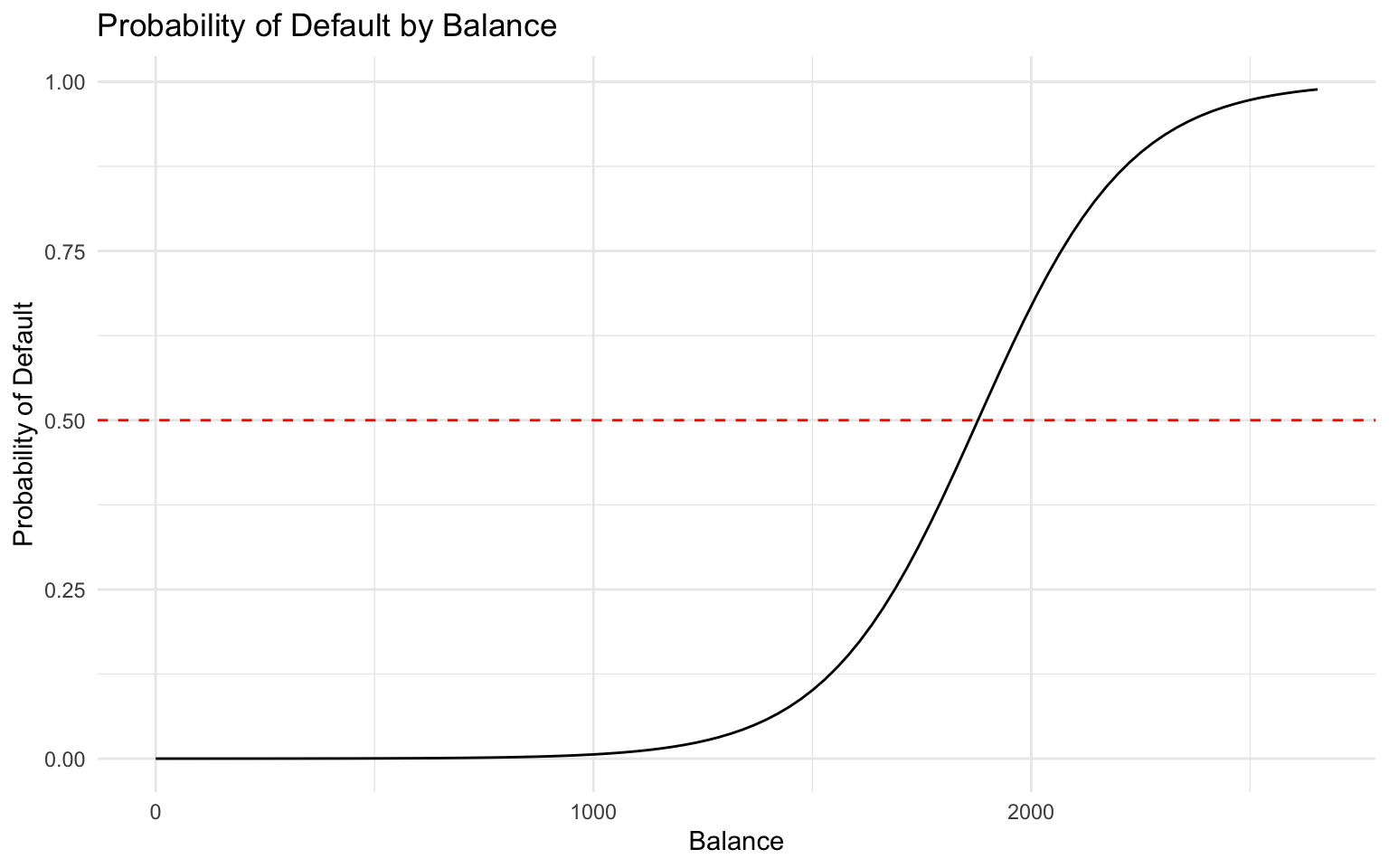

Visualizing Logistic Regression Results

We can visualize the relation between predictors and the predicted probability of default:

# Create a grid of balance values

balance_grid <- tibble(

balance = seq(min(default_data$balance), max(default_data$balance), length.out = 100),

income = mean(default_data$income),

student = "No"

)

# Make predictions on the grid

balance_grid <- balance_grid %>%

mutate(default_prob = predict(logistic_model, newdata = balance_grid, type = "response"))

# Plot the relation

ggplot(balance_grid, aes(x = balance, y = default_prob)) +

geom_line() +

geom_hline(yintercept = 0.5, linetype = "dashed", color = "red") +

labs(

title = "Probability of Default by Balance",

x = "Balance",

y = "Probability of Default"

) +

theme_minimal()

4.5 Decision Trees

Decision trees are rule-based models that recursively split the data based on the values of the predictors to create homogeneous groups.

How Decision Trees Work

Decision trees work by:

- Selecting the best feature to split the data

- Creating child nodes based on the split

- Recursively repeating the process for each child node

- Stopping when a stopping criterion is met (e.g., maximum depth, minimum samples per leaf)

The best split is determined by measures like Gini impurity or information gain, which quantify the homogeneity of the resulting nodes.

Implementing Decision Trees in R

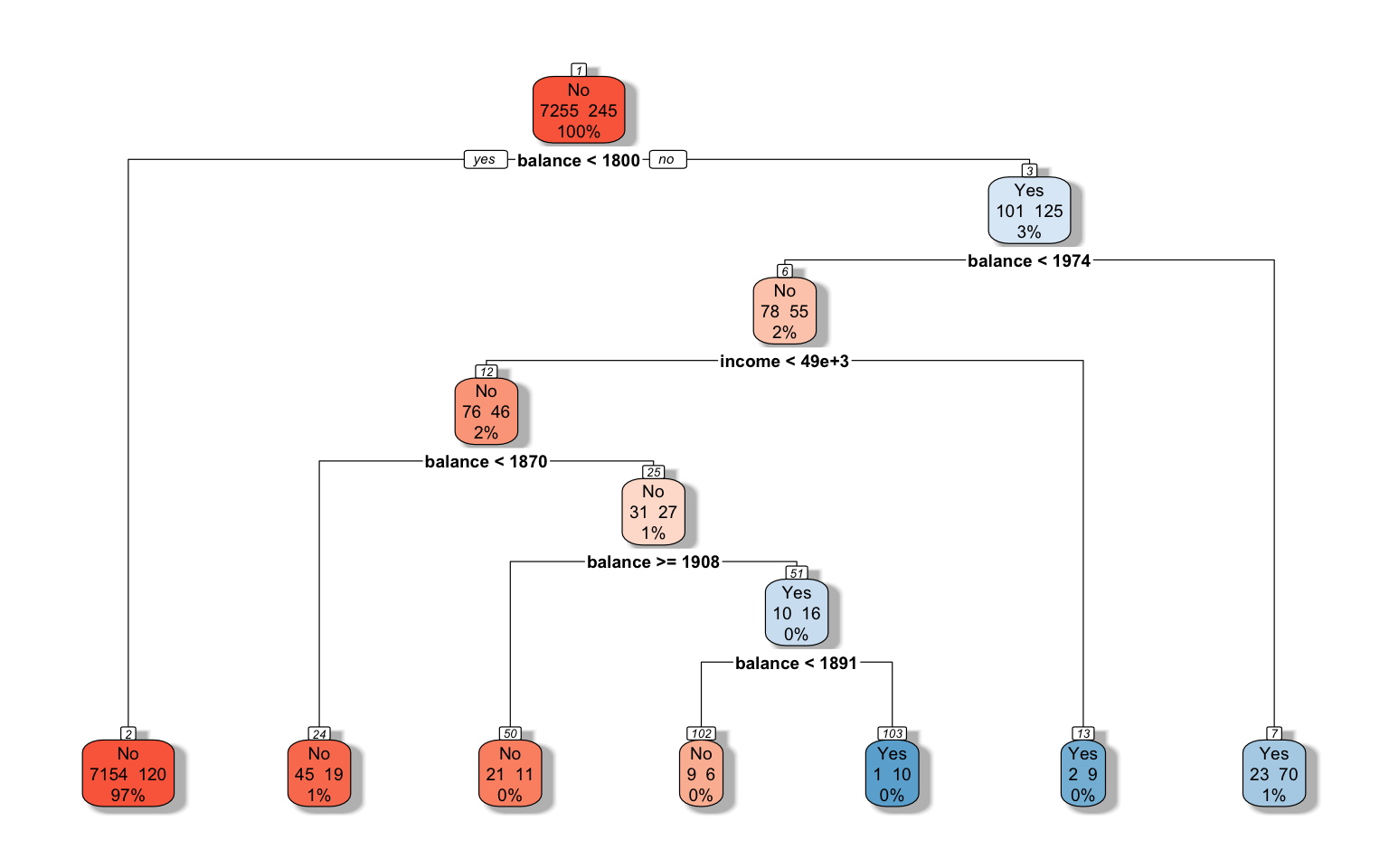

Let’s implement a decision tree for the credit default data:

# Fit a decision tree model

tree_model <- rpart(default ~ balance + income + student,

data = default_train,

method = "class",

control = rpart.control(cp = 0.01))

# Plot the decision tree

rpart.plot(tree_model, extra = 101, box.palette = "RdBu", shadow.col = "gray", nn = TRUE)

Interpreting Decision Trees

Decision trees are highly interpretable. Each node shows:

- The predicted class

- The probability of the positive class

- The percentage of observations in the node

The splits show the rules used to segment the data. For example, the first split might be “balance < 1000”, meaning that customers with a balance less than $1,000 go to the left branch, and those with a balance of $1,000 or more go to the right branch.

Making Predictions with Decision Trees

We can use the decision tree to make predictions on the test set:

# Make predictions on the test set

tree_pred <- default_test %>%

mutate(

default_prob = predict(tree_model, newdata = default_test, type = "prob")[, 2],

default_pred = predict(tree_model, newdata = default_test, type = "class")

)

# View the first few predictions

tree_pred %>%

select(default, default_prob, default_pred) %>%

head(10)# A tibble: 10 × 3

default default_prob default_pred

<fct> <dbl> <fct>

1 No 0.0165 No

2 No 0.0165 No

3 No 0.0165 No

4 No 0.0165 No

5 No 0.0165 No

6 No 0.0165 No

7 No 0.0165 No

8 No 0.0165 No

9 No 0.0165 No

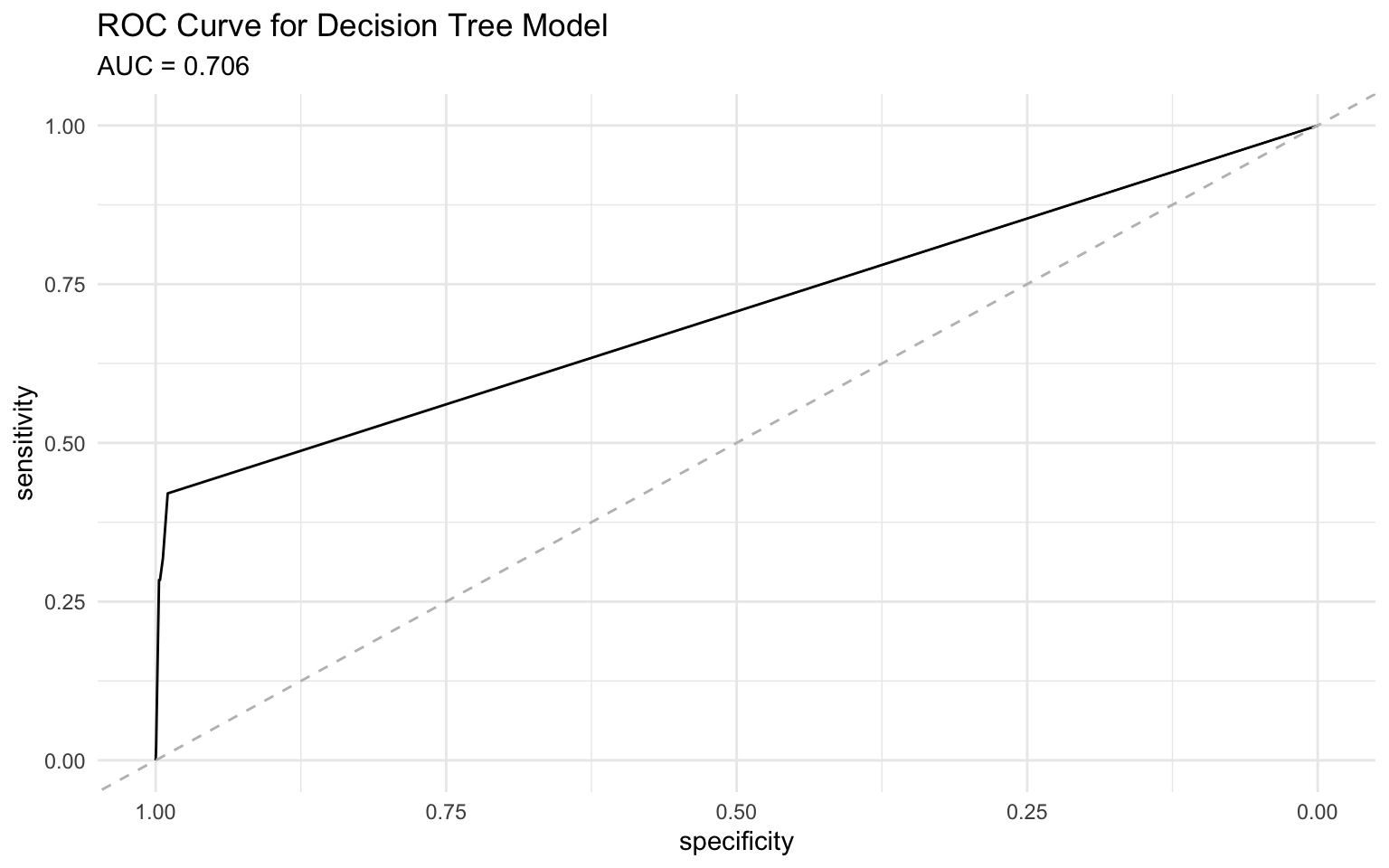

10 No 0.0165 No Evaluating Decision Tree Performance

Let’s evaluate the performance of our decision tree model:

# Create a confusion matrix

conf_mat(tree_pred, truth = default, estimate = default_pred) Truth

Prediction No Yes

No 2405 63

Yes 7 25# Calculate accuracy, precision, recall, and F1 score

metrics(tree_pred, truth = default, estimate = default_pred)# A tibble: 4 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 accuracy binary 0.972

2 precision binary 0.974

3 recall binary 0.997

4 f_meas binary 0.986# Create an ROC curve using pROC package for better curve properties

roc_obj <- roc(tree_pred$default, tree_pred$default_prob)Setting levels: control = No, case = YesSetting direction: controls < casesauc_value <- round(auc(roc_obj), 3)

# Plot the ROC curve

ggroc(roc_obj) +

geom_abline(slope = 1, intercept = 1, linetype = "dashed", color = "gray") +

labs(

title = "ROC Curve for Decision Tree Model",

subtitle = paste("AUC =", auc_value)

) +

theme_minimal()

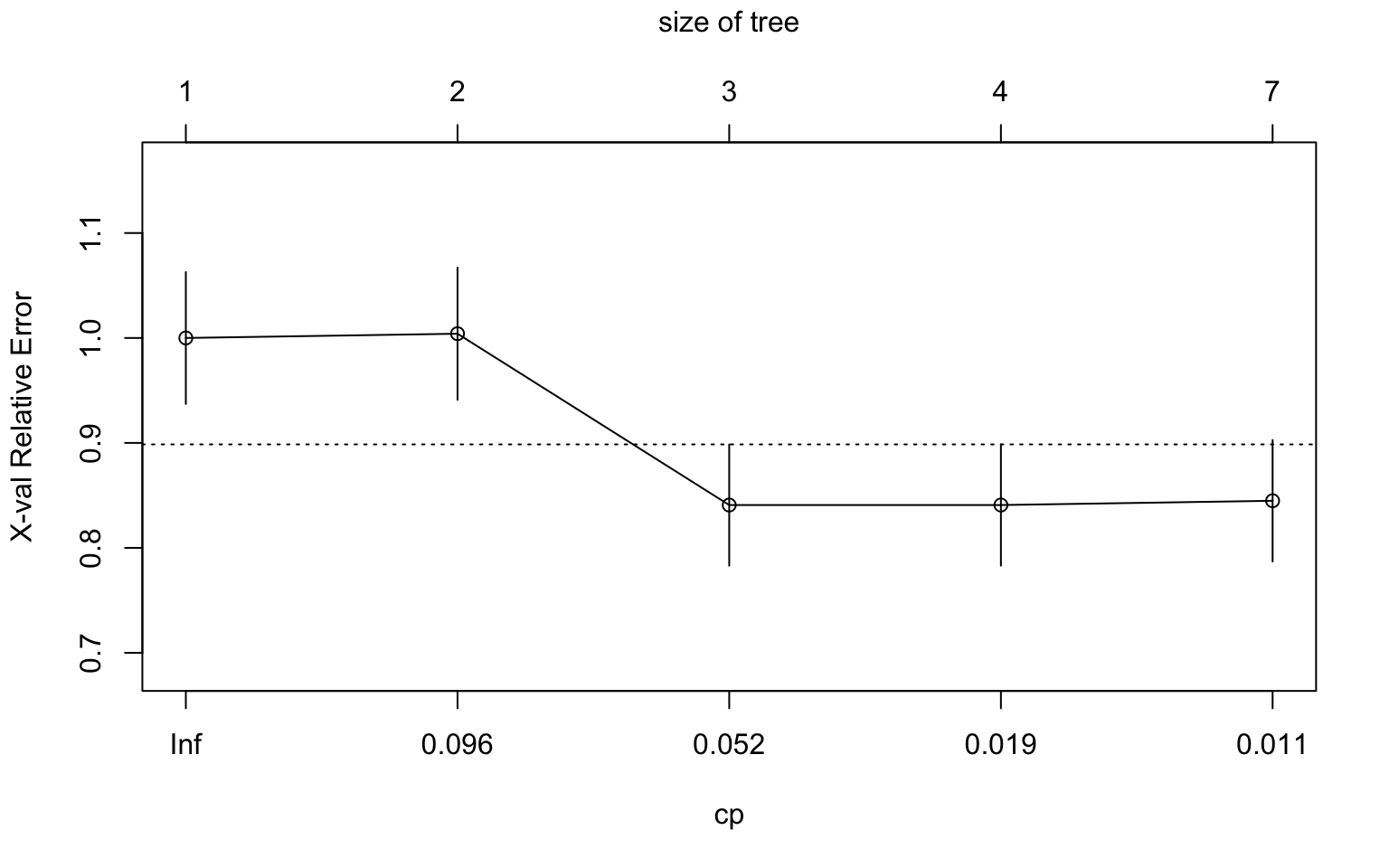

Pruning Decision Trees

Decision trees can be prone to overfitting, where they capture noise in the training data rather than the underlying pattern. Pruning is a technique to reduce overfitting by removing branches that do not significantly improve the model’s performance.

# Plot the complexity parameter table

plotcp(tree_model)

# Print the complexity parameter table

printcp(tree_model)

Classification tree:

rpart(formula = default ~ balance + income + student, data = default_train,

method = "class", control = rpart.control(cp = 0.01))

Variables actually used in tree construction:

[1] balance income

Root node error: 245/7500 = 0.032667

n= 7500

CP nsplit rel error xerror xstd

1 0.097959 0 1.00000 1.00000 0.062835

2 0.093878 1 0.90204 1.00408 0.062959

3 0.028571 2 0.80816 0.84082 0.057772

4 0.012245 3 0.77959 0.84082 0.057772

5 0.010000 6 0.74286 0.84490 0.057908# Prune the tree

pruned_tree <- prune(tree_model, cp = 0.02)

# Plot the pruned tree

rpart.plot(pruned_tree, extra = 101, box.palette = "RdBu", shadow.col = "gray", nn = TRUE)

4.6 Random Forests

Random forests are an ensemble learning method that combines multiple decision trees to improve prediction accuracy and reduce overfitting.

How Random Forests Work

Random forests work by:

- Creating multiple decision trees using bootstrap samples of the data

- Randomly selecting a subset of features for each split

- Aggregating the predictions of all trees (majority vote for classification)

This process, known as bagging (bootstrap aggregating) with random feature selection, helps to reduce variance and improve generalization.

Implementing Random Forests in R

Let’s implement a random forest for the credit default data using the ranger package:

# Fit a random forest model

rf_model <- ranger(

formula = default ~ balance + income + student,

data = default_train,

num.trees = 500,

mtry = 2,

importance = "impurity",

probability = TRUE

)

# View the model

rf_modelRanger result

Call:

ranger(formula = default ~ balance + income + student, data = default_train, num.trees = 500, mtry = 2, importance = "impurity", probability = TRUE)

Type: Probability estimation

Number of trees: 500

Sample size: 7500

Number of independent variables: 3

Mtry: 2

Target node size: 10

Variable importance mode: impurity

Splitrule: gini

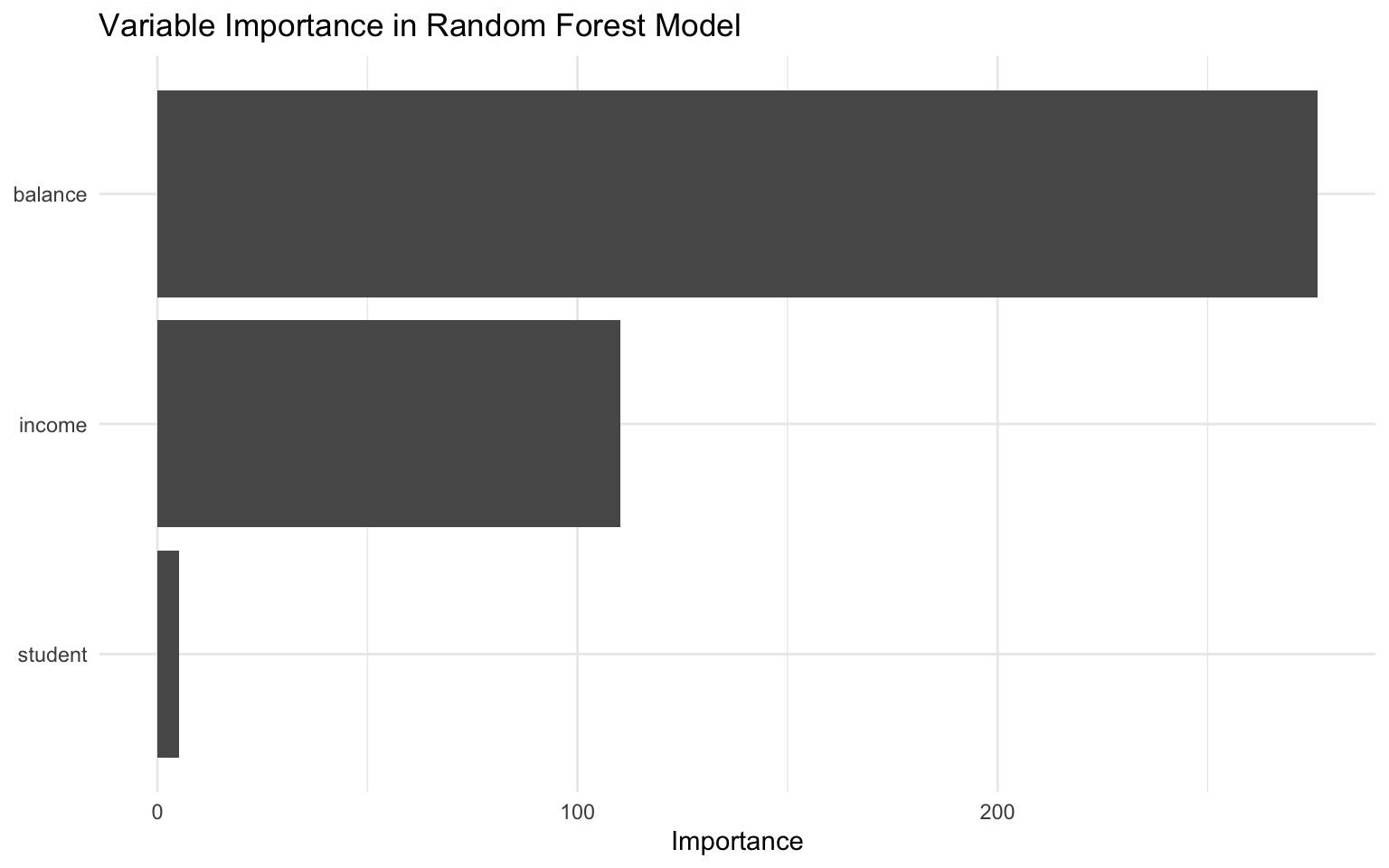

OOB prediction error (Brier s.): 0.02379122 Variable Importance in Random Forests

One advantage of random forests is that they provide a measure of variable importance, which indicates how much each feature contributes to the model’s predictive power:

# Extract variable importance

var_importance <- tibble(

variable = names(importance(rf_model)),

importance = importance(rf_model)

)

# Plot variable importance

ggplot(var_importance, aes(x = reorder(variable, importance), y = importance)) +

geom_col() +

coord_flip() +

labs(

title = "Variable Importance in Random Forest Model",

x = NULL,

y = "Importance"

) +

theme_minimal()

Making Predictions with Random Forests

We can use the random forest to make predictions on the test set:

# Make predictions on the test set

rf_pred <- default_test %>%

mutate(

default_prob = predict(rf_model, data = default_test)$predictions[, 2],

default_pred = ifelse(default_prob > 0.5, "Yes", "No"),

default_pred = factor(default_pred, levels = c("No", "Yes"))

)

# View the first few predictions

rf_pred %>%

select(default, default_prob, default_pred) %>%

head(10)# A tibble: 10 × 3

default default_prob default_pred

<fct> <dbl> <fct>

1 No 0 No

2 No 0 No

3 No 0.000222 No

4 No 0 No

5 No 0.00531 No

6 No 0 No

7 No 0.140 No

8 No 0 No

9 No 0 No

10 No 0.01 No Evaluating Random Forest Performance

Let’s evaluate the performance of our random forest model:

# Create a confusion matrix

conf_mat(rf_pred, truth = default, estimate = default_pred) Truth

Prediction No Yes

No 2399 65

Yes 13 23# Calculate accuracy, precision, recall, and F1 score

metrics(rf_pred, truth = default, estimate = default_pred)# A tibble: 4 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 accuracy binary 0.969

2 precision binary 0.974

3 recall binary 0.995

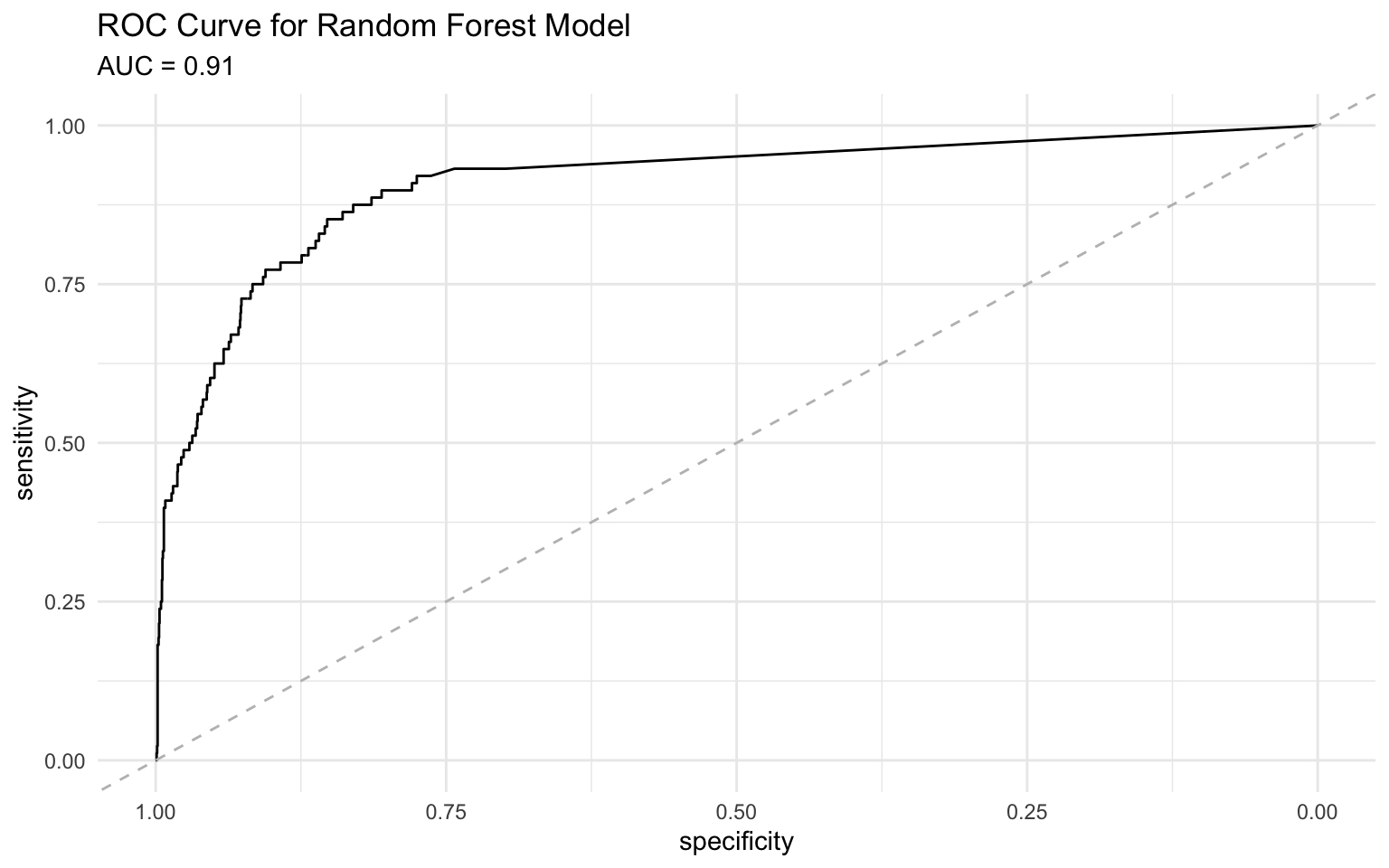

4 f_meas binary 0.984# Create an ROC curve using pROC package for better curve properties

roc_obj <- roc(rf_pred$default, rf_pred$default_prob)Setting levels: control = No, case = YesSetting direction: controls < casesauc_value <- round(auc(roc_obj), 3)

# Plot the ROC curve

ggroc(roc_obj) +

geom_abline(slope = 1, intercept = 1, linetype = "dashed", color = "gray") +

labs(

title = "ROC Curve for Random Forest Model",

subtitle = paste("AUC =", auc_value)

) +

theme_minimal()

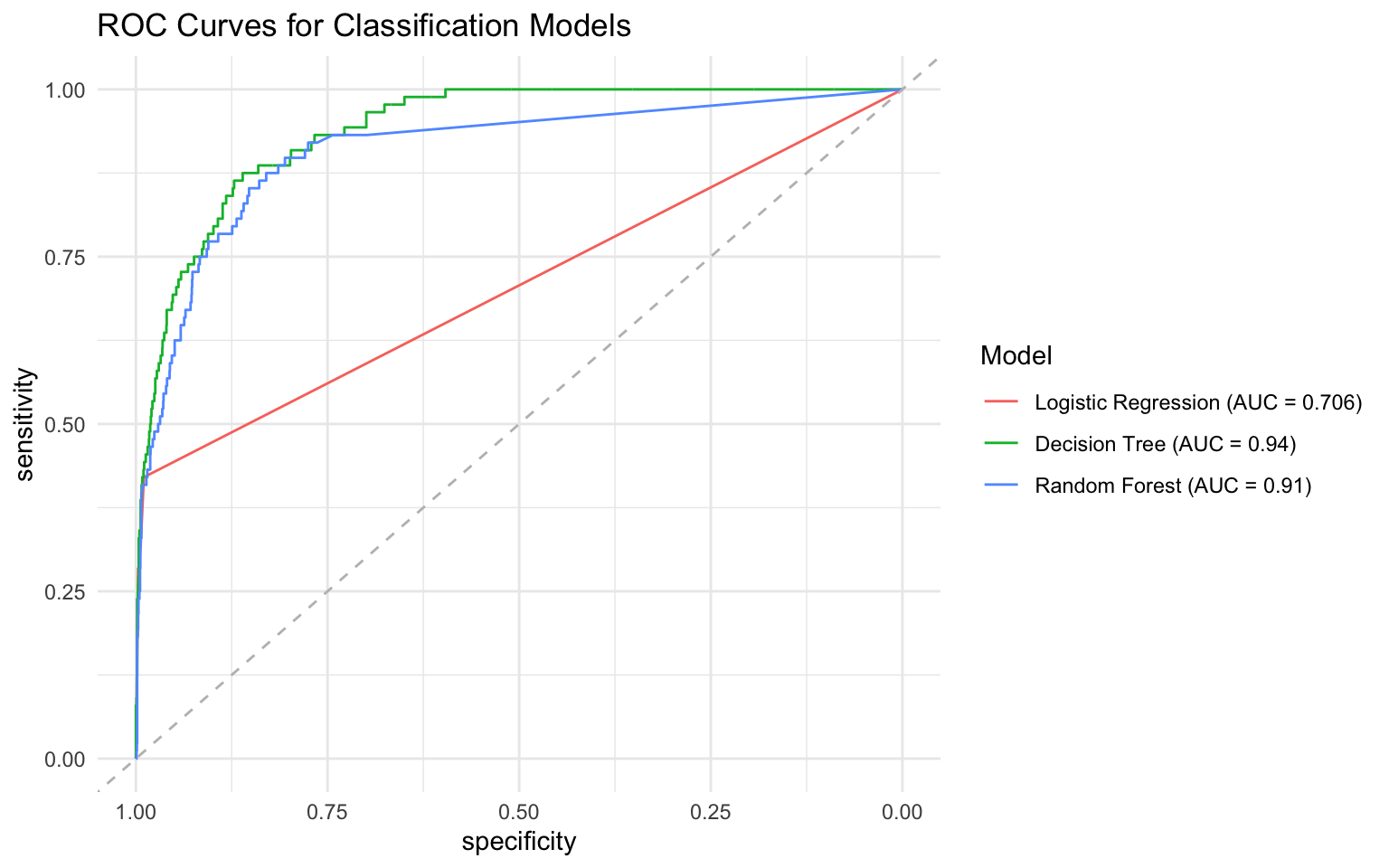

4.7 Comparing Classification Models

Let’s compare the performance of our logistic regression, decision tree, and random forest models:

# Combine predictions from all models

all_preds <- bind_rows(

default_pred %>%

select(default, default_prob, default_pred) %>%

mutate(model = "Logistic Regression"),

tree_pred %>%

select(default, default_prob, default_pred) %>%

mutate(model = "Decision Tree"),

rf_pred %>%

select(default, default_prob, default_pred) %>%

mutate(model = "Random Forest")

)

# Calculate metrics for all models

all_metrics <- all_preds %>%

group_by(model) %>%

summarize(

accuracy = accuracy_vec(default, default_pred),

precision = precision_vec(default, default_pred),

recall = recall_vec(default, default_pred),

f1 = f_meas_vec(default, default_pred),

auc = roc_auc_vec(default, default_prob)

)

# View the metrics

all_metrics# A tibble: 3 × 6

model accuracy precision recall f1 auc

<chr> <dbl> <dbl> <dbl> <dbl> <dbl>

1 Decision Tree 0.972 0.974 0.997 0.986 0.294

2 Logistic Regression 0.971 0.974 0.997 0.985 0.0597

3 Random Forest 0.969 0.974 0.995 0.984 0.0904# Create ROC curves for all models using pROC package

# Create a list to store ROC objects for each model

roc_list <- all_preds %>%

group_by(model) %>%

group_map(~roc(.x$default, .x$default_prob))Setting levels: control = No, case = YesSetting direction: controls < casesSetting levels: control = No, case = YesSetting direction: controls < casesSetting levels: control = No, case = YesSetting direction: controls < cases# Name the ROC objects in the list

names(roc_list) <- unique(all_preds$model)

# Calculate AUC for each model

auc_values <- sapply(roc_list, auc)

auc_labels <- paste0(names(auc_values), " (AUC = ", round(auc_values, 3), ")")

# Plot the ROC curves

ggroc(roc_list) +

geom_abline(slope = 1, intercept = 1, linetype = "dashed", color = "gray") +

scale_color_discrete(labels = auc_labels) +

labs(

title = "ROC Curves for Classification Models",

color = "Model"

) +

theme_minimal()

4.8 Handling Class Imbalance

In many business applications, the classes are imbalanced, meaning that one class (usually the one of interest) is much less frequent than the other. This can lead to models that perform poorly on the minority class.

Techniques for Handling Class Imbalance

There are several techniques for handling class imbalance:

- Resampling: Oversampling the minority class or undersampling the majority class

- Synthetic Data Generation: Creating synthetic examples of the minority class (e.g., SMOTE)

- Cost-Sensitive Learning: Assigning higher costs to misclassifying the minority class

- Ensemble Methods: Combining multiple models to improve performance on the minority class

- Threshold Adjustment: Changing the classification threshold to favor the minority class

Let’s demonstrate some of these techniques using the credit default data:

# Check the class distribution

default_train %>%

count(default) %>%

mutate(pct = n / sum(n) * 100)# A tibble: 2 × 3

default n pct

<fct> <int> <dbl>

1 No 7255 96.7

2 Yes 245 3.27Resampling with ROSE

The ROSE (Random Over-Sampling Examples) package provides functions for handling class imbalance:

# Create a balanced dataset using ROSE

balanced_data <- ROSE(default ~ balance + income + student,

data = default_train,

seed = 123)$data

# Check the class distribution in the balanced data

balanced_data %>%

count(default) %>%

mutate(pct = n / sum(n) * 100) default n pct

1 No 3792 50.56

2 Yes 3708 49.44# Fit a logistic regression model on the balanced data

balanced_model <- glm(default ~ balance + income + student,

data = balanced_data,

family = "binomial")

# Make predictions on the test set

balanced_pred <- default_test %>%

mutate(

default_prob = predict(balanced_model, newdata = default_test, type = "response"),

default_pred = ifelse(default_prob > 0.5, "Yes", "No"),

default_pred = factor(default_pred, levels = c("No", "Yes"))

)

# Evaluate the model

conf_mat(balanced_pred, truth = default, estimate = default_pred) Truth

Prediction No Yes

No 2069 12

Yes 343 76metrics(balanced_pred, truth = default, estimate = default_pred)# A tibble: 4 × 3

.metric .estimator .estimate

<chr> <chr> <dbl>

1 accuracy binary 0.858

2 precision binary 0.994

3 recall binary 0.858

4 f_meas binary 0.921Threshold Adjustment

Another approach is to adjust the classification threshold to favor the minority class:

# Calculate precision and recall at different thresholds

threshold_metrics <- tibble(

threshold = seq(0.1, 0.9, by = 0.1)

) %>%

mutate(

precision = map_dbl(threshold, ~ precision_vec(

default_pred$default,

ifelse(default_pred$default_prob > .x, "Yes", "No") %>% factor(levels = c("No", "Yes"))

)),

recall = map_dbl(threshold, ~ recall_vec(

default_pred$default,

ifelse(default_pred$default_prob > .x, "Yes", "No") %>% factor(levels = c("No", "Yes"))

)),

f1 = map_dbl(threshold, ~ f_meas_vec(

default_pred$default,

ifelse(default_pred$default_prob > .x, "Yes", "No") %>% factor(levels = c("No", "Yes"))

))

)

# Plot the metrics

threshold_metrics %>%

pivot_longer(cols = c(precision, recall, f1), names_to = "metric", values_to = "value") %>%

ggplot(aes(x = threshold, y = value, color = metric)) +

geom_line() +

geom_point() +

labs(

title = "Precision, Recall, and F1 Score at Different Thresholds",

x = "Threshold",

y = "Value",

color = "Metric"

) +

theme_minimal()

Based on the plot, we can select a threshold that balances precision and recall according to our business requirements.

4.9 Business Case Study: Customer Churn Prediction

Let’s apply classification techniques to a business case study on customer churn prediction.

The Scenario

You’re a data scientist at a telecommunications company. You’ve been asked to develop a model to predict which customers are likely to churn (cancel their service) in the next month. The goal is to identify high-risk customers so that the retention team can take proactive measures to retain them.

The Data

We’ll use a simulated telecom customer churn dataset:

# Create a simulated telecom customer churn dataset

set.seed(123)

n_customers <- 1000

# Generate customer characteristics

telecom_data <- tibble(

customer_id = 1:n_customers,

# Demographics

age = sample(18:80, n_customers, replace = TRUE),

gender = sample(c("Male", "Female"), n_customers, replace = TRUE),

# Service information

tenure_months = sample(1:72, n_customers, replace = TRUE),

contract = sample(c("Month-to-month", "One year", "Two year"), n_customers, replace = TRUE,

prob = c(0.6, 0.2, 0.2)),

internet_service = sample(c("DSL", "Fiber optic", "No"), n_customers, replace = TRUE),

online_security = sample(c("Yes", "No", "No internet service"), n_customers, replace = TRUE),

tech_support = sample(c("Yes", "No", "No internet service"), n_customers, replace = TRUE),

# Billing information

monthly_charges = runif(n_customers, min = 20, max = 120),

total_charges = NA_real_, # Will calculate based on tenure and monthly charges

# Customer satisfaction

satisfaction_score = sample(1:5, n_customers, replace = TRUE, prob = c(0.1, 0.1, 0.2, 0.3, 0.3))

)

# Calculate total charges based on tenure and monthly charges

telecom_data <- telecom_data %>%

mutate(

total_charges = tenure_months * monthly_charges * runif(n_customers, min = 0.9, max = 1.1)

)

# Generate churn based on a logistic model

telecom_data <- telecom_data %>%

mutate(

churn_prob = plogis(

-3 + # Intercept

-0.03 * tenure_months + # Longer tenure, less churn

ifelse(contract == "Month-to-month", 1.5, 0) + # Month-to-month more likely to churn

ifelse(contract == "Two year", -1.5, 0) + # Two year less likely to churn

ifelse(internet_service == "Fiber optic", 0.5, 0) + # Fiber customers more likely to churn

ifelse(tech_support == "Yes", -0.5, 0) + # Tech support reduces churn

ifelse(online_security == "Yes", -0.5, 0) + # Online security reduces churn

0.01 * monthly_charges + # Higher charges, more churn

-0.3 * satisfaction_score + # Higher satisfaction, less churn

rnorm(n_customers, mean = 0, sd = 0.5) # Random noise

),

churn = rbinom(n_customers, size = 1, prob = churn_prob)

) %>%

select(-churn_prob) %>% # Remove the probability column

mutate(churn = factor(churn, levels = c(0, 1), labels = c("No", "Yes"))) # Convert to factor

# View the data

glimpse(telecom_data)Rows: 1,000

Columns: 12

$ customer_id <int> 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, …

$ age <int> 48, 32, 68, 31, 20, 59, 67, 71, 60, 54, 69, 31, 71,…

$ gender <chr> "Male", "Male", "Male", "Female", "Female", "Male",…

$ tenure_months <int> 14, 37, 10, 49, 52, 71, 22, 44, 11, 18, 12, 71, 3, …

$ contract <chr> "Month-to-month", "One year", "Month-to-month", "Mo…

$ internet_service <chr> "Fiber optic", "DSL", "No", "Fiber optic", "DSL", "…

$ online_security <chr> "Yes", "No", "No", "No", "Yes", "No", "No", "No", "…

$ tech_support <chr> "No internet service", "Yes", "No internet service"…

$ monthly_charges <dbl> 40.84876, 97.95928, 35.23566, 114.55526, 101.70769,…

$ total_charges <dbl> 580.0644, 3810.2792, 361.0966, 6084.8424, 5308.8745…

$ satisfaction_score <int> 4, 4, 4, 4, 3, 1, 3, 5, 2, 2, 4, 4, 4, 5, 5, 3, 2, …

$ churn <fct> No, No, No, Yes, No, No, No, No, No, No, No, No, No…# Check the class distribution

telecom_data %>%

count(churn) %>%

mutate(pct = n / sum(n) * 100)# A tibble: 2 × 3

churn n pct

<fct> <int> <dbl>

1 No 962 96.2

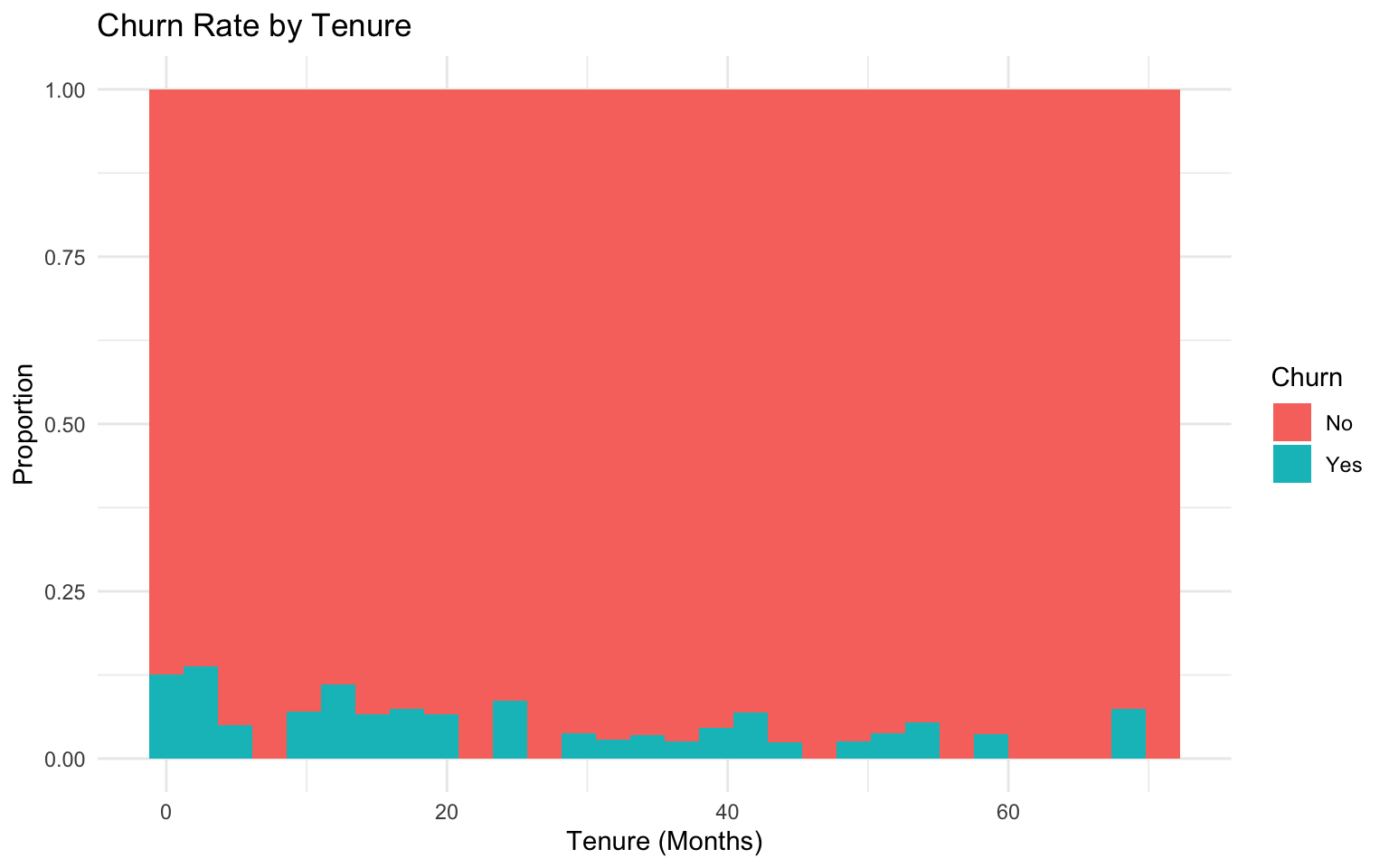

2 Yes 38 3.8Exploratory Data Analysis

Let’s explore the relations in the data:

# Explore the relation between tenure and churn

ggplot(telecom_data, aes(x = tenure_months, fill = churn)) +

geom_histogram(position = "fill", bins = 30) +

labs(

title = "Churn Rate by Tenure",

x = "Tenure (Months)",

y = "Proportion",

fill = "Churn"

) +

theme_minimal()

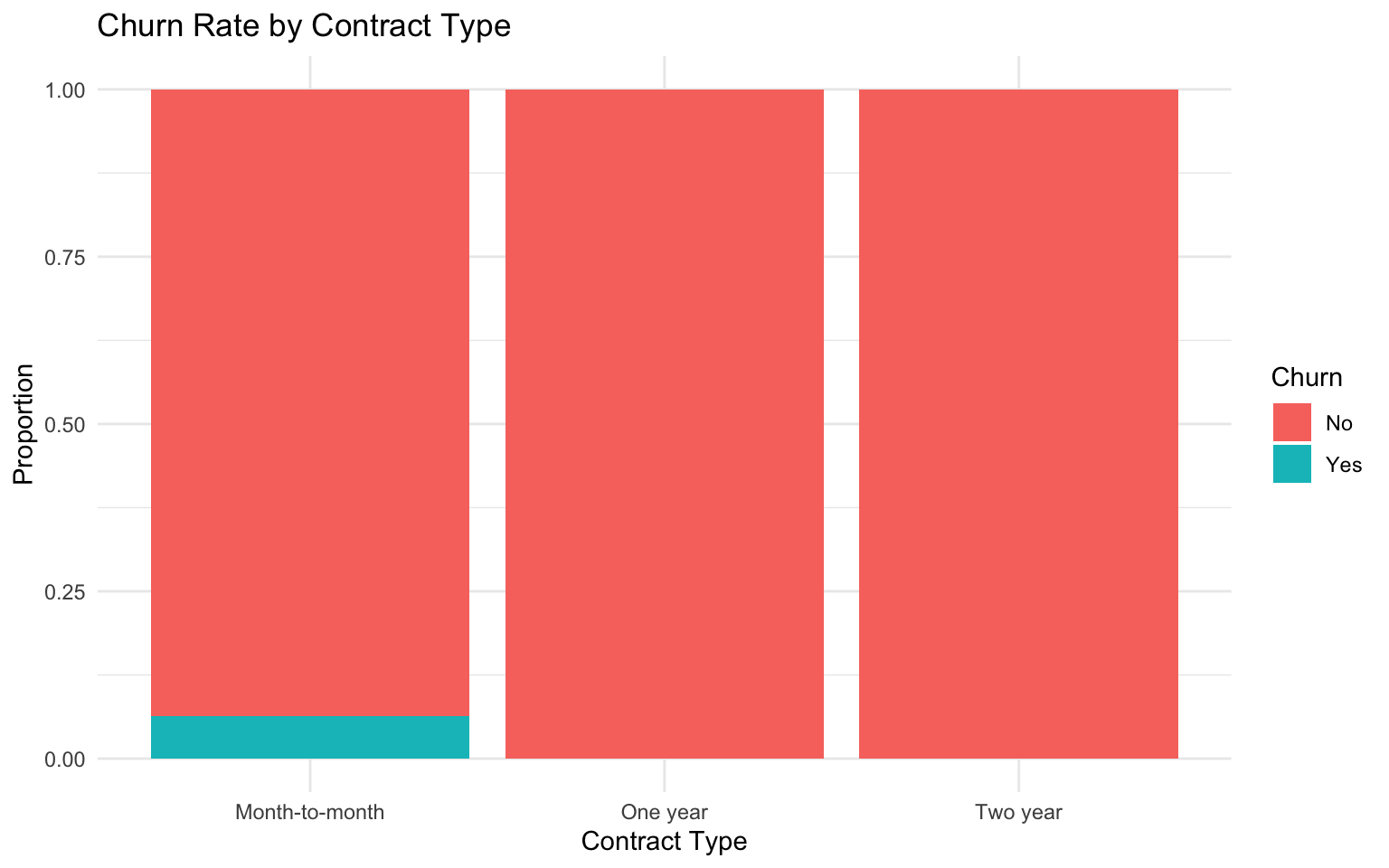

# Explore the relation between contract type and churn

ggplot(telecom_data, aes(x = contract, fill = churn)) +

geom_bar(position = "fill") +

labs(

title = "Churn Rate by Contract Type",

x = "Contract Type",

y = "Proportion",

fill = "Churn"

) +

theme_minimal()

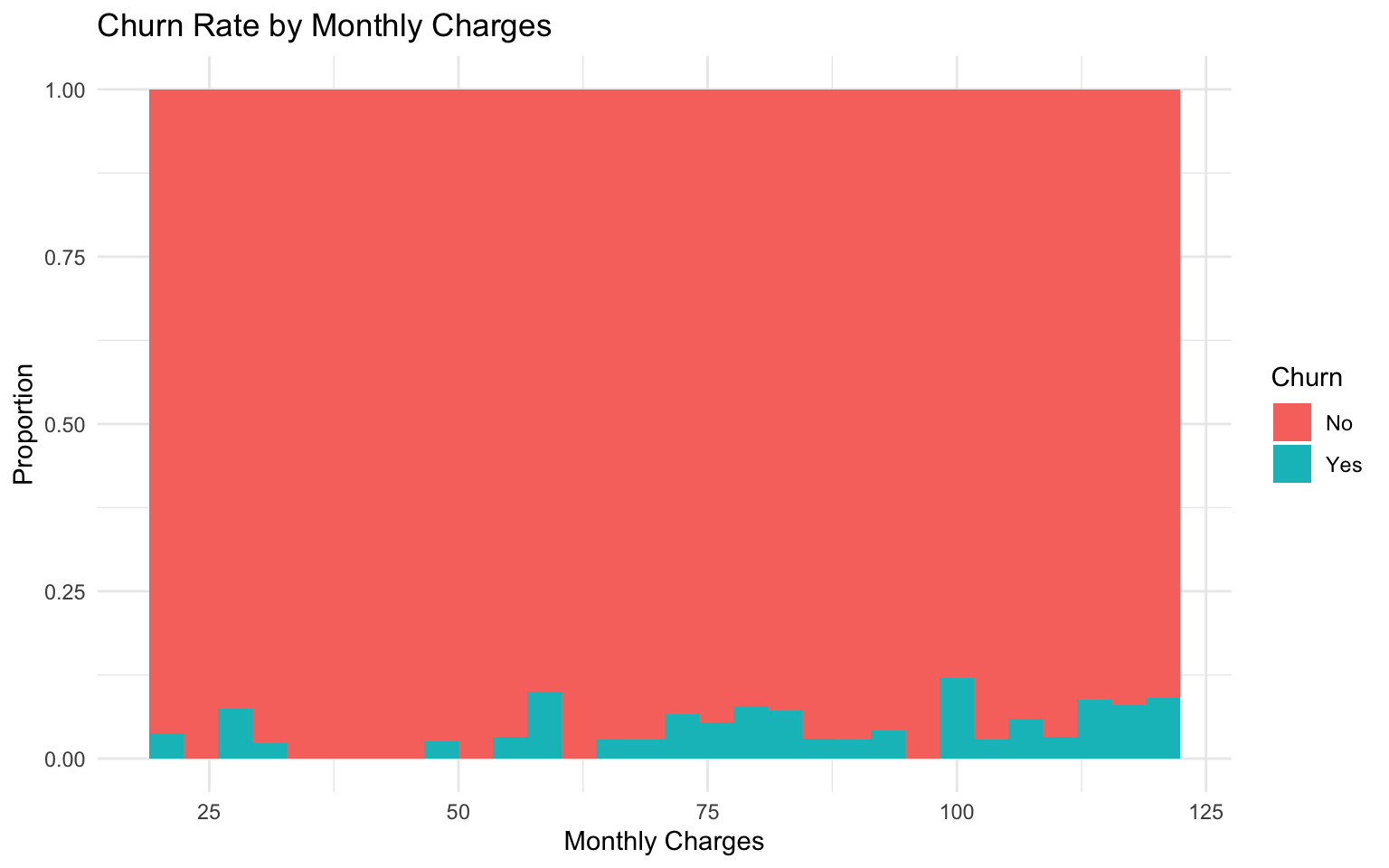

# Explore the relation between monthly charges and churn

ggplot(telecom_data, aes(x = monthly_charges, fill = churn)) +

geom_histogram(position = "fill", bins = 30) +

labs(

title = "Churn Rate by Monthly Charges",

x = "Monthly Charges",

y = "Proportion",

fill = "Churn"

) +

theme_minimal()

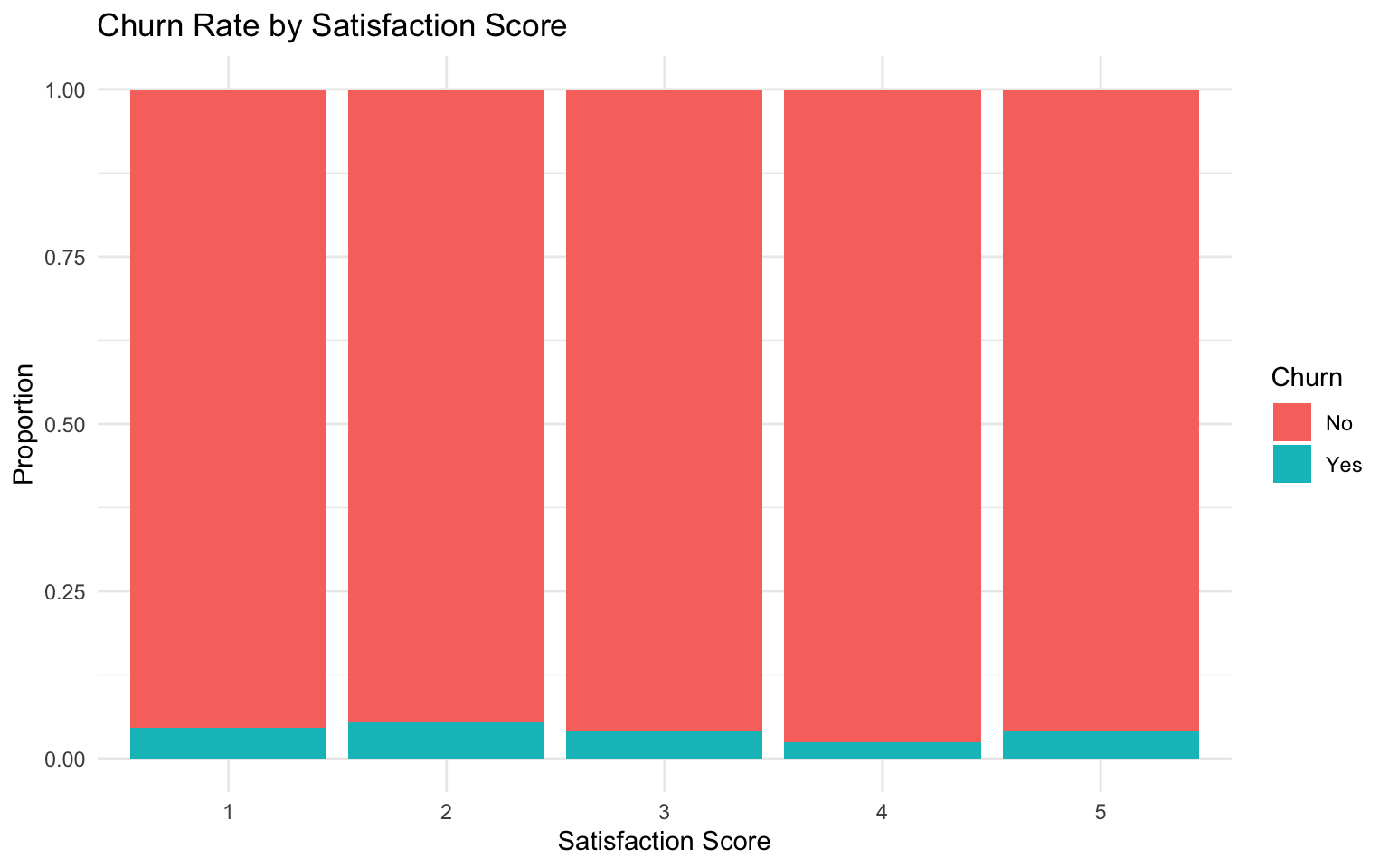

# Explore the relation between satisfaction score and churn

ggplot(telecom_data, aes(x = factor(satisfaction_score), fill = churn)) +

geom_bar(position = "fill") +

labs(

title = "Churn Rate by Satisfaction Score",

x = "Satisfaction Score",

y = "Proportion",

fill = "Churn"

) +

theme_minimal()

Data Preparation

Let’s prepare the data for modeling:

# Split the data into training and testing sets

set.seed(456)

telecom_split <- initial_split(telecom_data, prop = 0.75, strata = churn)

telecom_train <- training(telecom_split)

telecom_test <- testing(telecom_split)

# Create a recipe for preprocessing

telecom_recipe <- recipe(churn ~ tenure_months + contract + internet_service +

online_security + tech_support + monthly_charges +

satisfaction_score,

data = telecom_train) %>%

step_dummy(all_nominal_predictors()) %>%

step_normalize(all_numeric_predictors())

# Prepare the recipe

telecom_prep <- prep(telecom_recipe)

# Apply the recipe to the training and testing data

telecom_train_processed <- bake(telecom_prep, new_data = NULL)

telecom_test_processed <- bake(telecom_prep, new_data = telecom_test)Model Building

Let’s build and compare several classification models:

# Fit a logistic regression model

logistic_model <- glm(churn ~ .,

data = telecom_train_processed,

family = "binomial")

# Fit a decision tree model

tree_model <- rpart(churn ~ .,

data = telecom_train_processed,

method = "class",

control = rpart.control(cp = 0.01))

# Fit a random forest model

rf_model <- ranger(

formula = churn ~ .,

data = telecom_train_processed,

num.trees = 500,

mtry = floor(sqrt(ncol(telecom_train_processed) - 1)),

importance = "impurity",

probability = TRUE

)Model Evaluation

Let’s evaluate the performance of our models:

# Make predictions with logistic regression

logistic_pred <- telecom_test_processed %>%

mutate(

churn_prob = predict(logistic_model, newdata = telecom_test_processed, type = "response"),

churn_pred = ifelse(churn_prob > 0.5, "Yes", "No"),

churn_pred = factor(churn_pred, levels = c("No", "Yes"))

)

# Make predictions with decision tree

tree_pred <- telecom_test_processed %>%

mutate(

churn_prob = predict(tree_model, newdata = telecom_test_processed, type = "prob")[, 2],

churn_pred = predict(tree_model, newdata = telecom_test_processed, type = "class")

)

# Make predictions with random forest

rf_pred <- telecom_test_processed %>%

mutate(

churn_prob = predict(rf_model, data = telecom_test_processed)$predictions[, 2],

churn_pred = ifelse(churn_prob > 0.5, "Yes", "No"),

churn_pred = factor(churn_pred, levels = c("No", "Yes"))

)

# Combine predictions from all models

all_preds <- bind_rows(

logistic_pred %>%

select(churn, churn_prob, churn_pred) %>%

mutate(model = "Logistic Regression"),

tree_pred %>%

select(churn, churn_prob, churn_pred) %>%

mutate(model = "Decision Tree"),

rf_pred %>%

select(churn, churn_prob, churn_pred) %>%

mutate(model = "Random Forest")

)

# Calculate metrics for all models

all_metrics <- all_preds %>%

group_by(model) %>%

summarize(

accuracy = accuracy_vec(churn, churn_pred),

precision = precision_vec(churn, churn_pred),

recall = recall_vec(churn, churn_pred),

f1 = f_meas_vec(churn, churn_pred),

auc = roc_auc_vec(churn, churn_prob)

)

# View the metrics

all_metrics# A tibble: 3 × 6

model accuracy precision recall f1 auc

<chr> <dbl> <dbl> <dbl> <dbl> <dbl>

1 Decision Tree 0.96 0.96 1 0.980 0.5

2 Logistic Regression 0.96 0.96 1 0.980 0.152

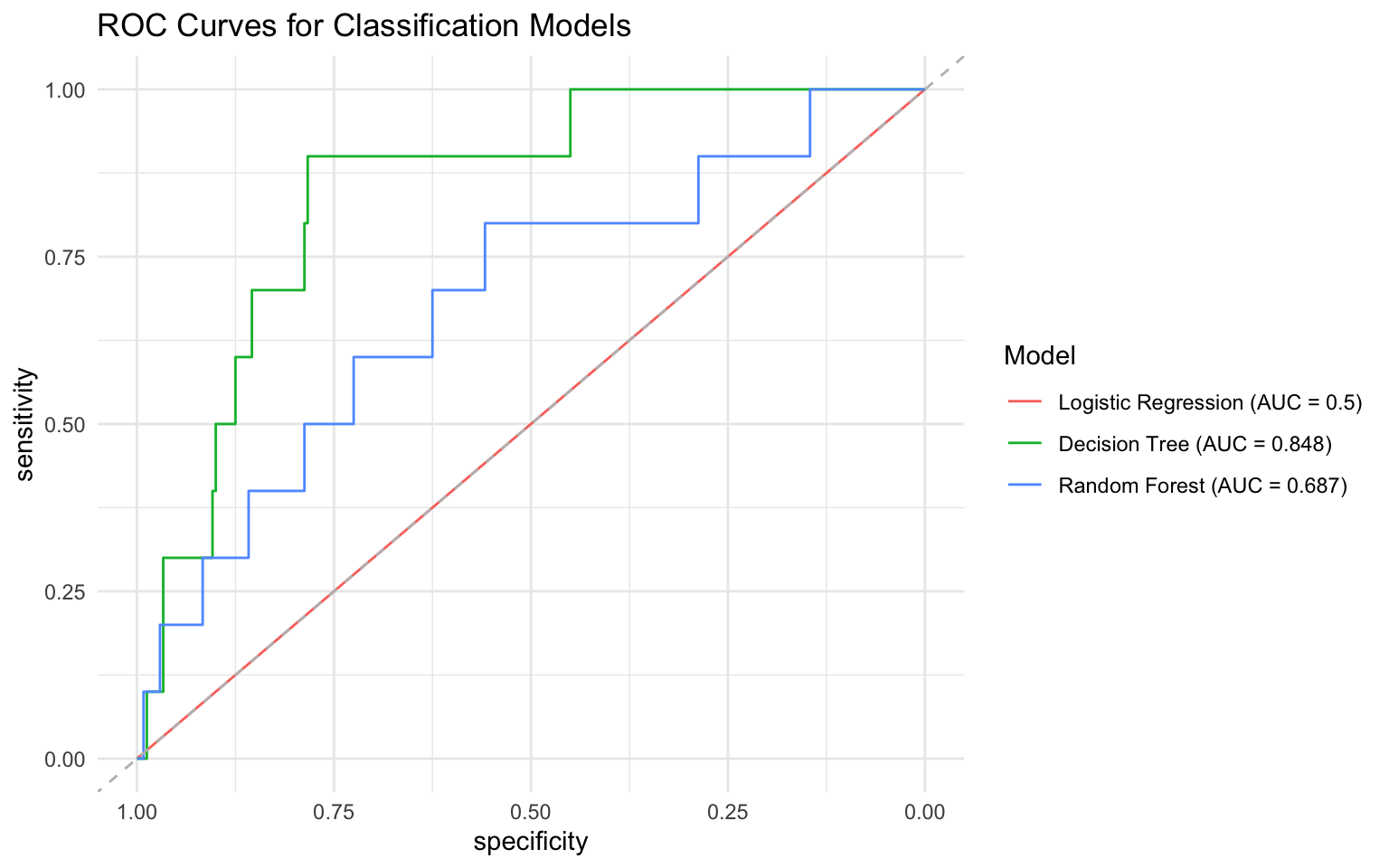

3 Random Forest 0.96 0.96 1 0.980 0.313# Create ROC curves for all models using pROC package

# Create a list to store ROC objects for each model

roc_list <- all_preds %>%

group_by(model) %>%

group_map(~roc(.x$churn, .x$churn_prob))Setting levels: control = No, case = YesSetting direction: controls < casesSetting levels: control = No, case = YesSetting direction: controls < casesSetting levels: control = No, case = YesSetting direction: controls < cases# Name the ROC objects in the list

names(roc_list) <- unique(all_preds$model)

# Calculate AUC for each model

auc_values <- sapply(roc_list, auc)

auc_labels <- paste0(names(auc_values), " (AUC = ", round(auc_values, 3), ")")

# Plot the ROC curves

ggroc(roc_list) +

geom_abline(slope = 1, intercept = 1, linetype = "dashed", color = "gray") +

scale_color_discrete(labels = auc_labels) +

labs(

title = "ROC Curves for Classification Models",

color = "Model"

) +

theme_minimal()

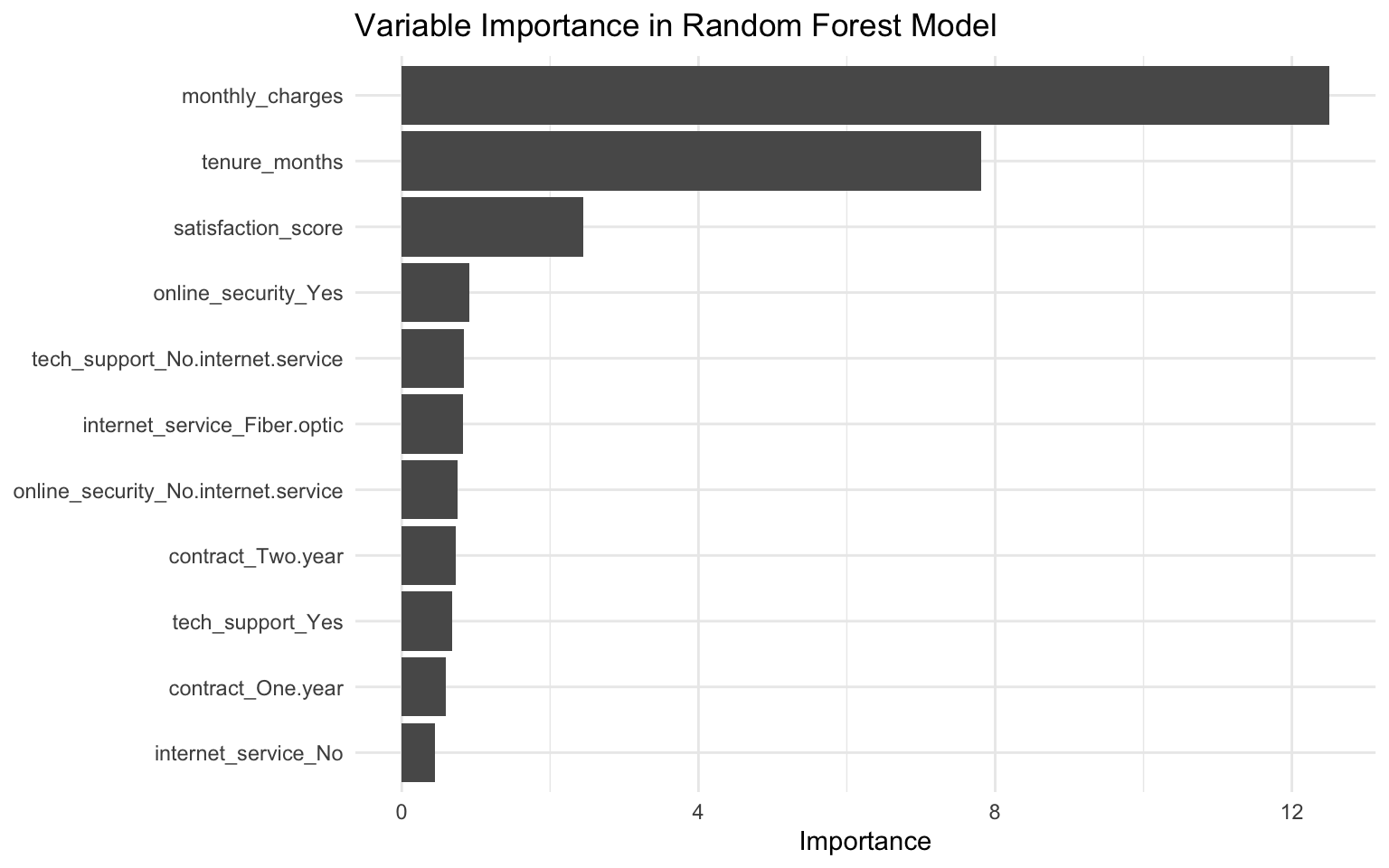

Variable Importance

Let’s examine which variables are most important for predicting churn:

# Extract variable importance from the random forest model

var_importance <- tibble(

variable = names(importance(rf_model)),

importance = importance(rf_model)

)

# Plot variable importance

ggplot(var_importance, aes(x = reorder(variable, importance), y = importance)) +

geom_col() +

coord_flip() +

labs(

title = "Variable Importance in Random Forest Model",

x = NULL,

y = "Importance"

) +

theme_minimal()

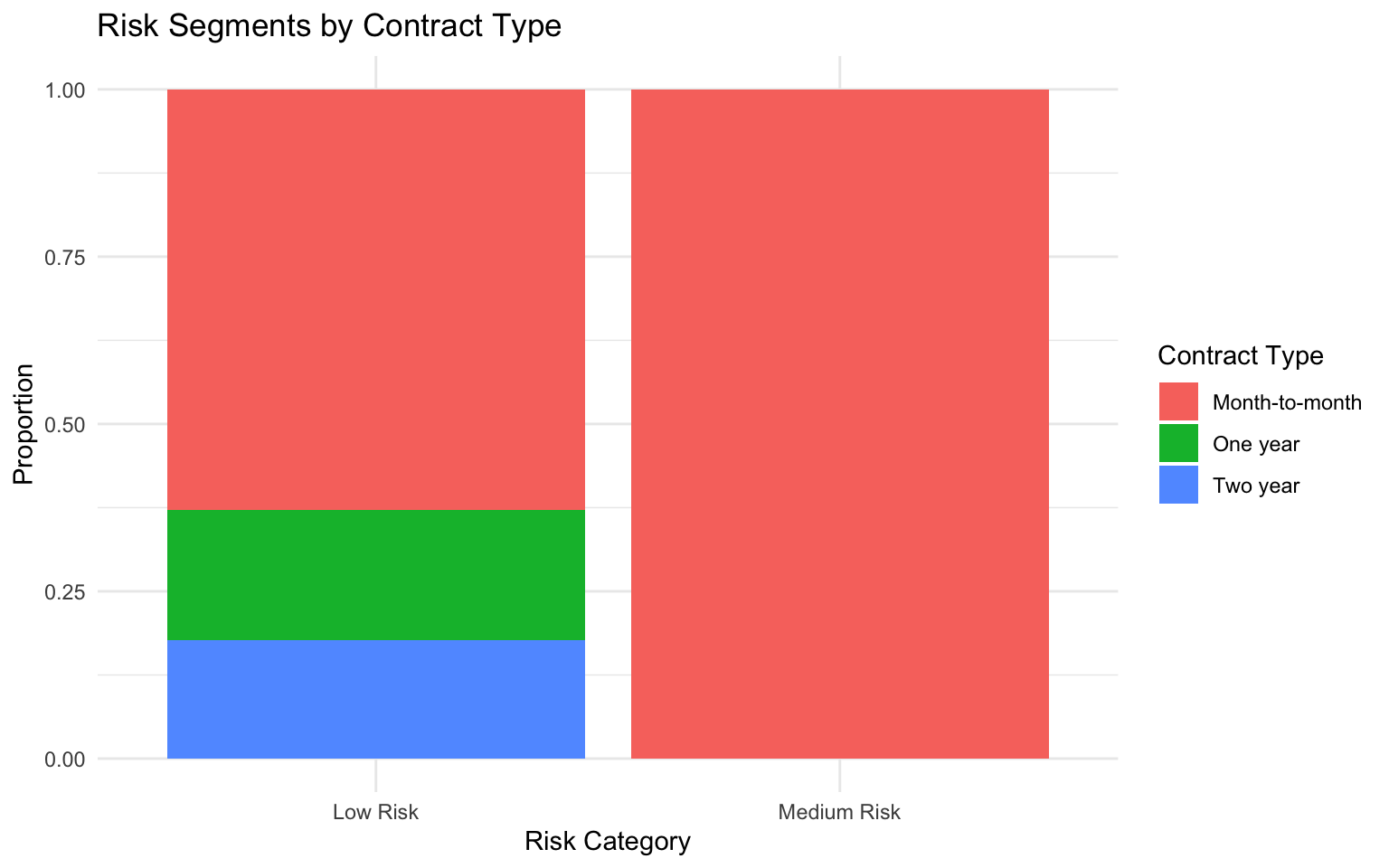

Customer Segmentation

We can use the predicted probabilities to segment customers into risk categories:

# Create risk segments

risk_segments <- rf_pred %>%

mutate(

risk_category = case_when(

churn_prob < 0.3 ~ "Low Risk",

churn_prob < 0.6 ~ "Medium Risk",

TRUE ~ "High Risk"

),

risk_category = factor(risk_category, levels = c("Low Risk", "Medium Risk", "High Risk"))

)

# Count customers in each risk category

risk_segments %>%

count(risk_category) %>%

mutate(pct = n / sum(n) * 100)# A tibble: 2 × 3

risk_category n pct

<fct> <int> <dbl>

1 Low Risk 248 99.2

2 Medium Risk 2 0.8# Visualize risk segments by contract type

ggplot(risk_segments, aes(x = risk_category, fill = telecom_test$contract)) +

geom_bar(position = "fill") +

labs(

title = "Risk Segments by Contract Type",

x = "Risk Category",

y = "Proportion",

fill = "Contract Type"

) +

theme_minimal()

Business Recommendations

Based on our analysis, we can provide the following recommendations:

- Target High-Risk Customers: Focus retention efforts on customers identified as high-risk by the model.

- Contract Type: Encourage month-to-month customers to switch to longer-term contracts, which are associated with lower churn rates.

- Service Additions: Promote online security and tech support services, which are associated with lower churn rates.

- Customer Satisfaction: Implement programs to improve customer satisfaction, as higher satisfaction scores are associated with lower churn rates.

- Early Intervention: Develop special offers for customers in their first year of service, as churn rates are higher for customers with shorter tenure.

Implementation Plan

To implement the churn prediction model in a business setting:

- Automate Data Collection: Set up automated data pipelines to collect and preprocess customer data.

- Deploy the Model: Implement the random forest model in a production environment.

- Create a Dashboard: Develop a dashboard for the retention team to identify and track high-risk customers.

- Design Interventions: Create targeted retention offers based on customer characteristics and risk level.

- Monitor Performance: Continuously monitor the model’s performance and update it as needed.

4.10 Exercises

Exercise 1: Logistic Regression

Using the titanic dataset from the titanic package:

- Fit a logistic regression model to predict survival based on passenger characteristics.

- Interpret the coefficients in terms of odds ratios.

- Evaluate the model’s performance using appropriate metrics.

- Create visualizations to illustrate the relation between predictors and survival probability.

- Provide business recommendations based on your analysis.

Exercise 2: Decision Trees

Using a dataset of your choice:

- Fit a decision tree model for a classification problem.

- Visualize the decision tree and interpret the rules.

- Experiment with different values of the complexity parameter and observe the effect on the tree.

- Evaluate the model’s performance using appropriate metrics.

- Discuss the advantages and disadvantages of decision trees for your specific problem.

Exercise 3: Random Forests

Using the credit dataset from the ISLR package:

- Fit a random forest model to predict credit default.

- Examine variable importance and discuss which factors are most predictive of default.

- Tune the hyperparameters of the random forest (e.g.,

mtry,num.trees) to improve performance. - Compare the performance of the random forest to logistic regression and decision trees.

- Discuss the trade-offs between model complexity and interpretability.

Exercise 4: Business Application

You are a data scientist at an e-commerce company. You’ve been asked to develop a model to predict which customers are likely to make a purchase in the next 30 days:

- Create a simulated dataset with relevant features (e.g., browsing behavior, past purchases, demographics).

- Explore the relations in the data using appropriate visualizations.

- Fit multiple classification models and compare their performance.

- Handle any class imbalance issues.

- Provide business recommendations based on your analysis.

4.11 Summary

In this chapter, we’ve covered the fundamentals of classification for business applications. We’ve learned how to:

- Implement logistic regression models for binary classification

- Apply tree-based classification algorithms including decision trees and random forests

- Evaluate classification model performance using appropriate metrics

- Interpret classification results in business contexts

- Handle class imbalance in classification problems

- Compare and select models based on business requirements

- Visualize classification results for business presentations

These skills provide a solid foundation for predictive modeling in business contexts. By understanding how to predict categorical outcomes, you can make more informed business decisions and develop effective strategies for customer acquisition, retention, risk management, and more.

In the next chapter, we’ll build on these skills to explore model selection and hyperparameter tuning, which are essential for optimizing model performance.

4.12 References

- James, G., Witten, D., Hastie, T., & Tibshirani, R. (2021). An Introduction to Statistical Learning with Applications in R. Springer.

- Kuhn, M., & Johnson, K. (2013). Applied Predictive Modeling. Springer.

- Breiman, L. (2001). Random Forests. Machine Learning, 45(1), 5-32.

- Hosmer, D. W., Lemeshow, S., & Sturdivant, R. X. (2013). Applied Logistic Regression. Wiley.

- Kuhn, M., & Silge, J. (2022). Tidy Modeling with R. O’Reilly Media. https://www.tmwr.org/